UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

For the fiscal year ended

or

For the transition period from __________ to __________

Commission File Number

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

|

|

( |

| (Address of principal executive offices) | (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

|

The (Nasdaq Capital Market) |

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405)

during the precedent 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| ☒ | Smaller reporting company | |||||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

State the aggregate market value of the voting

and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the

average bid and asked price of such common equity, as of October 31, 2021: $

As of July 28, 2022, the registrant had outstanding shares of common stock.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

| ii |

Cautionary Note Regarding Forward-Looking Statements

This Report on Form 10-K (“Report”) includes “forward-looking statements” within the meaning of the federal securities laws. All statements other than statements of historical fact are “forward-looking statements” for purposes of this Report, including any projections of earnings, revenue or other financial items, any statements regarding the plans and objectives of management for future operations, any statements concerning proposed new products or services, any statements regarding future economic conditions or performance, any statements regarding expected benefits from any transactions and any statements of assumptions underlying any of the foregoing. In some cases, forward-looking statements can be identified by use of terminology such as “may,” “will,” “should,” “believes,” “intends,” “expects,” “plans,” “anticipates,” “estimates,” “goal,” “aim,” “potential” or “continue,” or the negative thereof or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements contained in this Report are reasonable, there can be no assurance that such expectations or any of the forward-looking statements will prove to be correct, and actual results could differ materially from those projected or assumed in the forward-looking statements. Thus, investors should refer to and carefully review information in future documents we file with the U.S. Securities and Exchange Commission (“Commission”). Our future financial condition and results of operations, as well as any forward-looking statements, are subject to inherent risk and uncertainties, including, but not limited to, the risk factors set forth in “Part I, Item 1A – Risk Factors” set forth in this Report and for the reasons described elsewhere in this Report. Among others, these include our estimates regarding expenses, future revenues, capital requirements and needs for additional financing; whether the United States Food and Drug Administration (“FDA”) approves our Investigational New Drug Application (“IND”) after we complete the FDA’s requested studies and submit a response to the FDA’s clinical hold, so that we can commence our planned clinical trial involving locally advanced, inoperable, non-metastatic pancreatic cancer (“LAPC”); the success and timing of our preclinical studies and clinical trials; the potential that results of preclinical studies and clinical trials may indicate that any of our technologies and product candidates are unsafe or ineffective; our dependence on third parties in the conduct of our preclinical studies and clinical trials; the difficulties and expenses associated with obtaining and maintaining regulatory approval of our product candidates; the material adverse impact that the coronavirus pandemic may have on our business, including our planned clinical trial involving LAPC, which could materially affect our operations as well as the business or operations of third parties with whom we conduct business; and whether the FDA will approve our product candidates after our clinical trials are completed, assuming the FDA allows our clinical trials to proceed after submission and review of our response to the FDA’s clinical hold. All forward- looking statements and reasons why results may differ included in this Report are made as of the date hereof, and we do not intend to update any forward-looking statements except as required by law or applicable regulations. Except where the context otherwise requires, in this Report, the “Company,” “we,” “us” and “our” refer to PharmaCyte Biotech, Inc., a Nevada corporation, and, where appropriate, its subsidiaries.

| iii |

PART I

ITEM 1. BUSINESS.

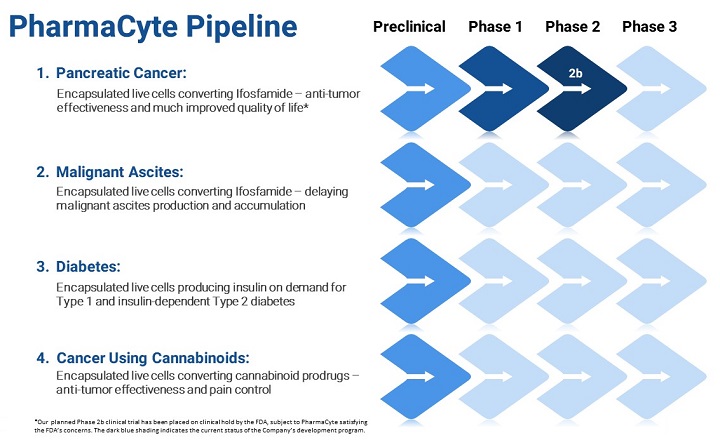

Product Candidates

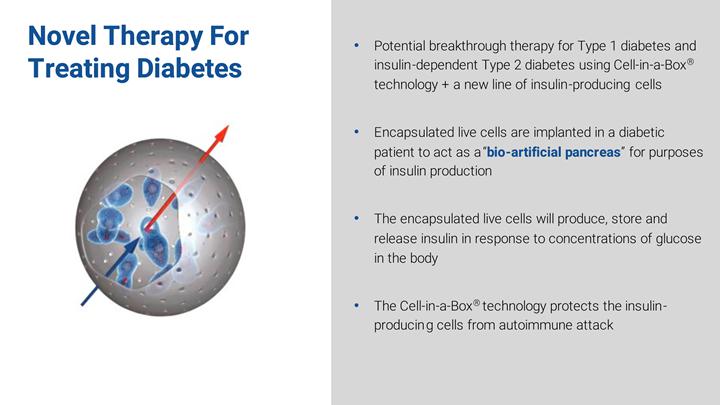

We are a biotechnology company focused on developing cellular therapies for cancer, diabetes, and malignant ascites based upon a proprietary cellulose-based live cell encapsulation technology known as “Cell-in-a-Box®..” The Cell-in-a-Box® technology is intended to be used as a platform upon which therapies for several types of cancer, including LAPC, will be developed. The current generation of our product candidate is referred to as “CypCaps™.”

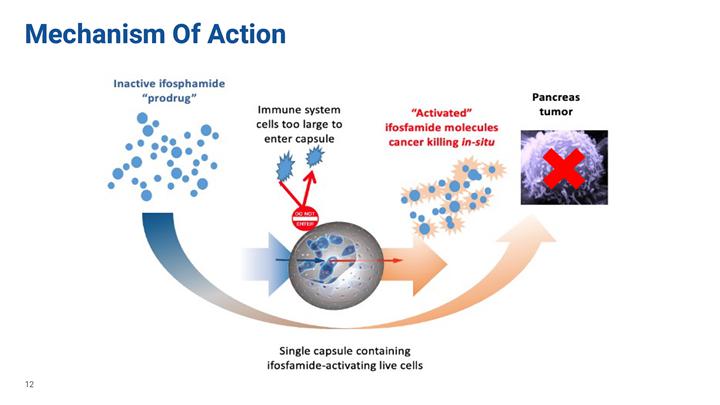

The Cell-in-a-Box® encapsulation technology potentially enables genetically engineered live human cells to be used to produce various biologically -active molecules. The technology is intended to result in the formation of pinhead -sized cellulose-based porous capsules in which genetically modified live human cells can be encapsulated and maintained. In a laboratory setting, this proprietary live cell encapsulation technology has been shown to create a micro-environment in which encapsulated cells survive and flourish. They are protected from environmental challenges, such as the sheer forces associated with bioreactors and passage through catheters and needles, etc., which we believe enables greater growth and production. The capsules are largely composed of cellulose (cotton) and are bio inert.

We are developing therapies for pancreatic and other solid cancerous tumors by using genetically engineered live human cells that we believe are capable of converting a cancer prodrug into its cancer-killing form. We encapsulate those cells using the Cell-in-a-Box® technology and place those capsules in the body as close as possible to the tumor. In this way, we believe that when a cancer prodrug is administered to a patient with a particular type of cancer that may be affected by the prodrug, the killing of the patient’s cancerous tumor may be optimized.

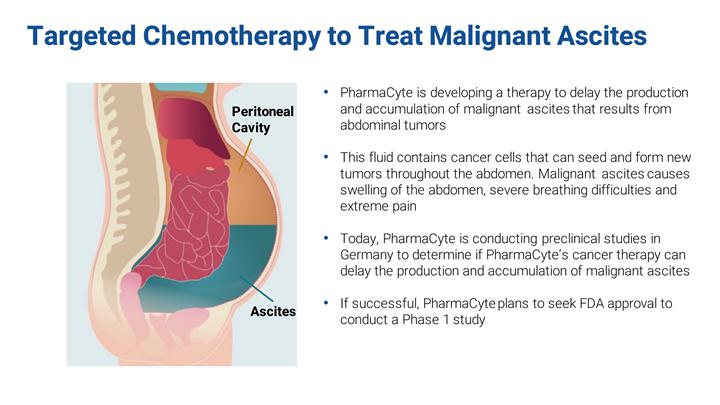

We are also developing a way to delay the production and accumulation of malignant ascites that results from many types of abdominal cancerous tumors. Our potential therapy for malignant ascites involves using the same encapsulated cells we employ for pancreatic cancer but placing the encapsulated cells in the peritoneal cavity of a patient and administering ifosfamide intravenously.

