UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Under § 240.14a–12

PharmaCyte Biotech, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

PHARMACYTE BIOTECH, INC.

3960 Howard Hughes Parkway, Suite 500

Las Vegas, Nevada 89169

(917) 595-2850

March 27, 2024

To Our Stockholders:

You are cordially invited to attend the annual meeting of stockholders of PharmaCyte Biotech, Inc. (“PharmaCyte”) to be held at 11:00 a.m. EST on Monday, April 29, 2024.

We have decided to hold this year’s annual meeting virtually via live audio webcast on the internet because hosting a virtual annual meeting enables greater stockholder attendance and participation from any location around the world, improves meeting efficiency and our ability to communicate effectively with our stockholders, and reduces the cost and environmental impact of our annual meeting. You will be able to attend the annual meeting by first registering at http://www.viewproxy.com/PMCB/2024. You will receive a meeting invitation by e-mail with your unique join link along with a password prior to the meeting date. You will not be able to attend the annual meeting in person.

Details regarding the meeting, the business to be conducted at the meeting, and information about PharmaCyte that you should consider when you vote your shares are described in the accompanying proxy statement.

At the annual meeting, five persons will be elected to our board of directors. In addition, we will ask stockholders to ratify the appointment of Marcum LLP as our independent registered public accounting firm for our fiscal year ending April 30, 2024 and to approve, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement. Our board of directors recommends the approval of each these proposals. Such other business will be transacted as may properly come before the annual meeting.

We hope you will be able to attend the annual meeting. Whether or not you plan to attend the annual meeting, we hope you will vote promptly. Information about voting methods is set forth in the accompanying proxy statement.

Thank you for your continued support of PharmaCyte. We look forward to seeing you at the annual meeting.

| Sincerely, | |

| Joshua N. Silverman | |

| Interim Chairman, Interim Chief Executive Officer and Interim President | |

PHARMACYTE BIOTECH, INC.

3960 Howard Hughes Parkway, Suite 500

Las Vegas, Nevada 89169

(917) 595-2850

March 27, 2024

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TIME: 11:00 a.m. EST

DATE: April 29, 2024

ACCESS:

You will be able to attend the annual meeting by first registering at http://www.viewproxy.com/PMCB/2024. You will receive a meeting invitation by e-mail with your unique join link along with a password prior to the meeting date. If you are a registered holder, your virtual control number will be on your proxy card. If you hold your shares beneficially through a bank or broker, you must provide a legal proxy from your bank or broker during registration and you will be assigned a virtual control number in order to vote your shares during the annual meeting. If you are unable to obtain a legal proxy to vote your shares, you will still be able to attend the annual meeting (but will not be able to vote your shares) so long as you demonstrate proof of stock ownership. Instructions on how to connect and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at http://www.viewproxy.com/PMCB/2024. On the day of the annual meeting, you may only vote during the meeting by e-mailing a copy of your legal proxy to virtualmeeting@viewproxy.com in advance of the meeting.

PURPOSES:

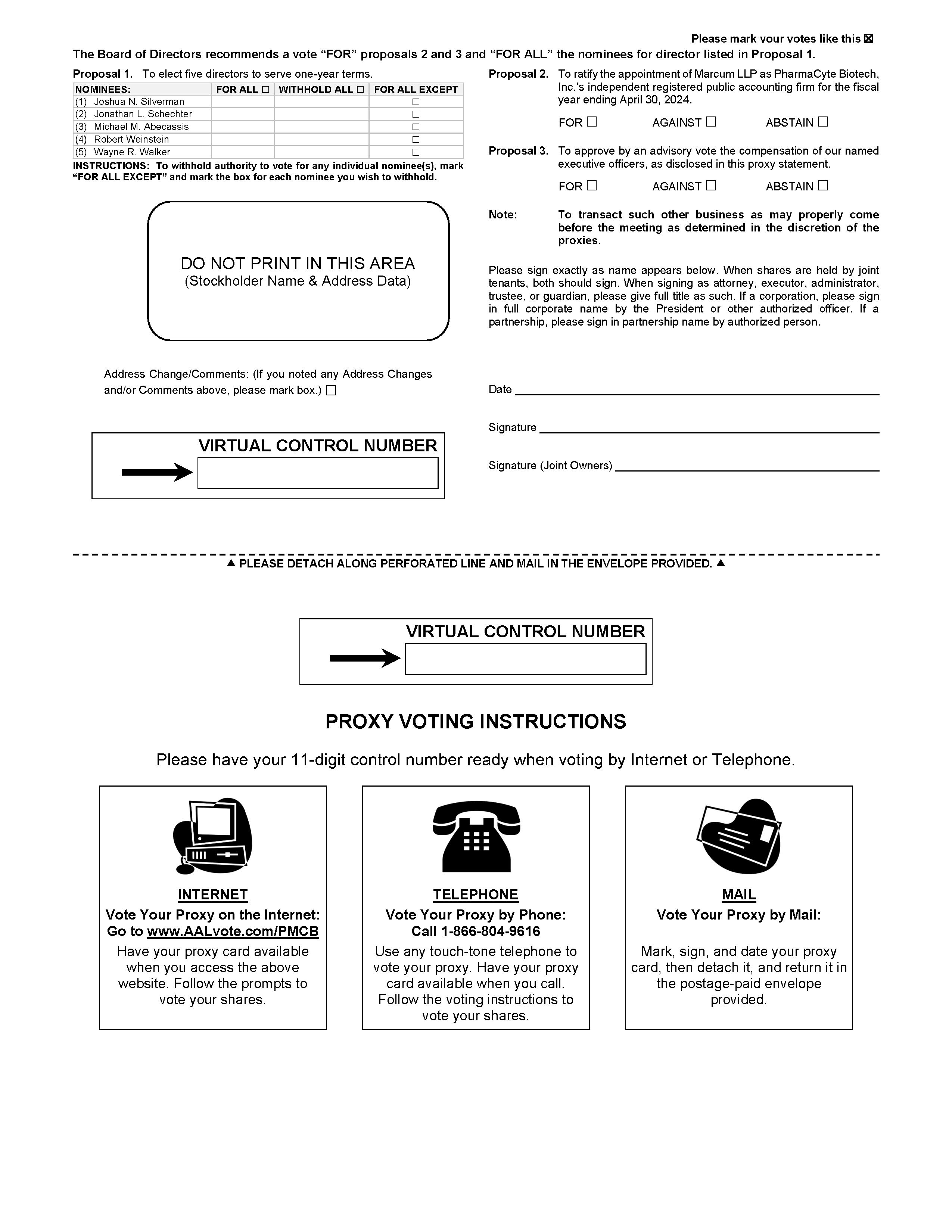

| 1. | To elect five directors to serve one-year terms expiring at our annual meeting of stockholders for the year ended April 30, 2025; | |

| 2. | To ratify the appointment of Marcum LLP as our independent registered public accounting firm for the fiscal year ending April 30, 2024; | |

| 3. | To approve by an advisory vote the compensation of our named executive officers, as disclosed in this proxy statement; and | |

| 4. | To transact such other business that is properly presented at the annual meeting and any adjournments or postponements thereof. |

WHO MAY VOTE:

You may vote if you were the record owner of PharmaCyte Biotech, Inc. common stock at the close of business on March 20, 2024. A list of stockholders of record will be available electronically at the annual meeting and during the 10 days prior to the annual meeting.

All stockholders are cordially invited to attend the annual meeting. Whether you plan to attend the annual meeting or not, we urge you to vote and submit your proxy by the Internet, telephone or mail in order to ensure the presence of a quorum. You may change or revoke your proxy at any time before it is voted at the annual meeting. If you participate in and vote your shares at the annual meeting, your proxy will not be used.

| BY ORDER OF OUR BOARD OF DIRECTORS | |

| Joshua N. Silverman | |

| Interim Chairman, Interim Chief Executive Officer and | |

| Interim President |

Page

PHARMACYTE BIOTECH, INC.

3960 Howard Hughes Parkway, Suite 500

Las Vegas, Nevada 89169

PROXY STATEMENT FOR THE PHARMACYTE BIOTECH, INC.