We have also been developing a potential therapy for Type 1 diabetes and insulin-dependent Type 2 diabetes. Our product candidate for the treatment of diabetes consists of encapsulated genetically modified insulin-producing cells. The encapsulation will be done using the Cell-in-a-Box® technology. Implanting these encapsulated cells in the body is designed to have them function as a bio-artificial pancreas for purposes of insulin production.

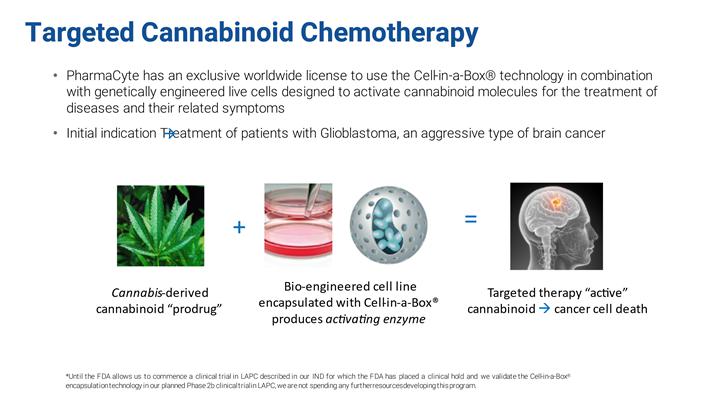

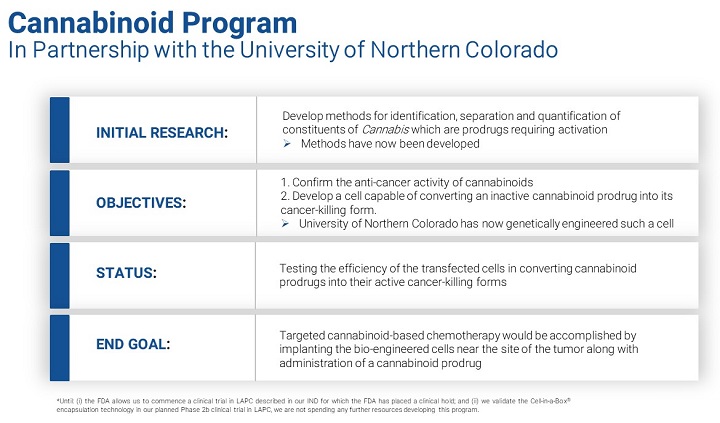

In addition to the two cancer programs discussed above, we have been working on ways to exploit the benefits of the Cell-in-a-Box® technology to develop therapies for cancer that involve prodrugs based upon certain constituents of the Cannabis plant. However, until the FDA allows us to commence our clinical trial in LAPC and we are able to validate our Cell-in-a-Box® encapsulation technology in a clinical trial, we are not spending any further resources developing our Cannabis Program.

| 1 |

Cancer Therapy

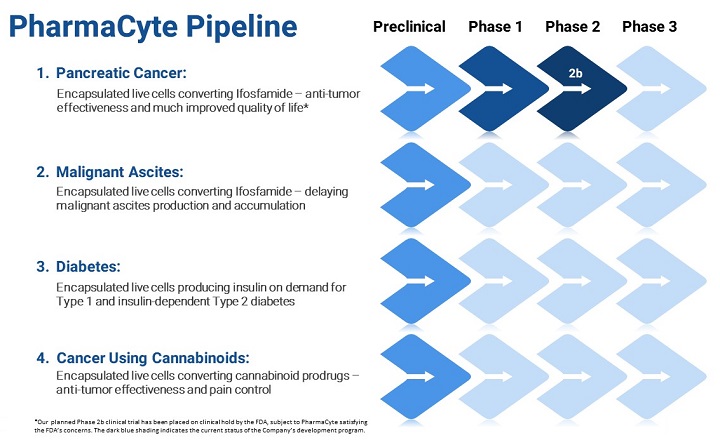

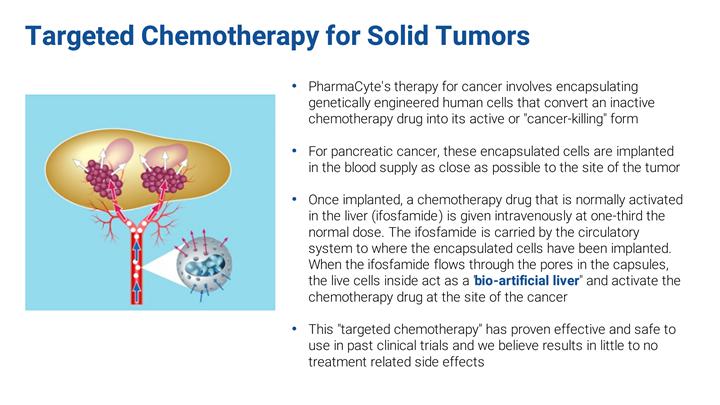

Targeted Chemotherapy

Our therapy for cancer involves encapsulating genetically engineered human cells that convert an inactive chemotherapy drug into its active or “cancer-killing” form. For pancreatic cancer, these encapsulated cells are implanted in the blood supply to the patient’s tumor as close as possible to the site of the tumor. Once implanted, a chemotherapy drug that is normally activated in the liver (ifosfamide) is given intravenously at one-third the normal dose. The ifosfamide is carried by the circulatory system to where the encapsulated cells have been implanted. When the ifosfamide flows through pores in the capsules, the live cells inside act as a “bio-artificial liver” and activate the chemotherapy drug at the site of the cancer.

| 2 |

| 3 |

Pancreatic Cancer

| 4 |

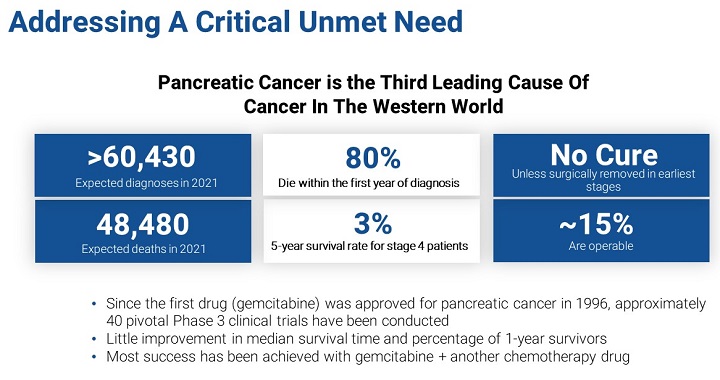

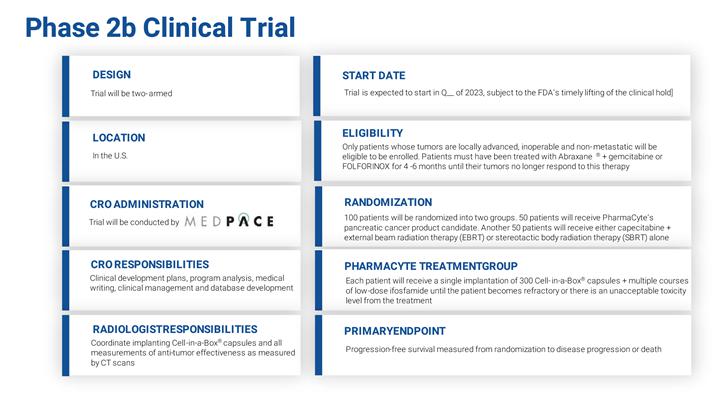

We believe an unmet medical need exists for patients with LAPC whose pancreas tumor no longer responds after 4-6 months of treatment with either Abraxane® plus gemcitabine or the 4-drug combination known as FOLFIRINOX. Both combinations are the current standards of care for pancreatic cancer. We believe that these refractory patients have no effective treatment alternative once their tumors no longer respond to these therapies. Treatments are being tried at various cancer centers in the U.S. in an attempt to address this lack of an effective treatment for LAPC patients, but their success is far from certain.

Two of the most commonly used treatments for these patients are 5-fluorouracil (“5-FU”) or capecitabine (a prodrug of 5-FU) plus radiation (chemoradiation therapy). More recently, radiation treatment alone is being used at some cancer centers in the U.S.

We believe that these treatments are only marginally effective in treating the LAPC tumor and result in serious side effects.

We believe that our therapy for LAPC, if approved, can serve as a “consolidation therapy” that can be used with the current standards of care and thus address this critical unmet medical need. On September 1, 2020, we submitted an Investigational New Drug Application (“IND”) to the FDA for a planned Phase 2b clinical trial in LAPC. Highlights of our planned clinical trial are shown below:

| 5 |

Clinical Hold

On October 1, 2020, we received notice from the FDA that it had placed our IND on clinical hold. On October 30, 2020, the FDA sent us a letter setting forth the reasons for the clinical hold and providing specific guidance on what we must do to have the clinical hold lifted.

In order to address the clinical hold, the FDA has requested that we:

| · | Provide additional sequencing data and genetic stability studies; |

| · | Conduct a stability study on our final formulated product candidate as well as the cells from our Master Cell Bank (“MCB”); |

| · | Evaluate the compatibility of the delivery devices (the prefilled syringe and the microcatheter used to implant the CypCaps™) with our product candidate for pancreatic cancer; |

| · | Provide additional detailed description of the manufacturing process of our product candidate for pancreatic cancer; |

| · | Provide additional product release specifications for our encapsulated cells; |

| · | Demonstrate comparability between the 1st and 2nd generation of our product candidate for pancreatic cancer and ensure adequate and consistent product performance and safety between the two generations; |

| · | Conduct a biocompatibility assessment using the capsules material; |

| · | Address specified insufficiencies in the Chemistry, Manufacturing and Controls information in the cross-referenced Drug Master File; |

| · | Conduct an additional nonclinical study in a large animal (such as a pig) to assess the safety, activity, and distribution of the product candidate for pancreatic cancer; and |

| · | Revise the Investigators Brochure to include any additional preclinical studies conducted in response to the clinical hold and remove any statements not supported by the data we generated. |

The FDA also requested that we address the following issues as an amendment to our IND:

| · | Provide a Certificate of Analysis for pc3/2B1 plasmid that includes tests for assessing purity, safety, and potency; |

| · | Perform qualification studies for the drug substance filling step to ensure that the product candidate for pancreatic cancer remains sterile and stable during the filling process; |

| · | Submit an updated batch analysis for the product candidate for the specific lot that will be used for manufacturing all future product candidates; |

| · | Provide additional details for the methodology for the Resorufin (CYP2B1) potency and the PrestoBlue cell metabolic assays; |

| · | Provide a few examples of common microcatheters that fit the specifications in our Angiography Procedure Manual; |

| · | Clarify the language in our Pharmacy Manual regarding proper use of the syringe fill with the product candidate for pancreatic cancer; and |

| · | Provide a discussion with data for trial of the potential for cellular and humoral immune reactivity against the heterologous rat CYP2B1 protein and potential for induction of autoimmune-mediated toxicities in our study population. |

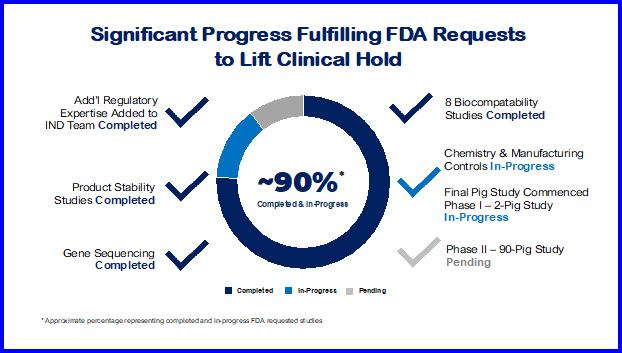

We assembled a scientific and regulatory team of experts to address the FDA requests. That team has been working diligently to complete the items requested by the FDA. To date we believe we have made significant progress in fulfilling the FDA requests needed to lift the clinical hold.

| 6 |

The following provides a detailed summary of our activities to have the clinical hold lifted:

| · | Additional Regulatory Expertise Added to IND Team. In addition to our existing team of regulatory experts, we retained Biologics Consulting to perform a regulatory “Gap Analysis” and to assist us with our resubmission of the IND. Biologics Consulting is a full-service regulatory and product development consulting firm for biologics, pharmaceuticals and medical devices and has personnel with extensive FDA experience. |

| · | Stability Studies on Our Clinical Trial Product Candidate for Pancreatic Cancer. We have successfully completed the required product stability studies. The timepoints were 3, 6, 9, 12, 18 and 24-months of our product candidate for pancreatic cancer being stored frozen at -80C. These studies included container closure integrity testing for certain timepoints. |

| · | Additional Studies Requested by the FDA. We have successfully completed various additional studies requested by the FDA, including a stability study on the cells from our MCB used to make our CypCaps™. We are already at the 36-month stability timepoint for the cells from our MCB. We are also collating existing information on the reproducibility and quality of the filling of the MCB cells into vials ready for CypCaps™ manufacturing. |

| · | Determination of the Exact Sequence of the Cytochrome P450 2B1 Gene. We have completed the determination of the exact sequence of the cytochrome P450 2B1 gene inserted at the site previously identified on chromosome 9 using state-of-the-art nanopore sequencing. This is a cutting edge, unique and scalable technology that permits real-time analysis of long DNA fragments. The result of this analysis of the sequence data confirmed that the genes are intact. |

| 7 |

| · | Confirmation of the Exact Sequence of the Cytochrome P450 2B1 Gene Insert. An additional, more finely detailed, analysis of the integration site of the cytochrome P450 2B1 gene from the augmented HEK293 cell clone that is used in our CypCaps™ was found to be intact. In this new study, we were able to confirm the previously determined structure of the integrated transgene sequence using more data points. These studies also set the stage for a next step analysis to determine the genetic stability of the cytochrome P450 2B1 gene at the DNA level after multiple rounds of cell growth. This new study has been completed in which our original Research Cell Bank (“RCB”) cells were compared with cells from the MCB. The analysis confirmed that the cytochrome P450 2B1 and the surrounding sequence has remained stable with no changes detected at the DNA level. |

|

|

· |

Biocompatibility Studies. We have been involved with 10 biocompatibility studies requested by the FDA, 8 of which have been completed successfully. The remaining studies are underway or about to start. The Acute Systemic Toxicity Study of Empty Cellulose Sulphate Capsules in Mice is underway. The Skin Sensitization Study of Empty Cellulose Sulphate Capsules in Guinea Pigs is about to start. These last two studies should be completed well before the pig study (see below) is completed.

To enable the biocompatibility studies to be performed, we had Austrianova Singapore Pte. Ltd. (“Austrianova”) manufacture an additional 400 syringes of empty capsules.

Systemic Toxicity Testing. We evaluated the potential toxicity of the capsule component of our product candidate for pancreatic cancer and determined there is no evidence of toxicity in any of the parameters examined. The study also confirmed previous data that shows our capsule material is bioinert. |

| · | Micro-Compression and Swelling Testing. This testing is underway. We are developing and optimizing two reproducible methods for testing and confirming the physical stability and integrity of our CypCaps™ under extreme pressure. These studies required the acquisition of new equipment by Austrianova as well as validation and integration into Austrianova’s Quality Control laboratory. |

| · | Break Force and Glide Testing. We are in the process of developing a protocol to measure whether the syringe, attached to the catheter when used to expel the capsules, will still have a break and glide force that is within the specifications we have established. We are setting the specifications based on the syringe/plunger manufacturer’s measured break and glide forces, or alternatively, accepted ranges for glide forces routinely used in the clinic. |

| · | Capsules Compatibility with the Syringe and Other Components of the Microcatheter Delivery System. We are in the process of showing that CypCaps™ are not in any way adversely affected by the catheters used by interventional radiologists to deliver them into a patient. Compatibility data is being generated to demonstrate that the quality of the CypCaps™ is maintained after passage through the planned microcatheter systems. |

| · | CypCaps Capsules and Cell Viability after Exposure to Contrast Medium. We have commenced testing to show that exposure of CypCaps™ to the contrast medium interventional radiologists used to implant the CypCaps™ in a patient has no adverse effect on CypCaps™. Contrast medium is used to visualize the blood vessels during implantation. |

| · | Master Drug File Information. Austrianova is providing additional detailed confidential information on the manufacturing process, including information on the improvements and advancements made to our product candidate for pancreatic cancer since the last clinical trials were conducted with respect to reproducibility and safety. However, Austrianova has not changed the overall physical characteristics of CypCaps™ between the 1st and 2nd generations. We are supporting Austrianova financially with this work. |

| · | Additional Documentation Requested by the FDA. We are in the process of updating our IND submission documentation, including our discussion on immunological aspects of our treatment for LAPC. |