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 29, 2024

This proxy statement, along with the accompanying notice of our annual meeting of stockholders, contains information about the annual meeting of stockholders of PharmaCyte Biotech, Inc. including any adjournments or postponements of the annual meeting. We are holding the annual meeting at 11:00 a.m. EST on Monday, April 29, 2024. You will be able to attend the annual meeting by first registering at http://www.viewproxy.com/PMCB/2024. You will receive a meeting invitation by e-mail with your unique join link along with a password prior to the meeting date.

In this proxy statement, we refer to PharmaCyte Biotech, Inc. as “PharmaCyte,” “the Company,” “we” and “us.”

This proxy statement relates to the solicitation of proxies by our board of directors for use at the annual meeting.

On or about April 1, 2024, we expect to begin sending this proxy statement, the attached Notice of Annual Meeting of Stockholders and the enclosed proxy card to all stockholders entitled to vote at the annual meeting.

Although not part of this proxy statement, we are also sending, along with this proxy statement, our annual report for the fiscal year ended April 30, 2023, which includes our financial statements for the same period.

| 1 |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON APRIL 29, 2024

This proxy statement, the Notice of Annual Meeting of Stockholders, our form of proxy card and our annual report for the fiscal year ended April 30, 2024 to stockholders are available for viewing, printing and downloading at www.proxyvote.com. To view these materials please have your 16-digit control number(s) available that appears on your proxy card. On this website, you can also elect to receive future distributions of our proxy statements and annual reports to stockholders by electronic delivery.

Additionally, you can find a copy of our Annual Report on Form 10-K, which includes our financial statements for the fiscal year ended April 30, 2023, on the website of the Securities and Exchange Commission, or the SEC, at www.sec.gov, or in the “SEC Filings” section of the “Investors” section of our website at ir.pharmacyte.com. You may also obtain a printed copy of our Annual Report on Form 10-K, including our financial statements, free of charge, from us by sending a written request to: Interim President, PharmaCyte Biotech, Inc., 3960 Howard Hughes Parkway, Suite 500, Las Vegas, Nevada 89169. Exhibits will be provided upon written request and payment of an appropriate processing fee.

| 2 |

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why is the Company Soliciting My Proxy?

Our board of directors (the “Board”) is soliciting your proxy to vote at the annual meeting of stockholders for the year ended April 30, 2024, to be held virtually, on Monday, April 29, 2024, at 11:00 a.m. EST and any adjournments or postponements of the meeting, which we refer to as the Annual Meeting. This proxy statement, along with the accompanying Notice of Annual Meeting of Stockholders, summarizes the purposes of the meeting and the information you need to know to vote at the Annual Meeting.

We have made available to you on the Internet or have sent you this proxy statement, the Notice of Annual Meeting of Stockholders, the proxy card and a copy of our Annual Report on Form 10-K for the fiscal year ended April 30, 2024 because you owned shares of our common stock on the record date. We intend to commence distribution of proxy materials to stockholders on or about April 1, 2024.

Why Are You Holding a Virtual Annual Meeting?

The Annual Meeting will be held in a virtual meeting format only. We have designed our virtual format to enhance, rather than constrain, stockholder access, participation and communication.

How do I access the Virtual Annual Meeting?

The live webcast of the Annual Meeting will begin promptly at 11:00 am EST. Online access to the audio webcast will open 15 minutes prior to the start of the Annual Meeting to allow time for you to log-in and test your device’s audio system. The virtual Annual Meeting is running the most updated version of the applicable software and plugins. You should ensure you have a strong Internet connection wherever you intend to participate in the Annual Meeting. You should also allow plenty of time to log in and ensure that you can hear streaming audio prior to the start of the Annual Meeting.

Log-in Instructions. You will be able to attend the Annual Meeting by first registering at http://www.viewproxy.com/PMCB/2024. You will receive a meeting invitation by e-mail with your unique join link along with a password prior to the meeting date. If you are a registered holder, your virtual control number will be on your proxy card. If you hold your shares beneficially through a bank or broker, you must provide a legal proxy from your bank or broker during registration and you will be assigned a virtual control number in order to vote your shares during the Annual Meeting. If you are unable to obtain a legal proxy to vote your shares, you will still be able to attend the Annual Meeting (but will not be able to vote your shares) so long as you demonstrate proof of stock ownership. Instructions on how to connect and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at http://www.viewproxy.com/ PMCB/2024. On the day of the Annual Meeting, you may only vote during the meeting by e-mailing a copy of your legal proxy to virtualmeeting@viewproxy.com in advance of the meeting.

What Happens if There Are Technical Difficulties during the Annual Meeting?

There will be technicians ready to assist you with any technical difficulties you may have accessing the Annual Meeting live audio webcast. Please be sure to check in by 10:45 a.m. EST on December 20, 2023, (15 minutes prior to the start of the meeting is recommended) the day of the meeting, so that any technical difficulties may be addressed before the Annual Meeting live audio webcast begins. If you encounter any difficulties accessing the webcast during the check-in or meeting time, please email VirtualMeeting@viewproxy.com or call 866-612-8937.

| 3 |

Who May Vote?

Only stockholders of record at the close of business on March 20, 2024 (the “Record Date”) will be entitled to vote at the Annual Meeting. On the Record Date, there were 8,453,396 shares of our common stock outstanding and entitled to vote. Our common stock is our only class of voting stock.

If on the Record Date your shares of our common stock were registered directly in your name with our transfer agent, Equiniti Trust Company, LLC, then you are a stockholder of record.

If on the Record Date your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a valid proxy from your broker or other agent.

You do not need to attend the Annual Meeting to vote your shares. Shares represented by valid proxies, received in time for the Annual Meeting and not revoked prior to the Annual Meeting, will be voted at the Annual Meeting. For instructions on how to change or revoke your proxy, see “May I Change or Revoke My Proxy?” below.

How Many Votes Do I Have?

Each share of our common stock that you own entitles you to one vote.

How Do I Vote?

Whether you plan to attend the Annual Meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via the Internet or telephone. You may specify whether your shares should be voted FOR or WITHHELD for each nominee for director, whether your shares should be voted for one year, two years, three years or abstain with respect to the frequency of voting on the compensation of our named executive officers, and whether your shares should be voted for, against or abstain with respect to each of the other proposals. If you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with our Board’s recommendations as noted below. Voting by proxy will not affect your right to attend the Annual Meeting.

If your shares are registered directly in your name through our stock transfer agent, Equiniti Trust Company, LLC, or you have stock certificates registered in your name, you may vote:

| · | By Internet or by telephone. Follow the instructions included in the Notice or, if you received printed materials, in the proxy card to vote over the Internet or by telephone. | |

| · | By mail. If you received a proxy card by mail, you can vote by mail by completing, signing, dating and returning the proxy card as instructed on the card. If you sign the proxy card but do not specify how you want your shares voted, they will be voted in accordance with our Board’s recommendations as noted below. | |

| · | During the meeting. You may vote your shares electronically through the portal at the virtual Annual Meeting. Even if you plan to attend the Annual Meeting virtually, we encourage you to vote in advance by telephone, through the Internet or by mail so that your vote will be counted in the event you later decide not to attend virtually the Annual Meeting. |

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. Eastern Time on April 28, 2024.

| 4 |

If your shares are held in “street name” (held in the name of a bank, broker or other holder of record), you will receive instructions from the holder of record. You must follow the instructions of the holder of record in order for your shares to be voted. Telephone and Internet voting also will be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you plan to vote your shares in person at the Annual Meeting, you should contact your broker or agent to obtain a legal proxy or broker’s proxy card and vote your shares online at the time of the meeting.

How Does Our Board Recommend that I Vote on the Proposals?

Our Board recommends that you vote as follows:

| ☐ | “FOR” the election of the nominees for director; and |

| ☐ | “FOR” the ratification of the appointment of Marcum LLP (“Marcum”) as our independent registered public accounting firm for our fiscal year ending April 30, 2024. |

Our Board makes no recommendation with respect to the advisory vote to approve the compensation of our named executive officers, as disclosed in this proxy statement.

If any other matter is presented at the Annual Meeting, your proxy provides that your shares will be voted by the proxy holder listed in the proxy in accordance with the proxy holder’s best judgment. At the time this proxy statement was first made available, we knew of no matters that needed to be acted on at the Annual Meeting, other than those discussed in this proxy statement.

May I Change or Revoke My Proxy?

If you give us your proxy, you may change or revoke it at any time before the Annual Meeting. You may change or revoke your proxy in any one of the following ways:

| ☐ | if you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above; |

| ☐ | by re-voting by Internet or by telephone as instructed above; |

| ☐ | by notifying PharmaCyte’s Interim President in writing before the Annual Meeting that you have revoked your proxy; or |

| ☐ | by attending the Annual Meeting and voting at the meeting. Attending the Annual Meeting will not in and of itself revoke a previously submitted proxy. You must specifically request at the Annual Meeting that it be revoked. |

Your most current vote, whether by telephone, Internet or proxy card is the one that will be counted.

What if I Receive More Than One Notice or Proxy Card?

You may receive more than one Notice or proxy card if you hold shares of our common stock in more than one account, which may be in registered form or held in street name. Please vote in the manner described above under “How Do I Vote?” for each account to ensure that all of your shares are voted.

| 5 |

Will My Shares be Voted if I Do Not Vote?

If your shares are registered in your name or if you have stock certificates, they will not be counted if you do not vote as described above under “How Do I Vote?” If your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares as described above, the bank, broker or other nominee that holds your shares has the authority to vote your unvoted shares only on the ratification of the appointment of our independent registered public accounting firm without receiving instructions from you. Therefore, we encourage you to provide voting instructions to your bank, broker or other nominee. This ensures your shares will be voted at the Annual Meeting and in the manner you desire. A “broker non-vote” will occur if your broker cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter or because your broker chooses not to vote on a matter for which it does have discretionary voting authority.

What Vote is Required to Approve Each Proposal and How are Votes Counted?

| Proposal No. 1: Elect Directors | The nominees for director who receive the most votes (also known as a “plurality” of the votes cast) will be elected. You may vote either FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one or more of the nominees. Votes that are withheld will not be included in the vote tally for the election of the directors. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the election of the directors. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. | |

| Proposal No. 2: Ratify Appointment of Independent Registered Public Accounting Firm | The affirmative vote of a majority of the shares cast affirmatively or negatively for this proposal is required to ratify the selection of our independent registered public accounting firm. Abstentions will have no effect on the results of this vote. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. If a broker does not exercise this authority, such broker non-votes will have no effect on the results of this vote. We are not required to obtain the approval of our stockholders to select our independent registered public accounting firm. However, if our stockholders do not ratify the appointment of Marcum as our independent registered public accounting firm for the year ended April 30, 2024, the audit committee of our Board (the “Audit Committee”) will reconsider its selection. | |

| Proposal No. 3: Approve an Advisory Vote on the Compensation of our Named Executive Officers | The affirmative vote of a majority of the votes present or represented by proxy and entitled to vote at the Annual Meeting is required to approve, on an advisory basis, the compensation of our named executive officers, as described in this proxy statement. Abstentions will be treated as votes against this proposal. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. Although the advisory vote is non-binding, the compensation committee of our Board (the “Compensation Committee”) and our Board will review the voting results and take them into consideration when making future decisions regarding executive compensation. |

| 6 |

Where Can I Find the Voting Results of the Annual Meeting?

The preliminary voting results will be announced at the Annual Meeting, and we will publish preliminary, or final results if available, in a Current Report on Form 8-K within four business days of the Annual Meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended report on Form 8-K to disclose the final voting results within four business days after the final voting results are known.

What Are the Costs of Soliciting these Proxies?

We will pay all of the costs of soliciting these proxies. Our directors and employees may solicit proxies in person or by telephone, fax or email. We will pay these employees and directors no additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses.

What Constitutes a Quorum for the Annual Meeting?

The presence, in person or by proxy, of the holders of one third of the voting power of all outstanding shares of our common stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Votes of stockholders of record who are present at the Annual Meeting in person or by proxy, abstentions, and broker non-votes are counted for purposes of determining whether a quorum exists.

Attending the Annual Meeting

This year, our Annual Meeting will be held in a virtual meeting format only. You will be able to attend the Annual Meeting by first registering at http://www.viewproxy.com/PMCB/2024. You will receive a meeting invitation by e-mail with your unique join link along with a password prior to the meeting date.

Householding of Annual Disclosure Documents

Some brokers or other nominee record holders may be sending you a single set of our proxy materials if multiple PharmaCyte stockholders live in your household. This practice, which has been approved by the U.S. Securities and Exchange Commission (the “SEC”), is called “householding.” Once you receive notice from your broker or other nominee record holder that it will be “householding” our proxy materials, the practice will continue until you are otherwise notified or until you notify them that you no longer want to participate in the practice. Stockholders who participate in householding will continue to have access to and utilize separate proxy voting instructions.

We will promptly deliver a separate copy of our Notice or if applicable, our proxy materials to you if you write or call our Interim President at: 3960 Howard Hughes Parkway, Suite 500, Las Vegas, Nevada 89169, Attention: Interim President. If you want to receive your own set of our proxy materials in the future or, if you share an address with another stockholder and together both of you would like to receive only a single set of proxy materials, you should contact your broker or other nominee record holder directly or you may contact us at the above address and phone number.

Electronic Delivery of Company Stockholder Communications

Most stockholders can elect to view or receive copies of future proxy materials over the Internet instead of receiving paper copies in the mail.

You can choose this option and save us the cost of producing and mailing these documents by:

| · | following the instructions provided on your proxy card; | |

| · | following the instructions provided when you vote over the Internet; or | |

| · | going to www.proxyvote.com and following the instructions provided. |

| 7 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of March 20, 2024 for (a) the executive officers named in the Summary Compensation Table on page 17 of this proxy statement, (b) each of our directors and director nominees, (c) all of our current directors and executive officers as a group and (d) each stockholder known by us to own beneficially more than 5% of our common stock. Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. We deem shares of common stock that may be acquired by an individual or group within 60 days of March 20, 2024 pursuant to the exercise of options or warrants or the vesting of restricted stock units to be outstanding for the purpose of computing the percentage ownership of such individual or group, but those shares are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person shown in the table. Except as indicated in footnotes to this table, we believe that the stockholders named in this table have sole voting and investment power with respect to all shares of common stock shown to be beneficially owned by them based on information provided to us by these stockholders.

Under the terms of certain of our outstanding warrants, holders may not exercise the warrants to the extent such exercise would cause such holder, together with its affiliates, to beneficially own a number of shares of our common stock which would exceed 4.99% or 9.99%, as applicable, of our then outstanding common stock following such exercise. Similarly, under the terms of our Series B Convertible Preferred Stock (the “Series B Preferred Shares”), holders may not convert their Series B Preferred Shares to the extent such conversion would cause such holder, together with its affiliates, to beneficially own a number of shares of our common stock which would exceed 4.99% or 9.99%, as applicable, of our then outstanding common stock following such conversion. The number of shares of common stock beneficially owned reflects these limitations.

Unless otherwise indicated below, the address for each beneficial owner listed is c/o PharmaCyte Biotech, Inc., 3960 Howard Hughes Parkway, Suite 500, Las Vegas, Nevada 89169. Percentage of ownership is based on 8,453,396 shares of common stock outstanding on March 20, 2024.

| Shares Beneficially Owned | ||||||||

| Name and Address | Number | Percent | ||||||

| 5%+ Stockholders: | ||||||||

| Entities affiliated with Ayrton Capital LLC (1) | 956,229 | 10.2% | ||||||

| Entities affiliated with Intracoastal Capital LLC (2) | 903,412 | 10.2% | ||||||

| Directors, Director Nominees and Named Executive Officers: | ||||||||

| Kenneth L. Waggoner (3) | 12,598 | * | ||||||

| Gerald W. Crabtree (4) | 3,000 | * | ||||||

| Joshua N. Silverman (5) | 220,000 | 2.6% | ||||||

| Carlos A. Trujillo (6) | 101,400 | 1.2% | ||||||

| Jonathan L. Schechter (7) | 111,248 | 1.3% | ||||||

| Michael M. Abecassis (8) | 65,384 | * | ||||||

| Robert Weinstein (9) | 61,248 | * | ||||||

| Wayne R. Walker (10) | 61,248 | * | ||||||

| All current directors, director nominees and current executive officers as a group (six persons) | 620,528 | 7.3% | ||||||