| · | Pig Study. We have commenced a study in pigs to address biocompatibility and long-term implantation and dispersion of CypCaps™. The study has two phases: (i) a pilot study with 2 pigs; and (ii) a 90-pig study. The first phase has commenced. We believe this study should complement the positive data already available from the previous human clinical trials showing the safety of CypCaps™ implantation in human patients. On July 21, 2022, the first phase of the pig study commenced. The second phase of the pig study may be delayed as a result of supply chain problems, including production delays at Austrianova possibly related to their financial condition. |

| 8 |

Malignant Ascites

| 9 |

We have been exploring ways to delay the production and accumulation of malignant ascites that results from several types of abdominal tumors. Malignant ascites is a fluid that is secreted by an abdominal tumor into the abdomen after the tumor reaches a certain stage of growth. This fluid contains cancer cells that can seed and form new tumors throughout the abdomen. As this malignant ascites fluid accumulates in the abdominal cavity, it can cause gross swelling of the abdomen, severe breathing difficulties and extreme pain. Accumulated malignant ascites must be removed by paracentesis on a periodic basis. This procedure is painful and costly. We know of no available therapy that prevents or delays the production and accumulation of malignant ascites. Seven preclinical studies were conducted by Translational Drug Development (“TD2”), an early-stage clinical research organization (“CRO”) specializing in oncology, to determine whether the combination of Cell-in-a-Box® encapsulated cells plus low doses of ifosfamide could delay the production and accumulation of malignant ascites. The data from these studies suggested that our cancer therapy might play a role in malignant ascites fluid production and accumulation. However, the data were difficult to interpret with certainty.

On May 23, 2022, we initiated the first in a new series of studies to test the ability of our pancreatic cancer therapy to treat malignant ascites. This is the eighth and final preclinical study that may lead to a Phase 1 clinical trial. Such a clinical trial may allow us to validate the Cell-in-a-Box® technology much faster than our planned Phase 2b clinical trial in LAPC.

If this new series of studies is successful, we plan to submit an IND to seek approval from the FDA to conduct a Phase 1 clinical trial to determine if our product candidate for pancreatic cancer can delay the production and accumulation of malignant ascites.

Diabetes Therapy

| 10 |

A Bio-Artificial Pancreas to Treat Diabetes

We are developing a therapy for Type 1 diabetes and insulin-dependent Type 2 diabetes based upon the encapsulation of a human cell line genetically engineered to produce, store and release insulin at levels in proportion to the levels of blood sugar in the human body.

The cell line we select will be encapsulated using the Cell-in-a-Box® encapsulation technology.

If appropriate animal testing is completed successfully, we intend to submit an IND to the FDA to seek its approval to transplant encapsulated insulin-producing cells into diabetic patients. The goal for this approach is to develop a bio-artificial pancreas for purposes of insulin production for diabetic patients who are insulin-dependent.

| 11 |

Our diabetes program began with two of the most critical components of a biological diabetes therapy - a line of human cells which release insulin in response to the blood glucose level in their environment and a technology to protect the cells from an attack by the immune system once they are transplanted into a patient to replace his or her own destroyed insulin-producing cells. This technology is the Cell-in-a-Box® encapsulation technology. The cells we initially used are Melligen cells. They are patent-protected and have been licensed to us by University of Technology Sydney (“UTS”).

Putting Melligen cells and the Cell-in-a-Box® technology together, we conducted the first functional study in diabetic mice. The results did not meet our expectations. We discovered that, contrary to what we had expected and what we had read in published scientific papers on the Melligen cells published by UTS, the cells are not stable. With extensive testing and experiments, we discovered that the Melligen cells lose some of their specific beneficial properties over time.

We entered into a research agreement with UTS to create an advanced version of the Melligen cells for the treatment of diabetes. Under this agreement, improvements are to be made to the Melligen cells that we believe will increase their stability, increase their insulin production and increase the bioactivity of the produced insulin.

Until recently, UTS has been conducting this research. The work is being funded by us and UTS. Our portion of the funding was previously paid to UTS. The research to date has not produced the results we had anticipated and is taking longer than we anticipated. It remains to be seen whether the Melligen cells are capable of producing the required insulin to be a viable cell line for the treatment of diabetes. Further research is requied.

Meanwhile, we have been working with two internationally renowned academic institutions to develop a cell line that will form the backbone of our Diabetes Program. These institutions are developing a stem-cell derived beta islet cell that we plan to encapsulate to treat Type 1 and insulin-dependent Type 2 diabetes. We are currently negotiating agreements with these institutions, although no assurance can be give that the negotiations will be successful.

| 12 |

Cannabinoids to Treat Cancer

| 13 |

Numerous studies have demonstrated the therapeutic potential of certain cannabinoids in patients with cancer. Studies have shown that cannabinoids are potentially: (i) anti-proliferative (slow tumor growth); (ii) anti-metastatic (slow tumor spread); (iii) anti-angiogenic (slowing blood vessel development); and (iv) pro-apoptotic initiate programed cell death). In in vitro and in vivo models, the therapeutic potential of cannabinoids is broad. Results support the therapeutic potential in lung, brain, thyroid, lymphoma, liver, skin, pancreas, uterus breast and prostate cancers.

We intend to use the Cell-in-a-Box® technology in combination with genetically modified cell lines designed to activate cannabinoid molecules for the treatment of diseases and their related symptoms. Our initial target will be glioblastoma – a very difficult-to treat form of brain cancer. However, until the FDA allows us to commence our clinical trial in LAPC and we are able to validate our Cell-in-a-Box® encapsulation technology in a clinical trial, we are not spending any further resources developing our Cannabis Program.

| 14 |

The goal of the original research was to develop methods for the identification, separation and quantification of constituents of Cannabis, some of which are prodrugs, which could potentially be used in combination with the Cell-in-a-Box® technology to treat cancer. After achieving this milestone, we then went on to assess the synthesis of the patG gene and its incorporation into a vector, transfection of human embryonic kidney cells using this vector and assessment of cannabinoic acid decarboxylase activity. We later identified an organism whose genome contains the genetic code for production of an enzyme capable of activating a cannabinoid prodrug into its active cancer-killing form.

Our Cannabis Program now has two primary areas of focus. The first is evaluating the therapeutic potential of cannabinoids in our main “target” tumor – glioblastoma. In laboratory research, we have confirmed that a purified cannabinoid showed a potent dose-dependent decrease in cell viability for various cancers, suggesting that this cannabinoid exhibits significant anti-proliferative effects (stops the growth and multiplication of cancer cells). This activity has been demonstrated in brain, pancreas, breast, lung, colon and melanoma cancer cells. The second area of focus is in finding an enzyme capable of converting an inactive, side-effect-free, cannabinoid prodrug into its active cancer-killing form.

Clinically, targeted cannabinoid-based chemotherapy would be accomplished by implanting the encapsulated bio-engineered cells near the site of a tumor, along with administration of a cannabinoid prodrug which would become activated at the site of the tumor by an enzyme produced by the encapsulated cells. We believe this could lead to better efficacy than existing therapies with minimal treatment related adverse events.

Impact of the COVID-19 Pandemic on Operations

The coronavirus SARS-Cov2 pandemic (“COVID-19”) continues to cause uncertainty and significant, industry-wide delays in clinical trials. The availability of vaccines holds promise for the future; however, new variants of the virus and potential waning immunity from vaccines may result in continued impact from COVID-19 in the future, which could adversely impact our operations. Although we are not yet in a clinical trial, we have filed an IND with the FDA to commence a clinical trial in LAPC. While the IND has been placed on clinical hold by the FDA, we have assessed the impact of COVID-19 on our operations.

As of the date of this Report, COVID-19 has had an impact upon our operations and that impact is increasing. The impact relates to, among other things, delays in (i) completing studies required by the FDA; (ii) manufacturing a new batch of CypCap™ for our planned clinical trial in LAPC; (iii) manufacturing syringes of CypCaps™ for use in our Malignant Ascites Program; (iv) securing third party contractors to conduct various research and development projects; and (v) disruptions in our supply chain.

As a result of COVID-19, commencement of our planned clinical trial to treat LAPC may be delayed beyond lifting of the clinical hold by the FDA should that occur. Also, enrollment may be difficult for the reasons discussed above. In addition, after enrollment in the trial, if a patient contracts COVID-19 during his or her participation in the trial or is subject to isolation or shelter in place restrictions, this may cause him or her to drop out of our clinical trial, miss scheduled therapy appointments or follow-up visits or otherwise fail to follow the clinical trial protocol. If a patient is unable to follow the clinical trial protocol or if the trial results are otherwise affected by the consequences of COVID-19 on patient participation or actions taken to mitigate COVID-19 spread, the integrity of data from the clinical trial may be compromised or not be accepted by the FDA. This could further adversely impact or delay our clinical development program if the FDA allows it to proceed.