________________

| * | Represents beneficial ownership of less than 1% of the outstanding shares of our common stock. |

| (1) | Includes 956,229 shares underlying warrants and Series B Preferred Shares held by Alto Opportunity Master Fund, SPC – Segregated Master Portfolio B (“Alto”). This information is based solely on the Schedule 13G filed with the SEC by Alto, Ayrton Capital LLC (“Ayrton”) and Waqas Khatri on February 14, 2024. Alto is a private investment vehicle for which Ayrton serves as the investment manager. Mr. Khatri serves as the managing member of Ayrton. The address of Alto is Suite #7, Grand Pavilion Commercial Centre, 802 West Bay Road, Grand Cayman, P.O. Box 10250, Cayman Islands. The address of Ayrton is 55 Post Rd West, 2nd Floor, Westport, CT 06880. The address of Mr. Khatri is 55 Post Rd West, 2nd Floor, Westport, CT 06880. |

| (2) | Includes (i) 475,884 shares and (ii) 427,528 shares issuable upon the exercise of warrants owned by Intracoastal Capital LLC (“Intracoastal”). This information is based on the Schedule 13G/A filed with the SEC on February 6, 2024 by Intracoastal, Mitchell P. Kopin and Daniel B. Asher. The address of Mr. Kopin and Intracoastal is c/o Intracoastal Capital, LLC, 245 Palm Trail, Delray Beach, Florida 33483. The address of Mr. Asher is 111 W. Jackson Boulevard, Suite 2000, Chicago, Illinois 60604. |

| 8 |

| (3) | Includes 9,000 shares issuable upon the exercise of options to purchase common stock. Mr. Waggoner resigned from all positions with the company effective October 6, 2022. |

| (4) | Includes 3,000 shares issuable upon the exercise of options to purchase common stock. Mr. Crabtree resigned from all positions with the company effective October 12, 2022. |

| (5) | Includes 170,000 shares issuable upon the exercise of options to purchase common stock. |

| (6) | Includes 91,000 shares issuable upon the exercise of options to purchase common stock. |

| (7) | Includes 61,248 shares issuable upon the exercise of options to purchase common stock. |

| (8) | Includes 62,582 shares issuable upon the exercise of options to purchase common stock. |

| (9) | Includes 61,248 shares issuable upon the exercise of options to purchase common stock. |

| (10) | Includes 61,248 shares issuable upon the exercise of options to purchase common stock. |

| 9 |

MANAGEMENT AND CORPORATE GOVERNANCE

Our Board

On March 20, 2024, our Board accepted the recommendation of the nominating committee of the Board (the “Nominating Committee”) and voted to nominate Joshua N. Silverman, Jonathan L. Schechter, Michael M. Abecassis, Robert Weinstein and Wayne R. Walker for election at the Annual Meeting for a term of one year to serve until the annual meeting of stockholders for the year ended April 30, 2025 (the “Next Annual Meeting”), and until their respective successors have been elected and qualified.

Set forth below are the names of the persons nominated for election as directors, their ages, their offices in the Company, if any, their principal occupations or employment for at least the past five years, the length of their tenure as directors and the names of other public companies in which such persons hold or have held directorships during the past five years as of March 27, 2024. Additionally, information about the specific experience, qualifications, attributes or skills that led to our Board’s conclusion at the time of filing of this proxy statement that each person listed below should serve as a director is set forth below:

| Name | Age | Position with the Company | ||

| Joshua N. Silverman | 53 | Interim Chairman, Interim Chief Executive Officer and Interim President | ||

| Jonathan L. Schechter | 50 | Director | ||

| Michael M. Abecassis | 65 | Director | ||

| Robert Weinstein | 64 | Director | ||

| Wayne R. Walker | 65 | Director |

Our Board has reviewed the materiality of any relationship that each of our directors has with PharmaCyte, either directly or indirectly. Based upon this review, our Board has determined that the following members of our Board are “independent directors” as defined by The Nasdaq Stock Market: Jonathan L. Schechter, Michael M. Abecassis, Robert Weinstein and Wayne R. Walker.

Joshua Silverman has served as a director of the Company since August 2022 and currently serves as Chairman of the Board. Mr. Silverman currently serves as the managing member of Parkfield Funding LLC. Mr. Silverman was the co-founder, and a principal and managing partner of Iroquois Capital Management, LLC (“Iroquois”), an investment advisory firm. Since its inception in 2003 until July 2016, Mr. Silverman served as co-chief investment officer of Iroquois. While at Iroquois, he designed and executed complex transactions, structuring and negotiating investments in both public and private companies and has often been called upon by the companies solve inefficiencies as they relate to corporate structure, cash flow, and management. From 2000 to 2003, Mr. Silverman served as co-chief investment officer of Vertical Ventures, LLC, a merchant bank. Prior to forming Iroquois, Mr. Silverman was a director of Joele Frank, a boutique consulting firm specializing in mergers and acquisitions. Previously, Mr. Silverman served as assistant press secretary to the president of the United States. Mr. Silverman currently serves as a director of AYRO, Inc., MYMD Pharmaceuticals, Inc., Synaptogenix, Inc., Femasys Inc. and Petros Pharmaceuticals, Inc., all of which are public companies. He previously served as a director of Protegenics Therapeutics, Inc. from 2016 to 2022. Mr. Silverman received his B.A. from Lehigh University in 1992.

Jonathan L. Schechter has served as a director of the Company since August 2022. Mr. Schechter currently serves as a partner of The Special Equities Group, a division of Dawson James Securities, Inc., a full-service investment bank specializing in healthcare, biotechnology, technology, and clean-tech sectors, since April 2021. Mr. Schechter is one of the founding partners of The Special Equities Opportunity Fund, a long-only fund that makes direct investments in micro-cap companies and has served in this capacity since August 2019. He currently serves on the board of directors of Synaptogenix, Inc., a clinical-stage biopharmaceutical company (Nasdaq: SNPX), and previously served as a director of DropCar, Inc. Mr. Schechter also serves as a member of the Board of Directors of Oblong, Inc. (Nasdaq: OBLG), a technology company. He has extensive experience analyzing and evaluating the financial statements of public companies. Mr. Schechter earned his A.B. in Public Policy/Political Science from Duke University and his J.D. from Fordham University School of Law. Mr. Schechter was chosen as a director of PharmaCyte because of his lengthy public company, legal and investment banking experience.

| 10 |

Michael M. Abecassis, MD has served as a director of the Company since July 2017. Since November 2019, Dr. Abecassis has been Dean of the University of Arizona College of Medicine – Tucson, and following postgraduate training at the University of Toronto, Dr. Abecassis began his professional career as Assistant Professor of Surgery and Director of Liver Transplantation and Hepato-pancreatico-biliary (HPB) Surgery at the University of Iowa. In 1992, Dr. Abecassis became Northwestern University’s Director of Liver Transplantation, where he initiated Northwestern’s liver transplant program. In 2004, Dr. Abecassis was named Chief of the Division of Transplantation at the Feinberg School of Medicine, and the James Roscoe Miller Distinguished Professor with Tenure at Feinberg. He then became Founding Director of the Comprehensive Transplant Center at Northwestern in 2009. He was appointed Dean for Clinical Affairs at the Feinberg School of Medicine in 2008, serving until 2011. Dr. Abecassis received continuous funding from the National Institutes of Health (“NIH”) for 20+ consecutive years as principal investigator in research studies that include both laboratory and clinical studies. Dr. Abecassis is a member in good standing of several important professional societies, including the Society of University Surgeons and the American Surgical Association, and was elected President of the American Society of Transplant Surgeons from 2010-2011. He has served on the Editorial Boards of major scientific journals related to the fields of both HPB and transplant surgery. He has served as a member of NIH grant study sections and special emphasis panels relating to both transplantation and virology. He served as a permanent member of the National Institute of Allergy and Infectious Diseases study section for career development and training grants. Dr. Abecassis has been a course director for the American Society of Transplant Surgeons Leadership Development Program for the Advanced Leader Development Program in 2013 at Northwestern’s Kellogg School of Management. He was a voting member of the Medicare Coverage Advisory Committee and served on the United HealthCare Group Physician Advisory Board on Healthcare Performance and Quality. Dr. Abecassis has been a member of various local, regional and national regulatory committees and has published seminal papers on both the regulatory and financial aspects of transplantation, including the Healthcare Reform and the Affordable Care Act. Dr. Abecassis received his Medical Degree from the University of Toronto in 1983 and was awarded a Master of Business Administration degree from the Kellogg School of Management at Northwestern University in 2000. Dr. Abecassis was also a co-founder of Transplant Genomics Inc., a company focused on developing, validating and commercializing molecular biomarkers for transplant rejection, and currently a subsidiary of Eurofins Diagnostics. Dr. Abecassis was chosen as a director of PharmaCyte because of the combination of his clinical training and experience in HPB diseases – e.g. liver and pancreatic cancer, his research background in related areas, and in regulatory and business aspects of translation and commercialization of research efforts.