Clinical trials in the biopharma industry may be delayed due to COVID-19. There are numerous reasons for these potential delays. For example, patients have shown a reluctance to enroll or continue in a clinical trial due to fear of exposure to COVID-19 when they are in a hospital or doctor’s office. There are local, regional, and state-wide orders and regulations restricting usual normal activity by people. These discourage and interfere with patient visits to a doctor’s office if the visit is not COVID-19 related. Healthcare providers and health systems are shifting their resources away from clinical trials toward the care of COVID-19 patients. The FDA and other healthcare providers are making product candidates for the treatment of COVID-19 a priority over product candidates unrelated to COVID-19.

It is highly speculative in projecting the effects of COVID-19 on our proposed clinical development program and our company generally. The effects of COVID-19 may quickly and dramatically change over time. Its evolution is difficult to predict, and no one can say with certainty when the pandemic will fully subside.

| 15 |

History of the Business

In 2013, we restructured our operations to focus on biotechnology. On January 6, 2015, we changed our name from “Nuvilex, Inc.” to “PharmaCyte Biotech, Inc.” to reflect the nature of our business.

We are a biotechnology company focused on developing and preparing to commercialize cellular therapies for cancer, diabetes, and malignant ascites using our live cell encapsulation technology. This resulted from entering into the following agreements.

Commencing in May 2011, we entered into a series of agreements and amendments with SG Austria Pte. Ltd. (“SG Austria”) to acquire certain assets from SG Austria as well as an exclusive, worldwide license to use, with a right to sublicense, the Cell-in-a-Box® technology and trademark for the development of therapies for cancer (“SG Austria APA”).

In June 2013, we and SG Austria entered a Third Addendum to the SG Austria APA (“Third Addendum”). The Third Addendum materially changed the transaction contemplated by the SG Austria APA. Under the Third Addendum, we acquired 100% of the equity interests in Bio Blue Bird and received a 14.5% equity interest in SG Austria. We paid: (i) $500,000 to retire all outstanding debt of Bio Blue Bird; and (ii) $1.0 million to SG Austria. We also paid SG Austria $1,572,193 in exchange for a 14.5% equity interest of SG Austria. The transaction required SG Austria to return to us the 66,667 shares of our common stock held by SG Austria and for us to return to SG Austria the 67 shares of common stock of Austrianova we held.

Effective as of the same date we entered the Third Addendum, we and SG Austria also entered a Clarification Agreement to the Third Addendum (“Clarification Agreement”) to clarify and include certain language that was inadvertently left out of the Third Addendum. Among other things, the Clarification Agreement confirmed that the Third Addendum granted us an exclusive, worldwide license to use, with a right to sublicense, the Cell-in-a-Box® technology and trademark for the development of therapies for cancer.

With respect to Bio Blue Bird, Bavarian Nordic A/S (“Bavarian Nordic”) and GSF-Forschungszentrum für Umwelt u. Gesundheit GmbH (collectively, “Bavarian Nordic/GSF”) and Bio Blue Bird entered into a non-exclusive License Agreement (“Bavarian Nordic/GSF License Agreement”) in July 2005, whereby Bio Blue Bird was granted a non-exclusive license to further develop, make, have made (including services under contract for Bio Blue Bird or a sub-licensee, by Contract Manufacturing Organizations, Contract Research Organizations, Consultants, Logistics Companies or others), obtain marketing approval, sell and offer for sale the clinical data generated from the pancreatic cancer clinical trials that used the cells and capsules developed by Bavarian Nordic/GSF (then known as “CapCells™”) or otherwise use the licensed patent rights related thereto in the countries in which patents had been granted. Bio Blue Bird was required to pay Bavarian Nordic a royalty of 3% of the net sales value of each licensed product sold by Bio Blue Bird and/or its Affiliates and/or its sub-licensees to a buyer. The term of the Bavarian Nordic/GSF License Agreement continued on a country-by-country basis until the expiration of the last valid claim of the licensed patent rights.

Bavarian Nordic/GSF and Bio Blue Bird amended the Bavarian Nordic License Agreement in December 2006 (“First Amendment to Bavarian Nordic/GSF License Agreement”) to reflect that: (i) the license granted was exclusive; (ii) a royalty rate increased from 3% to 4.5%; (iii) Bio Blue Bird assumed the patent prosecution expenses for the existing patents; and (iv) to make clear that the license will survive as a license granted by one of the licensors if the other licensor rejects performance under the Bavarian Nordic License Agreement due to any actions or declarations of insolvency.

In June 2013, we acquired from Austrianova an exclusive, worldwide license to use the Cell-in-a-Box® technology and trademark for the development of a therapy for Type 1 and insulin-dependent Type 2 diabetes (“Diabetes Licensing Agreement”). This allows us to develop a therapy to treat diabetes through encapsulation of a human cell line that has been genetically modified to produce, store and release insulin in response to the levels of blood sugar in the human body.

In October 2014, we entered into an exclusive, worldwide license agreement with the UTS (“Melligen Cell License Agreement”) in Australia to use insulin-producing genetically engineered human liver cells developed by UTS to treat Type 1 diabetes and insulin-dependent Type 2 diabetes. These cells, named “Melligen,” were tested by UTS in mice and shown to produce insulin in direct proportion to the amount of glucose in their surroundings. In those studies, when Melligen cells were transplanted into immunosuppressed diabetic mice, the blood glucose levels of the mice became normal. In other words, the Melligen cells reportedly reversed the diabetic condition.

| 16 |

In December 2014, we acquired from Austrianova an exclusive, worldwide license to use the Cell-in-a-Box® technology and trademark in combination with genetically modified non-stem cell lines which are designed to activate cannabinoid prodrug molecules for development of therapies for diseases and their related symptoms using of the Cell-in-a-Box® technology and trademark (“Cannabis Licensing Agreement”). This allows us to develop a therapy to treat cancer and other diseases and symptoms through encapsulation of genetically modified cells designed to convert cannabinoids to their active form using the Cell-in-a-Box® technology and trademark.

In July 2016, we entered into a Binding Memorandum of Understanding with Austrianova (“Austrianova MOU”). Pursuant to the Austrianova MOU, Austrianova will actively work with us to seek an investment partner or partners who will finance clinical trials and further develop products for our therapy for cancer, in exchange for which we, Austrianova and any future investment partner will each receive a portion of the net revenue from the sale of cancer products.

In October 2016, Bavarian Nordic/GSF and Bio Blue Bird further amended the Bavarian Nordic License Agreement (“Second Amendment to Bavarian Nordic/GSF License Agreement”) in order to: (i) include the right to import in the scope of the license; (ii) reflect ownership and notification of improvements; (iii) clarify which provisions survive expiration or termination of the Bavarian Nordic License Agreement; (iv) provide rights to Bio Blue Bird to the clinical data after the expiration of the licensed patent rights; and (v) change the notice address and recipients of Bio Blue Bird.

In May 2018, the Company entered into a series of binding term sheet amendments (“Binding Term Sheet Amendments”). The Binding Term Sheet Amendments provide that our obligation to make milestone payments to Austrianova is eliminated in their entirety under the: (i) Cannabis License Agreement; and (ii) the Diabetes License Agreement, as amended. The Binding Term Sheet Amendments also provide that our obligation to make milestone payments to SG Austria for therapies for cancer be eliminated in their entirety. In addition, the Binding Term Sheet Amendments also provides that the scope of the Diabetes License Agreement is expanded to include all cell types and cell lines of any kind or description now or later identified, including, but not limited to, primary cells, mortal cells, immortal cells and stem cells at all stages of differentiation and from any source specifically designed to produce insulin for the treatment of diabetes.

In addition, one of the Binding Term Sheet Amendments provides that we will have a 5-year right of first refusal from August 30, 2017 in the event that Austrianova chooses to sell, transfer or assign at any time during this period the Cell-in-a-Box® technology, tradename and Associated Technologies (defined below), intellectual property, trade secrets and know-how, which includes the right to purchase any manufacturing facility used for the Cell-in-a-Box® encapsulation process and a non-exclusive license to use the special cellulose sulfate utilized with the Cell-in-a-Box® encapsulation process (collectively, “Associated Technologies”); provided, however, that the Associated Technologies subject to the right of first refusal do not include Bac-in-a-Box® (which is used to encapsulate bacteria). Additionally, for a period of one year from August 30, 2017 one of the Binding Term Sheet Amendments provides that Austrianova will not solicit, negotiate or entertain any inquiry regarding the potential acquisition of the Cell-in-a-Box® and its Associated Technologies.

The Binding Term Sheet Amendments further provide that: (i) the royalty payments on gross sales as specified in the SG Austria APA, the Cannabis License Agreement and the Diabetes License Agreement are changed to 4%; and (ii) the royalty payments on amounts received by us from sublicensees on sublicensees’ gross sales under the same agreements are changed to 20% of the amount received us from our sublicensees, provided, however, that in the event the amounts received by us from sublicensees is 4% or less of sublicensees’ gross sales, Austrianova will receive 50% of what we receive (up to 2%) and then additionally 20% of any amount we receive over that 4%.

One of the Binding Term Sheet Amendments requires that we pay $900,000 to Austrianova ratably over a nine-month period in the amount of two $50,000 payments each month during the nine-month period on the days of the month to be agreed upon between the parties, with a cure period of 20 calendar days after receipt by us of written notice from Austrianova that we have failed to pay timely a monthly payment. As of April 30, 2020, the $900,000 amount has been paid in full. The Binding Term Sheet Amendments also provide that Austrianova receives 50% of any other financial and non-financial consideration received from our sublicensees of the Cell-in-a-Box® technology.

| 17 |

Goal and Strategies to Implement

Our goal is to become an industry-leading biotechnology company using the Cell-in-a-Box® technology as a platform upon which therapies for cancer, malignant ascites and diabetes are developed and obtain marketing approval for these therapies from regulatory agencies in the U.S., the European Union, Australia and Canada.

Our strategies to implement our goal consist of the following:

| · | Submission of our response to the FDA’s clinical hold and for the FDA to allow us to commence a clinical trial in LAPC; | |

| · | Completion of preclinical studies and clinical trials that demonstrate the effectiveness of our product candidate in reducing the production and accumulation of malignant ascites fluid in the abdomen that is characteristic of pancreatic and other abdominal cancers; | |

| · | Completion of preclinical studies and clinical trials that involve the encapsulation of the Melligen cells and genetically modified stem cells using the Cell-in-a-Box® technology to develop a therapy for Type 1 and insulin-dependent Type 2 diabetes; | |

| · | Acquisition of contracts that generate revenue or provide research and development capital utilizing our sublicensing rights; | |

| · | Further development of uses of the Cell-in-a-Box® technology platform through contracts, licensing agreements and joint ventures with other companies; and | |

| · | Completion of testing, expansion and marketing of existing and newly derived product candidates. |

Market Opportunity and Competitive Landscape

The three areas we are developing for live cell encapsulation-based therapies are cancer, diabetes and malignant ascites.

The Cell-in-a-Box® capsules are comprised of cotton’s natural component - cellulose. Other materials used by competitors include alginate, collagen, chitosan, gelatin and agarose. Alginate appears to be the most widely used of these. We believe the inherent strength and durability of our cellulose-based capsules provides us with advantages over the competition. They do so with no evidence of rupture, damage, degradation, fibrous overgrowth or immune system response. The cells within the capsules also remained alive and functioning during these studies. Other encapsulating materials degrade in the human body over time, leaving the encapsulated cells open to immune system attack. Damage to surrounding tissues has also been reported to occur over time when other types of encapsulation materials begin to degrade.

The cells encapsulated using the Cell-in-a-Box® technology can be frozen for extended periods of time. When thawed, the cells are recovered with approximately 85% viability. We are unaware of any other cell encapsulation material that is capable of protecting their encapsulated cells to this degree. The implications of this property of the Cell-in-a-Box® technology are obvious - long-term storage of encapsulated cells and shipment of encapsulated cells over long distances.

We believe our live cell encapsulation technology may have significant new advantages and opportunities for us in numerous and developing ways. For example:

| · | Cancerous diseases may be treated by placing encapsulated drug-converting cells that convert a chemotherapy prodrug near the cancerous tumor; | |

| · | Confinement and maintenance of therapeutic cells that activate a chemotherapy prodrug may be placed at the site of implantation in a blood vessel near the cancerous tumor results in “targeted chemotherapy”; | |

| · | Increased efficacy of a chemotherapy prodrug may allow for lower doses of the prodrug to be given to a patient, significantly reducing or even eliminating side effects from the chemotherapy; | |

| · | Encapsulating genetically modified live cells has the potential for the treatment of systemic diseases of various types, including diabetes; | |

| · | Multi-layered trade secret protection and marketing exclusivity for our technology exists and is being expanded; | |

| · | Cell-in-a-Box® capsules can prevent immune system attack of functional cells inside them without the need for immunosuppressive drug therapy; and | |

| · | Promising data with the Cell-in-a-Box® technology and the cells used with our technology from animal and initial human clinical trials. |

| 18 |

Pancreatic cancer is increasing in most industrialized countries. The American Cancer Society estimates that in 2022 there will be 62,210 people in the U.S. diagnosed with pancreatic cancer. It also estimates 48,830 patients with pancreatic cancer will die in 2022. Pancreatic cancer accounts for about 3% of all cancers in the U.S. and about 7% of all cancer deaths.

Our goal is to satisfy a clear unmet medical need for patients with LAPC whose tumors no longer respond after 4-6 months of treatment with the chemotherapy combination of Abraxane® plus gemcitabine or the four-drug combination known as FOLFIRINOX. For these patients, there is currently no effective therapy. We believe there will be no therapy comparable to our Cell-in-a-Box® plus low dose of ifosfamide combination therapy when it is used in these patients.

We face intense competition in the field of treating pancreatic cancer. There are dozens of startups, smaller biotech companies, big pharma, and several academic institutions and cancer centers all trying to improve the outcome for pancreatic cancer patients. For example, in a single patient case report published June 2022 in the New England Journal of Medicine, a study funded by the Providence Portland Medical Foundation in conjunction with the Earle A. Chiles Research Institute reported objective regression of metastatic pancreatic cancer using genetically-engineered autologous T cells. There are several drugs already available and in the pipelines of pharmaceutical companies worldwide, not the least of which is the combination of the drugs of Abraxane® and gemcitabine. This is the primary FDA-approved combination of drugs for treating advanced pancreatic cancer. In Europe and in the U.S., the 4-drug combination FOLFIRINOX has also found use as a first-line treatment for advanced pancreatic cancer. Some of our competitive strengths include the Orphan Drug Designation we have been granted by the FDA and the European Medicines Agency for our pancreatic cancer therapy, our trade secrets, the patents we are seeking and the licensing agreements we have that are described in this Report. Yet many of our competitors have substantially greater financial and marketing resources than we do. They also have stronger name recognition, better brand loyalty and long-standing relationships with customers and suppliers. Our future success will be dependent upon our ability to compete.

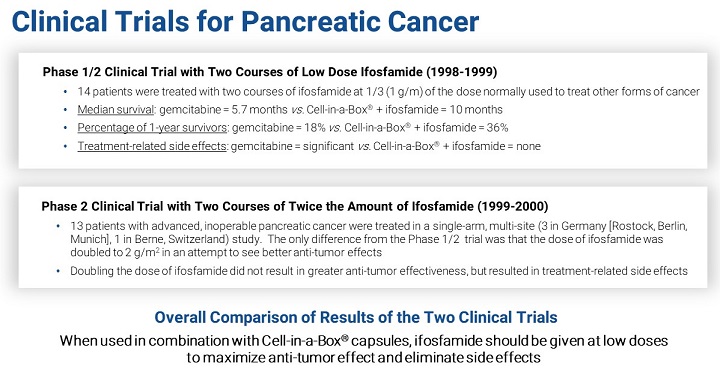

We believe our product candidate for pancreatic cancer has already shown promise through the completion of a Phase 1/2 and a Phase 2 clinical trial in advanced, inoperable pancreatic cancer carried out in Europe by Bavarian Nordic in 1998 – 1999 and 2000, respectively.