Robert Weinstein has served as a director of the Company since November 2022. Mr. Weinstein joined Neurotrope in June 2013 as its acting Chief Financial Officer and has continued to serve in that role for Synaptogenix, Inc. following the Spin-Off. In addition, Mr. Weinstein performs work as a consultant for Petros Pharmaceuticals, Inc., which is the surviving company from the merger of Metuchen and Neurotrope. He has extensive accounting and finance experience, spanning more than 30 years, as a public accountant, investment banker, healthcare private equity fund principal and chief financial officer. From September 2011 to the present, Mr. Weinstein has been an independent consultant for several healthcare companies in the pharmaceutical and biotechnology industries. From March 2010 to August 2011, he was the Chief Financial Officer of Green Energy Management Services Holdings, Inc., an energy consulting company. From August 2007 to February 2010, Mr. Weinstein served as Chief Financial Officer of Xcorporeal, Inc., a development-stage medical device company which was sold in March 2010 to Fresenius Medical USA, the largest provider of dialysis equipment and services worldwide. Mr. Weinstein also serves as a member of the Board of Directors of Xwell, Inc. (formerly XpresSpa Group, Inc.) (Nasdaq: XWEL), a health and wellness company whose core asset, XpresSpa, is a leading airport retailer of spa services and related health and wellness products, and Oblong, Inc. (Nasdaq: OBLG), a company that provides multi-stream collaboration technologies and managed services for video collaboration and network applications in the United States and internationally. Mr. Weinstein received his MBA degree in finance and international business from the University of Chicago Graduate School of Business, is a Certified Public Accountant (inactive), and received his BS degree in accounting from the State University of New York at Albany. Mr. Weinstein was chosen as a director of PharmaCyte because of his public company and financial expertise.

| 11 |

Wayne R. Walker has served as a director of the Company since December 28, 2022. Mr. Walker has over 35 years of experience in corporate governance, turnaround management, corporate restructuring and bankruptcy matters. In 1998, Mr. Walker founded Walker Nell Partners, Inc., an international business consulting firm, and has served as its president from its founding to the present. Before founding Walker Nell Partners, Inc., Mr. Walker worked for 15 years at the DuPont Company in Wilmington, Delaware in the Securities and Bankruptcy group, where he worked in the Corporate Secretary’s office and served as Senior Counsel. From 2022 to the present, Mr. Walker has served as a director of AMMO, Inc. (Nasdaq: POWW), a designer, producer, and marketer of ammunition products. From December 2020 to the present, Mr. Walker has served as a director of AYRO, Inc. (Nasdaq: AYRO), a designer and manufacturer of compact, sustainable electric vehicles. From 2018 to 2023, Mr. Walker has served as a director of Wrap Technologies, Inc. (Nasdaq: WRAP), an innovator of modern policing solutions, where he served as chairman of the board. From 2018 to 2023, Mr. Walker has served as a director of Pitcairn Company and as the Chair of its Compensation Committee. From 2013 to 2014, Mr. Walker served as chairman of the board of directors of BridgeStreet Worldwide, Inc., a global provider of extended corporate housing. From 2016 to 2018, Mr. Walker served as chairman of the board of directors of Last Call Operating Companies, an owner of various national restaurants. From 2013 to 2020, Mr. Walker served as chairman of the board of trustees of National Philanthropic Trust, a public charity. From 2018 to 2020, Mr. Walker served as Vice President of the Board of Education of the City of Philadelphia. From 2020 to the present, Mr. Walker has served as a director of Petros Pharmaceuticals, Inc. (Nasdaq: PTPI), which focuses on men’s health. Mr. Walker has also served on the board of directors for the numerous companies and foundations including Seaborne Airlines, Inc., Green Flash Brewery, Inc., and Eagleville Hospital and Foundation. Mr. Walker has a J.D. from Catholic University (Washington, DC) and a Bachelor of Arts from Loyola University (New Orleans). He is an attorney licensed by the State Bar of Georgia. He is a member of the State Bar Association of Georgia, American Bar Association, American Bankruptcy Institute and Turnaround Management Association. Mr. Walker was chosen as a director of PharmaCyte because of his extensive board experience.

The Board Diversity Matrix, below, provides the diversity statistics for our Board. To see our Board Diversity Matrix as of November 25, 2022, please see the proxy statement filed with the SEC on November 25, 2022.

| Board Diversity Matrix (As of March 27, 2024) | ||||

| Total Number of Directors | ||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |

| Gender: | ||||

| Directors | – | 5 | – | – |

| Number of Directors Who Identify in Any of the Categories Below: | ||||

| African American or Black | – | 1 | – | – |

| Alaskan Native or Native American | – | – | – | – |

| Asian (other than South Asian) | – | – | – | – |

| South Asian | – | – | – | – |

| Hispanic or Latinx | – | – | – | – |

| Native Hawaiian or Pacific Islander | – | – | – | – |

| White | – | 4 | – | – |

| Two or More Races or Ethnicities | – | – | – | – |

| LGBTQ+ | – | |||

| Persons with Disabilities | – | |||

| 12 |

Committees of our Board and Meetings

Meeting Attendance. During the fiscal year ended April 30, 2023, there were nine meetings of our Board, and the various committees of our Board met a total of 13 times. No director attended fewer than 75% of the total number of meetings of our Board and of committees of our Board on which he or she served during the fiscal year ended April 30, 2023. Our directors are expected to attend meetings of the Board as frequently as necessary to properly discharge their responsibilities and to spend the time needed to prepare for each such meeting. If an annual meeting of stockholders is held, our directors are expected to attend that meeting, but we do not have a formal policy requiring them to do so. Two directors attended our annual meeting of stockholders held during the fiscal year ended April 30, 2023.

Audit Committee. Our Audit Committee met four times during the fiscal year ended April 30, 2023. This committee currently has three members, Mr. Weinstein (Chairman), Mr. Walker and Mr. Schechter. Our Audit Committee’s role and responsibilities are set forth in the Audit Committee’s written charter and include the authority to retain and terminate the services of our independent registered public accounting firm. In addition, the Audit Committee reviews annual financial statements, considers matters relating to accounting policy and internal controls and reviews the scope of annual audits. All members of the Audit Committee satisfy the current independence standards promulgated by the SEC and by The Nasdaq Stock Market, as such standards apply specifically to members of audit committees. Our Board has determined that each of Mr. Weinstein and Mr. Schechter is an “audit committee financial expert,” as the SEC has defined that term in Item 407 of Regulation S-K. Please also see the report of the Audit Committee set forth elsewhere in this proxy statement.

A copy of the Audit Committee’s written charter is publicly available on our website at ir.pharmacyte.com/governance-docs.

Compensation Committee. Our Compensation Committee did not meet during the fiscal year ended April 30, 2023. This committee currently has three members, Mr. Schechter (Chairman), Mr. Walker and Dr. Abecassis. Our Compensation Committee’s role and responsibilities are set forth in the Compensation Committee’s written charter and includes reviewing, approving and making recommendations regarding our compensation policies, practices and procedures to ensure that legal and fiduciary responsibilities of our Board are carried out and that such policies, practices and procedures contribute to our success. Our Compensation Committee also administers our PharmaCyte Biotech, Inc. 2021 Equity Incentive Plan (the “2021 Plan”). The Compensation Committee is responsible for making a recommendation to the Board regarding the compensation of our chief executive officer, and shall conduct its decision making process with respect to that issue without the chief executive officer present. All members of the Compensation Committee qualify as independent under the definition promulgated by The Nasdaq Stock Market.