We have a number of competitors developing Cannabis-based treatments for cancer. In February 2021, Jazz Pharmaceuticals Public Limited Company (“Jazz”), a neuroscience and oncology focused company, acquired GW Pharmaceuticals, PLC for $7.2 billion. Jazz now has two approved cannabinoid extract-based products: Epidiolex® (CBD) oral solution for the treatment of seizures associated with Lennox-Gastaut syndrome, Dravet syndrome or tuberous sclerosis complex, and Sativex® (THC/CBD) oromucosal spray for the treatment of severe multiple sclerosis spasticity. Sativex® is currently being studied in conjunction with the Brain Tumour Charity and the UK National Health Service to examine effectiveness in the treatment of recurrent glioblastoma brain tumor when used alongside the chemotherapeutic agent temozolomide. Jazz’s pipeline indications include: neonatal hypoxic-ischemic encephalopathy, neuropsychiatry targets, autism spectrum disorders, epilepsy, spasticity and undisclosed targets. Cannabis Science, Inc. (“CBIS”) has a number of indications in its product development pipeline, all pre-clinical, the most advanced being for the treatment of oxidative stress, psychosis/anxiety, PTSD, and sleep deprivation. CBIS also has plans to develop treatments for Stage 4 lung cancer and pancreatic cancer. CNBX Pharmaceuticals Inc. (previously Cannabics Pharmaceuticals, Inc.) (“CNBX”) has a primary research focus on the development of cannabinoid therapies for the treatment of cancer, mainly cancers of the gastrointestinal tract, skin, breast and prostate. CNBX’s other Cannabis-based areas of research include Alzheimer’s disease, mental health conditions, and auto-immune diseases. Cannabotech Ltd. (“Cannabotech”), an Israeli company, in collaboration with Haifa University, is studying an improved method for killing pancreatic and colon cancer cells using a botanical drug based on an extract of the Cyathus striatus fungus and a cannabinoid extract. Cannabotech is also developing therapies for breast, lung and prostate cancers.

In contrast to the work being done by these companies, we plan to focus on developing specific therapies based on chosen molecules rather than using Cannabis extracts. We intend to use the Cell-in-a-Box® technology in combination with genetically -modified cell lines designed to activate cannabinoid molecules for the targeted treatment of diseases and their related symptoms.

The Centers for Disease Control and Prevention estimates that in 2022 a total of 37.3 million people in the U.S. have been diagnosed with diabetes (11.3% of the U.S. population) and another 8.5 million people (23.0% of adults) are undiagnosed. The diabetes market is estimated in the tens of billions of dollars, and it continues to grow.

| 19 |

The field of diabetes cell therapy development is very competitive. There are numerous companies developing cell-based therapies for diabetes. These competitors include companies such as ViaCyte, Inc. which has two stem cell-based product candidates in Phase 1/2 clinical trials for type 1 diabetes: PEC-Direct, which is a pouch that is “open” to the surrounding vasculature and requires the use of immunosuppressive drugs, and PEC-Encap, which is a pouch that contains the implanted cells and prevents contact with the vasculature and immune cells but still allows passage of nutrients and proteins to travel between the cells inside the device and blood vessels which grow along the outside of the device. PEC-Encap is reported to generally prevent immune rejection and immune sensitization. Conceptually, PEC-Encap has similarities with Cell-in-a-Box®. Other companies developing some form of encapsulation-based diabetes therapy include Vertex Pharmaceuticals Inc., Defymed, Diatranz Otsuka Limited, Seraxis, Inc., Unicyte AG, Sernova Corp., Betalin Therapeutics Ltd., Novo Nordisk, Beta-O2 Technologies Ltd., Eli Lilly & Co. in collaboration with Sigilon Therapeutics, Inc. and the Diabetes Research Institute Foundation.

Although such competition exists in the diabetes space, we believe these other companies are developing encapsulation-based therapies using materials and methodologies that produce capsules or devices that are far less robust than ours or that are associated with other problems, such as extremely short shelf-life of the product and/or fibrotic overgrowth of their encapsulation products when implanted in the body. We believe these properties are not characteristic of the Cell-in-a-Box® capsules. Our product candidate for diabetes has shown promise. Completed research studies have resulted in positive responses in animal models using the Melligen cells. We believe we are in a strong competitive position considering our unique encapsulation technology and the genetically modified cells that we have the exclusive worldwide license to use in most industrialized countries.

Malignant ascites occurs when cancer cells irritate the peritoneum causing an overproduction of ascitic fluid which causes the abdomen to swell as fluid accumulates. It is more likely to develop in patients who have ovarian, uterine, cervical, colorectal, stomach, pancreatic, breast and liver cancers. In most patients, development of malignant ascites is a sign of advanced disease and poor prognosis. Malignant ascites can result in impairment to the quality of life of a cancer patient. In addition to abdominal distention, pain and difficulty breathing, it may also cause nausea, vomiting, early satiety, lower extremity edema, weight gain and reduced mobility. These symptoms can interfere with a patient’s ability to eat, to walk and to perform daily activities. They also reduce a patient’s ability to withstand anti-cancer therapies, potentially reducing survival.

We are developing a therapy to delay the production and accumulation of malignant ascites using our cancer therapy (i.e., ifosfamide converting encapsulated live cells). Preclinical studies are underway in Germany, and, if successful, we plan to seek FDA approval to conduct a Phase 1 study. Typical treatments for malignant ascites include paracentesis, percutaneously implanted catheters, peritoneal ports and peritoneovenous shunts. These treatments can be painful, ineffective and expensive. There is currently no available treatment that delays the production and accumulation of malignant ascites fluid, and we know of no competitors in this area.

Previous Clinical Trials Using Encapsulation Technology

| 20 |

Two previous clinical trials using what is now our encapsulation technology were carried out in Europe by Bavarian Nordic in 1998-1999 and 2000, respectively. Both employed the combination of the cellulose-based live cell encapsulation technology with low doses of the anticancer drug ifosfamide. However, the FDA may not accept the results of these trials for various reasons, none of which are in our control. In such event, we may have to conduct a Phase 1 trial, not a Phase 2b trial, or even further pre-clinical animal trials.

The results of the two clinical trials have been published in the peer-reviewed scientific literature and are summarized as follows:

Phase 1/2 Clinical Trial

Dates of Trial and Location: This clinical trial was opened on July 28, 1998 and closed on September 20, 1999. It was carried out at the Division of Gastroenterology, University of Rostock, Germany.

Identity of Trial Sponsors: The clinical trial was sponsored by Bavarian Nordic.

Trial Design: The clinical trial was an open-label, prospective, single-arm and single center trial.

Patient Information: A total of 17 patients were enrolled in the clinical trial (51 were screened). A total of 14 patients were treated because two of the original 17 patients developed severe infections before the start of the clinical trial and had to be treated by other means. For the other patient, angiography was not successful, causing the patient to be disqualified from participating in the clinical trial.

Trial Criteria: Criteria for enrolling in the clinical trial included inoperable pancreatic adenocarcinoma Stage 3-4 (according to IUCC criteria) as determined by histology and measured by computerized tomography (“CT”) scan and the patients must not have had any prior chemotherapy for their disease.

Duration of Treatment and Dosage Information: On day 0, celiac angiography was performed and 300 (in 13 patients, 250 in one) of the capsules containing the ifosfamide-activating cells were placed by supraselective catheterization of an artery leading to the tumor. Each capsule (~0.7 mm in diameter) contained about 20,000 cells. The cells overexpressed CYP2B1 (a cytochrome P450 isoform), which catalyzed the conversion of the anticancer prodrug ifosfamide into its “cancer-killing” form.

On day 1, patients were monitored for evidence of any clinically relevant adverse reactions, e.g., allergy and/or pancreatitis. On days 2-4, each patient received low-dose (1 g/m2 body surface area) ifosfamide in 250 ml of normal saline administered systemically as a 1-hour infusion. This was accompanied by a 60% dose equivalent of the uroprotective drug Mesna, which is used to reduce the side effects of ifosfamide chemotherapy, given as three intravenous injections. This regimen was repeated on days 23-25 for all but two patients who received only one round of ifosfamide. A total of only two cycles of ifosfamide were given to the remainder of the patients.

Specific Clinical Endpoints: Median survival time from the time of diagnosis, the percentage of patients who survived one year or more and the quality of life of each patient were examined in the clinical trial.