The Compensation Committee has adopted processes and procedures for the consideration and determination of executive and director compensation. It may delegate any of its authority to any subcommittee of the Compensation Committee so long as all members of such subcommittee are independent directors, and it may retain a compensation consultant for compensation advice. At least annually, the Compensation Committee evaluates all officers’ performance in light of corporate goals and objectives and makes recommendations to the Board regarding such officers’ compensation.

A copy of the Compensation Committee’s written charter is publicly available on our website at ir.pharmacyte.com/governance-docs.

| 13 |

Nominating Committee. Our Nominating Committee did not meet during the fiscal year ended April 30, 2023 and has two members, Mr. Abecassis (Chairman), Mr. Walker and Mr. Schechter. Our Board has determined that all members of the Nominating Committee qualify as independent under the definition promulgated by The Nasdaq Stock Market. The Nominating Committee’s responsibilities are set forth in the Nominating Committee’s written charter and include:

| · | evaluating and making recommendations to the full Board as to the composition of our Board and its committees; | |

| · | evaluating and making recommendations as to director candidates; | |

| · | evaluating current Board members’ performance; and | |

| · | developing and recommending governance guidelines for the Company. |

Generally, our Nominating Committee considers candidates recommended by stockholders as well as from other sources such as other directors or officers, third party search firms or other appropriate sources. Once identified, the Nominating Committee will evaluate a candidate’s qualifications in accordance with our Nominating Committee’s written charter. Threshold criteria include judgment, skill, diversity, experience with businesses and other organizations of comparable size, the interplay of the candidate’s experience with the experience of other Board members and the extent to which the candidate would be a desirable addition to the Board and any committees of the Board. Our Nominating Committee has not adopted a formal diversity policy in connection with the consideration of director nominations or the selection of nominees. However, the Nominating Committee will consider issues of diversity among its members in identifying and considering nominees for director, and strive where appropriate to achieve a diverse balance of backgrounds, perspectives, experience, age, gender, ethnicity and country of citizenship on our Board and its committees.

If a stockholder wishes to propose a candidate for consideration as a nominee for election to our Board, it must follow the procedures described in “Stockholder Proposals and Nominations for Director” at the end of this proxy statement. In general, persons recommended by stockholders will be considered in accordance with our Nominating Committee’s written charter. Any such recommendation should be made in writing to the Nominating Committee, care of our Interim President at our principal office and should be accompanied by the following information concerning each recommending stockholder and the beneficial owner, if any, on whose behalf the nomination is made:

| · | all information relating to such person that would be required to be disclosed in a proxy statement; | |

| · | certain biographical and share ownership information about the stockholder and any other proponent, including a description of any derivative transactions in the Company’s securities; | |

| · | a description of certain arrangements and understandings between the proposing stockholder and any beneficial owner and any other person in connection with such stockholder nomination; and | |

| · | a statement whether or not either such stockholder or beneficial owner intends to deliver a proxy statement and form of proxy to holders of voting shares sufficient to carry the proposal. |

The recommendation must also be accompanied by the following information concerning the proposed nominee:

| · | certain biographical information concerning the proposed nominee; | |

| · | all information concerning the proposed nominee required to be disclosed in solicitations of proxies for election of directors; | |

| · | certain information about any other security holder of the Company who supports the proposed nominee; | |

| · | a description of all relationships between the proposed nominee and the recommending stockholder or any beneficial owner, including any agreements or understandings regarding the nomination; and | |

| · | additional disclosures relating to stockholder nominees for directors, including completed questionnaires and disclosures required by our Bylaws. |

A copy of the Nominating Committee’s written charter, including its appendices, is publicly available on our website at ir.pharmacyte.com/governance-docs.

| 14 |

Board Leadership Structure and Role in Risk Oversight

The Board does not have a policy on whether or not the roles of Chief Executive Officer and Chairman of the Board should be separate. The Board believes that it should be free to make a choice from time to time in any manner that is in the best interests of the Company and our stockholders. Currently, we believe that it is in the best interest of the Company and its stockholders to combine these roles due to the small size of the Company. While the Company does not have a lead independent director, each current member of the Board aside from the Chairman is independent.

The Board administers its risk oversight function directly and through its committees. The Audit Committee receives reports from members of senior management on areas of material risk to the Company, including operational, financial, legal, regulatory, strategic and reputational risks. As part of its charter, our Audit Committee regularly discusses with management our major risk exposures, their potential financial impact on our Company and the steps we take to manage them. In addition, our Compensation Committee assists the Board in fulfilling its oversight responsibilities with respect to the management and risks arising from our compensation policies and programs. Our Nominating Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks associated with Board organization, membership and structure, succession planning for our directors and executive officers and corporate governance.

Stockholder Communications to our Board

Generally, stockholders who have questions or concerns should contact our Investor Relations team at 917-595-2856. However, any stockholders who wish to address questions regarding our business directly with our Board, or any individual director, should direct his or her questions in writing to the Chairman of the Board at 3960 Howard Hughes Parkway, Suite 500, Las Vegas, Nevada, 89169. These communications will be reviewed by our Chief Executive Officer, who will determine whether the communications should be presented to our Board. The purpose of this screening is to allow the Board to avoid having to consider irrelevant or inappropriate communications.

Communications will be distributed to our Board, or to any individual director or directors as appropriate, depending on the facts and circumstances outlined in the communications. Items that are unrelated to the duties and responsibilities of our Board may be excluded, such as:

| · | junk mail and mass mailings; | |

| · | resumes and other forms of job inquiries; | |

| · | surveys; and | |

| · | solicitations or advertisements. |

In addition, any material that is unduly hostile, threatening, or illegal in nature may be excluded, in which case it will be made available to any outside director upon request.

Executive Officers

As of March 27, 2024, we have two executive officers. Mr. Silverman serves as our Interim Chairman, Interim Chief Executive Officer and Interim President, and his biography is set forth above under “Our Board.” Mr. Silverman is an at-will employee. Mr. Trujillo serves as our Chief Financial Officer, and his biography is set forth below. We have an employment agreement with Mr. Trujillo.

| 15 |

Carlos A. Trujillo, 66, has been our Chief Financial Officer since March 2017 and served as a member of the Board from March 2017 to August 2022. Prior to this, Mr. Trujillo served as our Vice President of Finance from January 2015 to March 2017 after joining us as an independent contractor in September 2014. From January 2015 until March 2017, Mr. Trujillo served as Vice President of Finance for Viridis Biotech, Inc. and from March 2017 to current day, has been the Chief Financial Officer of Viridis. Mr. Trujillo has over three decades of experience in management, business, operations and financial accounting. From June 2008 through September 2014, Mr. Trujillo was the Chief Financial Officer of VelaTel Global Communications, Inc. In 1996, Mr. Trujillo established a consulting and accounting practice, through which he provided services as the chief financial accountant to numerous organizations in several different industries. Mr. Trujillo started his career in public accounting in 1983 and was the manager of an audit department in a regional public accounting firm. Mr. Trujillo’s experience has extended to companies in the biotechnology, telecommunications, manufacturing, construction and real estate development sectors. He has experience in preparing and filing periodic reports with the SEC, in mergers and acquisitions and in the preparation of comprehensive financial statements. Mr. Trujillo received his Bachelor of Accounting degree from California State University, Fullerton in 1982 and is a Certified Public Accountant with an active license from the State of California.

| 16 |

EXECUTIVE OFFICER AND DIRECTOR COMPENSATION

This section discusses the material components of the executive compensation program for our executive officers who are named in the “Summary Compensation Table” below (each a “Named Executive Officer”), as well as the director compensation program for our directors. As a smaller reporting company, we are not required to include a Compensation Discussion and Analysis and have elected to comply with the scaled disclosure requirements applicable to smaller reporting companies.

For our fiscal year ended April 30, 2023, our Named Executive Officers and their positions were as follows:

| · | Joshua N. Silverman, current Interim Chief Executive Office, President and Chairman of the Board; | |

| · | Kenneth L. Waggoner, former Chief Executive Officer, President, General Counsel and Chairman of the Board; | |

| · | Gerald W. Crabtree, former Chief Scientific Officer and Director; and | |

| · | Carlos A. Trujillo, Chief Financial Officer and former Director. |

The following tables provide information about compensation earned during our fiscal years ended April 30, 2023 and 2022, by our Named Executive Officers.

| Name | Principal Position | Fiscal Year |

Salary ($) |

Bonus ($) |

Stock Awards ($)(1) |

Option Awards ($)(1) |

Total ($) |

|||||||||||||

| Joshua N. Silverman | Interim Chief Executive | 2023 | $ | 197,917 | $ | – | $ | – | $ | – | $ | 197,917 | ||||||||

| Officer and Interim President | 2022 | $ | – | $ | – | $ | – | $ | – | $ | – | |||||||||

| Kenneth L. Waggoner (3) | Former Chief Executive | 2023 | $ | 433,334 | $ | – | $ | 4,000 | $ | 3,889 | $ | 441,223 | ||||||||

| Officer, President and | 2022 | $ | 674,295 | $ | 212,049 | $ | 18,080 | $ | 14,727 | $ | 919,151 | |||||||||

| General Counsel | ||||||||||||||||||||

| Gerald W. Crabtree, (4) | Former Chief Scientific | 2023 | $ | 64,695 | $ | – | $ | 667 | $ | 1,296 | $ | 66,658 | ||||||||

| Officer | 2022 | $ | 128,827 | $ | – | $ | 3,013 | $ | 4,909 | $ | 136,749 | |||||||||

| Carlos A. Trujillo | Chief Financial Officer | 2023 | $ | 380,000 | $ | – | $ | 2,667 | $ | 2,592 | $ | 385,259 | ||||||||

| 2022 | $ | 485,577 | $ | 124,402 | $ | 12,053 | $ | 9,819 | $ | 631,851 | ||||||||||

_____________________

(1) The amounts in the columns titled “Stock Awards” and “Option Awards” reflect the grant date fair values of awards made during the identified fiscal year, as computed in accordance with FASB ASC Topic 718 and the assumptions stated in Note 4 and Note 5 of the Consolidated Financial Statements to this Report.

(2) Includes $10,417 of compensation for Mr. Silverman’s service as a member of the board of directors.

(3) Mr. Waggoner resigned from all positions with the Company and its subsidiaries effective October 6, 2022.

(4) Dr. Crabtree resigned from all positions with the Company and its subsidiaries effective October 12, 2022.

| 17 |

Narrative Disclosure To Summary Compensation Table

Employment Arrangements

Joshua N. Silverman

On November 14, 2022, the Board approved employment of Mr. Silverman as the Interim Chief Executive Officer, Interim President and Interim Chairman of the Board on a month-to-month basis, and it further approved paying Mr. Silverman a monthly salary of $31,250.

Kenneth L. Waggoner

On May 8, 2022, we entered into an Amended and Restated Executive Compensation Agreement with Mr. Waggoner (the “Waggoner Compensation Agreement”), effective as of January 1, 2022. The Waggoner Compensation Agreement provided that Mr. Waggoner would serve as a member of our Board, as our Chief Executive Officer, President and General Counsel and as the Chief Executive Officer and General Counsel of our subsidiary Viridis Biotech, Inc. Under this agreement, Mr. Waggoner was paid a base salary of $520,000 subject to annual increases in the discretion of our Compensation Committee and was eligible to receive cash incentive compensation (“Bonus”). Mr. Waggoner was eligible to participate in the 2021 Plan. On May 20, 2022, the Compensation Committee granted Mr. Waggoner (i) a stock option grant to purchase 529,000 shares of common stock exercisable over a ten-year term at an exercise price per share equal to the closing price of the common stock on the date of grant, vesting at the rate of 25% immediately and the remaining vesting monthly over three years from the date of grant (approximately 11,000 option shares per month), and (ii) a grant of 150,800 restricted stock units, vesting at the rate of 25% immediately and an additional 25% on each anniversary of the grant date.

On October 6, 2022, Mr. Waggoner resigned from all positions with the Company and its subsidiaries, effective immediately. In connection with Mr. Waggoner’s departure, on October 6, 2022, the Company entered into a Separation, Consulting and Release Agreement with Mr. Waggoner (the “Separation Agreement”). The Separation Agreement became effective on October 13, 2022 (the “Effective Date”). Pursuant to the Separation Agreement, the Company agreed to pay Mr. Waggoner a lump sum payment of $216,667. Mr. Waggoner is entitled to continued medical and health benefits at his sole expense and retains his option to purchase 15,000 shares of common stock of the Company and 23,000 restricted stock units previously granted to Mr. Waggoner. The Separation Agreement includes mutual releases of claims, by Mr. Waggoner in favor of the Company and certain Company Parties (as defined therein) and by the Company in favor of Mr. Waggoner, and mutual non-disparagement obligations on Mr. Waggoner and on the Company. Mr. Waggoner remains subject to certain restrictive covenants, including any confidentiality, non-compete, non-solicit, invention assignment, or similar agreement or arrangement to which he is a party with any member of the Company Group and other provisions of the Waggoner Compensation Agreement. During the twelve months immediately following the Separation Date (the “Consulting Period”), Mr. Waggoner agreed to serve as a consultant to facilitate the orderly transfer of work to other employees of the Company. In consideration for Mr. Waggoner’s consulting services, the Company agreed to pay Mr. Waggoner $433,333, payable in twelve installments at the end of each month of the Consulting Period in arrears.

Gerald W. Crabtree

On March 10, 2015, we entered into an Executive Compensation Agreement with Dr. Crabtree, effective as of January 1, 2015 (as amended on December 30, 2015, March 10, 2017 and October 14, 2020, the “Crabtree Compensation Agreement”). The Crabtree Compensation Agreement provided that Dr. Crabtree would serve as a member of our Board, as our Chief Scientific Officer and as the Chief Scientific Officer of our subsidiary Viridis Biotech. Dr. Crabtree was paid a base salary of $84,000 subject to annual increases in the discretion of our Compensation Committee. The Crabtree Compensation Agreement also provided that, during his continued employment, Dr. Crabtree would receive annual stock grants of 400 shares of restricted common stock, vesting at the rate of 33 shares per month, and an annual stock option grant to purchase 1,000 shares of common stock exercisable over a five-year term at an exercise price per share equal to the closing price of the common stock on the date of grant, vesting at the rate of 83 option shares per month.

| 18 |

On August 15, 2022, Mr. Crabtree resigned from his position as a director, effective immediately, and on October 12, 2022, Mr. Crabtree resigned from his position as Chief Scientific Officer, effective immediately. In connection with Mr. Crabtree’s departure, on October 12, 2022, the Company entered into a Release Agreement with Mr. Crabtree (the “Release Agreement”). The Release Agreement became irrevocable seven days after execution of the Release Agreement and became effective on October 20, 2022 (the “Effective Date”). Pursuant to the Release Agreement, the Company agreed to pay Mr. Crabtree the aggregate sum of $29,694.88, which consisted of accrued wages, expense reimbursements, accrued unused paid time off (less applicable withholdings and deductions), and three months of Mr. Crabtree’s base salary as of the separation date, which salary is payable in substantially equal installments over a three-month period in accordance with the Company’s regular payroll practices. The Release Agreement includes releases of claims by Mr. Crabtree in favor of the Company and certain Released Parties (as defined therein). Mr. Crabtree remains subject to certain continuing obligations, including a confidentiality agreement to which he is a party.

Carlos A. Trujillo

On May 8, 2022, we entered into an Amended and Restated Executive Compensation Agreement with Mr. Trujillo (the “Trujillo Compensation Agreement”), effective as of January 1, 2022. The current term of the Trujillo Compensation Agreement extends until December 31, 2024, with annual extensions at the end of the term (or any extension of the term) unless we or Mr. Trujillo provide 90-days written notice of termination.

The Trujillo Compensation Agreement provided that Mr. Trujillo will serve as a member of our Board, from which he resigned on August 15, 2022, and as our Chief Financial Officer. Mr. Trujillo is paid an annual base salary of $380,000, subject to annual increases at the discretion of the Compensation Committee and shall be eligible to receive an annual Bonus. Mr. Trujillo is eligible to participate in the 2021 Plan. On May 20, 2022, the Compensation Committee granted Mr. Trujillo (i) a stock option grant to purchase 201,860 shares of common stock exercisable over a ten-year term at an exercise price per share equal to the closing price of the common stock on the date of grant, vesting at the rate of 25% immediately and the remaining vesting monthly over three years from the date of grant, approximately 4,200 option shares per month, and (ii) a grant of 57,540 restricted stock units, vesting at the rate of 25% immediately and an additional 25% on each anniversary of the grant date.

If Mr. Trujillo’s employment is terminated by us without “Cause” or by him for “Good Reason” (as such terms are defined in the Trujillo Compensation Agreement), then subject to his execution of a timely release, he is entitled to: (i) severance equal to two times the sum of his base salary at the time his employment terminates, (ii) payment of the annual bonus, if any, earned by Mr. Trujillo for the year preceding the year of termination, or, if greater, the target bonus, if any, for the year of termination, (iii) accelerated vesting of any unvested stock or option awards and (iv) continued health coverage for Mr. Trujillo and his family and life insurance coverage for Mr. Trujillo, if any, at the Company’s expense until the earliest of: (A) the eighteen-month anniversary of termination; (B) the date Mr. Trujillo is no longer eligible to receive COBRA continuation coverage; and (C) the date on which Mr. Trujillo receives or becomes eligible to receive substantially similar coverage from another employer.

Notwithstanding the foregoing, if Mr. Trujillo’s employment is terminated by us without Cause or by him for Good Reason within two years after a “Change in Control” (as such term is defined in the Trujillo Compensation Agreement) or within six months prior to a Change in Control, then the base salary and bonus, if any, component of severance would be paid in lump sum. Also, Mr. Trujillo would be entitled to receive a full Code Section 280G tax gross-up, with respect to any amounts that may be subject to the excise tax provisions under Code Section 280G.

If Mr. Trujillo’s employment ceases due to his death, (i) any otherwise unvested equity awards held by him at the time of his death would become vested, (ii) his eligible dependents would be entitled to continued healthcare coverage at the Company’s expense for up to 18 months, and (iii) his designated beneficiary or estate would receive the proceeds, if any, from any life insurance.

| 19 |

If Mr. Trujillo’s employment is terminated due to “Disability” (as such term is defined in the Trujillo Compensation Agreement) he would receive continued health coverage and life insurance coverage, if any, for 18 months at our expense, as well as any disability benefits payable under any long-term disability plan or policy we maintain. In addition, any otherwise unvested equity awards would then become vested.

Additionally, Mr. Trujillo is bound by confidentiality and non-disparagement provisions as well as non-solicitation and non-competition covenants that apply during the term of his employment and for twenty-four months after termination of his employment.

Outstanding Equity Awards at Fiscal Year-End

The following table shows grants of stock options and grants of unvested stock awards outstanding on the last day of the fiscal year ended April 30, 2023, including both awards subject to performance conditions and non-performance-based awards, to each of the executive officers named in the Summary Compensation Table.

| Option Awards |

| Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price ($) | Option Expiration Date | ||||||||||||

| Kenneth L. Waggoner (1) | ||||||||||||||||

| 3,000 | – | $ | 74.25 | 03/20/2024 | ||||||||||||

| 3,000 | – | $ | 61.20 | 01/02/2025 | ||||||||||||

| 3,000 | – | $ | 10.05 | 12/31/2025 | ||||||||||||

| 3,000 | – | $ | 2.50 | 01/01/2027 | ||||||||||||

| – | – | $ | – | – | ||||||||||||

| Gerald W. Crabtree (2) | ||||||||||||||||

| 1,000 | – | $ | 74.25 | 12/31/2024 | ||||||||||||

| 1,000 | – | $ | 61.20 | 01/02/2025 | ||||||||||||

| 1,000 | – | $ | 10.05 | 12/31/2026 | ||||||||||||

| 1,000 | – | $ | 2.50 | 01/01/2027 |

||||||||||||

| – | – | $ | – | – | ||||||||||||

| Carlos A. Trujillo | ||||||||||||||||

| 2,000 | – | $ | 74.25 | 12/31/2024 | ||||||||||||

| 2,000 | – | $ | 61.20 | 01/02/2025 | ||||||||||||

| 2,000 | – | $ | 10.05 | 12/31/2025 | ||||||||||||

| 2,000 | – | $ | 2.50 | 01/01/2027 | ||||||||||||

| – | – | $ | – | – | ||||||||||||

__________________

| (1) | Mr. Waggoner resigned from all positions with the Company effective October 6, 2022. | |

| (2) | Mr. Crabtree resigned from all positions with the Company effective October 12, 2022. |

| 20 |

Potential Payments upon Termination or Change-In-Control

Employment Agreements

Information regarding potential payments upon termination or change-in-control pursuant to employment agreements with officers of the Company is set forth above.

2021 Plan

Under our 2021 Plan, upon a Change in Control (as defined in the 2021 Plan), the Compensation Committee may, in its sole discretion, take one or more of the following actions:

| · | cause any or all outstanding awards to become vested and immediately exercisable (as applicable), in whole or in part; | |

| · | cause any outstanding option or stock appreciation right to become fully vested and immediately exercisable for a reasonable period in advance of the Change in Control and, to the extent not exercised prior to that Change in Control, cancel that option or stock appreciation right upon closing of the Change in Control; | |

| · | cancel any unvested award or unvested portion thereof, with or without consideration; | |

| · | cancel any award in exchange for a substitute award; | |

| · | redeem any restricted stock or restricted stock unit for cash and/or other substitute consideration with value equal to the fair market value of an unrestricted share on the date of the Change in Control; | |

| · | cancel any option or stock appreciation right in exchange for cash and/or other substitute consideration with a value equal to: (a) the number of shares subject to that option or stock appreciation right, multiplied by (b) the difference, if any, between the fair market value on the date of the Change in Control and the exercise price of that option or the base price of the stock appreciation right; provided, that if the fair market value on the date of the Change in Control does not exceed the exercise price of any such option or the base price of any such stock appreciation right, the committee may cancel that option or stock appreciation right without any payment of consideration therefor; and/or | |

| · | take such other action as the Compensation Committee determines to be appropriate under the circumstances. |

Further, in the discretion of the Compensation Committee, any cash or substitute consideration payable upon cancellation of an award may be subjected to (i) vesting terms substantially identical to those that applied to the cancelled award immediately prior to the Change in Control, or (ii) earn-out, escrow, holdback or similar arrangements, to the extent such arrangements are applicable to any consideration paid to stockholders in connection with the Change in Control.

Under the 2021 Plan, upon termination of a participant’s service with the Company and unless otherwise specified in an applicable award agreement, any portion of an option or stock appreciation right that is not exercisable upon termination will expire immediately, and any portion of an option or stock appreciation right that is exercisable upon termination will expire on the date it ceases to be exercisable, as determined by the reason for termination:

| · | Termination by reason of death: If a participant’s service with the Company terminates by reason of death, any option or stock appreciation right held by such participant may thereafter be exercised, to the extent it was exercisable at the time of his or her death or on such accelerated basis as the Compensation Committee may determine at or after grant, by the legal representative of the estate or by the legatee of the participant, for a period expiring (i) at such time as may be specified by the Compensation Committee at or after grant, or (ii) if not specified by the Compensation Committee, then 12 months from the date of death, or (iii) if sooner than the applicable period specified under (i) or (ii) above, upon the expiration of the stated term of such option or stock appreciation right. | |

| · | Termination by reason of disability: If a participant’s service with the Company terminates by reason of disability, any option or stock appreciation right held by such participant may thereafter be exercised by the participant or his or her personal representative, to the extent it was exercisable at the time of termination, or on such accelerated basis as the Compensation Committee may determine at or after grant, for a period expiring (i) at such time as may be specified by the Compensation Committee at or after grant, or (ii) if not specified by the Compensation Committee, then 12 months from the date of termination of service, or (iii) if sooner than the applicable period specified under (i) or (ii) above, upon the expiration of the stated term of such option or stock appreciation right. |

| 21 |