Observational Metrics Utilized and Actual Results Observed: Standard National Cancer Institute (“NCI”) criteria for evaluating tumor growth were used to assess results:

| · | stable disease (tumors 50-125% of initial size) (“SD”); | |

| · | partial remission (more than 50% reduction in tumor volume) (“PR”); and | |

| · | minor response (tumor reduction of between 25% and 50%) (“MR”). |

Effects of the treatment on tumor size were measured by CT scans. Control CT scans were scheduled for weeks 10 and 20, respectively. During the final visit, a control angiography was performed. On the initial CT scan, the scan demonstrating the largest diameter of the primary tumor was identified and the area measured. Using appropriate landmarks, an identical scan was used for comparison. CT scans were evaluated by two unrelated radiologists, one of whom was not involved in the clinical trial. After formally finishing the clinical trial, patients were followed on an ambulatory basis with visits once every three months.

| 21 |

Toxicity was measured based on World Health Organization (“WHO”)/NCI guidelines on common toxicity criteria. The WHO and the NCI use standardized classifications of the adverse events associated with the use of cancer drugs. In cancer clinical trials, these are used to determine if a drug or treatment causes unwanted side effects (“Adverse Events”) when used under specific conditions. For example, the most commonly used classification is known as the “Common Terminology Criteria for Adverse Events” developed by the NCI in the U.S. Most clinical trials carried out in the U.S. and the United Kingdom code their Adverse Event. This system consists of five grades. These are: 1 = mild; 2 = moderate; 3 = severe; 4 = life-threatening; 5 = death. In the studies reported for Cell-in-a-Box® plus low-dose ifosfamide combination in pancreatic cancer patients, the study investigators noted 11 Serious Adverse Events (“SAEs”) in 7 patients, none of which were believed to be treatment-related.

Each patient’s need for pain medication and the quality of life (“QOL”) was monitored using a questionnaire established for diseases of the pancreas. A QOL questionnaire for cancer patients, QLQ-C30, had been validated in several languages, but the module for pancreatic cancer per se was still under development at the time of the study with respect to reliability, sensibility against changes and multicultural validation. Accordingly, a version of the core questionnaire and a German QOL scale (published in 1995) for pancreatic cancer patients was used. QOL data were documented independently from safety and efficacy data by having patients complete an independent questionnaire. Assessment of QOL data did not interfere with routine documentation of Adverse Events reported by the patients. QOL questionnaires were analyzed according to the criteria developed by the European Organization for Research and Treatment of Cancer (“EORTC”). As used in the description of the QOL results discussed in the published report of the Phase 1/2 trial of the Cell-in-a-Box® plus low-dose ifosfamide combination in pancreatic cancer patients, the questionnaire was used to assess the QOL of patients undergoing treatment. The QOL was analyzed in a similar manner to the way that a QOL questionnaire developed by the EORTC is usually analyzed. This latter questionnaire is known as EORTC QLQ-C30. QOL data were available from the baseline evaluation for 14 patients and for analysis of change for 8 patients.

A clinical benefit score based on variables, including the “Karnofsky Score” and body weight, was determined. Pain and analgesic consumption were calculated from the QOL questionnaires. The Karnofsky Score is a scale that is used to attempt to quantify a cancer patient’s general well-being and activities of daily life. It is often used to judge the suitability of patients for inclusion into clinical trials. As a clinical trial progresses, a patient’s Karnofsky Score can change. It is also used to assess a patient’s QOL as a clinical trial progresses. The scale starts at 100 (normal, no complaints, no evidence of disease) and decreases in decrements of 10 down through 50 (requires considerable assistance and frequent medical care) all the way to 10 (moribund, fatal processes progressing rapidly) and finally to 0 (deceased). Pain intensity was measured on a visual analog scale ranging from 0 (no pain) to 100 (the most intensive pain imaginable) in increments of 10. Analgesic consumption was assessed using a separate scale in which 0 indicated no regular consumption of analgesics and 25, 50 and 100 indicated administration of non-steroidal anti-inflammatory drugs or opiates several times per year, per month or per week, respectively.

The primary tumor did not grow in any of the 14 patients. Two patients had a PR; 12 patients exhibited SD; and two patients showed an MR.

Median survival time of patients in this clinical trial was 39 weeks. The one-year survival rate was 36%.

Within the 20-week study period, three patients died from disease progression (on days 9, 85 and 132). Upon postmortem examination, the patient who died on day 9 from recurrent pulmonary embolism was found to have extensive tumor necrosis.

The chemotherapy regimen was well tolerated. No toxicity beyond Grade 2 (moderate adverse effect) was detected in any of the 14 patients.

Eleven SAEs were seen in 7 patients during the study period. None of them were treatment-related (due to capsule implantation or ifosfamide administration). These SAEs were attributed to underlying disease and/or the effects associated with the disease.

Implanting the capsules did not result in any obvious allergic or inflammatory response, and no patients developed pancreatitis during the trial. Some patients exhibited elevated amylase levels, presumably due to tumor infiltration of the pancreas and limited obstructive chronic pancreatitis. However, no further increase in amylase levels was seen after angiography and capsule implantation.

In accordance with the report of the study, only one Adverse Event (increased lipase activity on day 15 after installation of the capsules), which was a Grade 1 Adverse Event, “may” have been linked to implanting the capsules.

| 22 |

Ten of 14 patients experienced a “clinical benefit” which means either no increase or a decrease in pain intensity. For 7 of the patients, this was confirmed by their analgesic consumption. None of these “benefited” patients registered an increased analgesic usage either in terms of dosage or WHO levels.

None of the patients showed an increased Karnofsky Score after treatment. However, 7 of the 14 patients had stable Karnofsky Scores at the week 10 assessment. For 4 of these patients, their indices were still stable at the week 20 assessment.

One patient’s body weight increased at both weeks 10 and 20 and another patient showed increased weight at week 10 (this patient withdrew from the clinical trial and no week 20 weight was obtained). Two patients showed stable body weights at week 10, one of whom dropped out of the clinical trial and the other showed weight loss at week 20.

Two scenarios were used to establish the overall integrative clinical benefit response, where each patient was given a +2 score for an improved value, a +1 score for a stable value and a -1 score for a worsened value for each of four criteria (pain, analgesic consumption, Karnofsky Score and body weight) as compared to the relevant week 0 values.

The “worst case scenario” required a pain relief score of 20 points or more to be judged an improvement and a decrease in the Karnofsky Score of 10 points or more to indicate worsening. Using this scenario, 50% or 7 of the treated patients experienced clinical benefit; 21.4% or 3 patients were neutral (benefits were offset by impairments); and 28.6% or 4 patients had no clinical benefit. The latter included those passing away before the median survival time.

In the “best case scenario,” a pain relief score of 10 points or more was an improvement. A decrease in Karnofsky Score of 20 points or more was considered a worsening. In this scenario, 71.4% or 10 patients had clinical benefit, 14.2% of patients showed neither benefit nor deterioration and 14.3% patients had no benefit.

Standard of Care: At the time this clinical trial was conducted, only one FDA-approved treatment for advanced, inoperable pancreatic cancer was available. That was the drug gemcitabine, first approved by the FDA in 1996.

An examination of the prescribing information for gemcitabine reflects that the median survival seen in the Phase 3 pancreatic cancer clinical trial for gemcitabine was approximately 23 weeks (5.7 months). The percentage of one-year survivors was approximately 18%. In a Phase 3 clinical trial of Celgene’s Abraxane® plus gemcitabine combination that was approved by the FDA in September 2013, the median survival time for patients was about 8.5 months and the percentage of one-year survivors was approximately 35%.

The treatment with gemcitabine of patients with pancreatic cancer is often associated with severe side effects. According to the prescribing information for gemcitabine, for use to treat pancreatic cancer the recommended dose is 1000 mg/m2 given intravenously over 30 minutes. The schedule of administration is weeks 1-8, weekly dosing for 7 weeks followed by one-week rest and then after week 8, weekly dosing on days 1, 8 and 15 of 28-day cycles.

Reductions in the doses of gemcitabine are necessitated by the occurrence of myelosuppression. Permanent discontinuation of gemcitabine is necessary for any of the following:

| · | unexplained dyspnea or other evidence of severe pulmonary toxicity; | |

| · | severe hepatotoxicity; | |

| · | hemolytic-uremic syndrome; | |

| · | capillary leak syndrome; and | |

| · | posterior reversible encephalopathy syndrome. |

Gemcitabine should be withheld, or its dose reduced by 50% for other severe (Grade 3 or 4) non-hematologic toxicity until that toxicity is resolved.

Conclusions: In the opinion of the trial’s investigators, in this Phase 1/2 clinical trial the use of the combination of Cell-in-a-Box® capsules plus low-dose ifosfamide was both safe and effective. This assessment was not based on the opinion of any drug regulatory authority and does not guarantee that that this assessment will be maintained in any late-phase clinical trial or that any drug regulatory authority will ultimately determine that the Cell-in-a-Box® plus low-dose ifosfamide combination is safe and effective for the purposes of granting marketing approval.

| 23 |

In the Phase 1/2 clinical trial only a small number of patients were evaluated. Statistical parameters were not used in the published reports of the Phase 1/2 trial to validate the anticancer efficacy of the Cell-in-a-Box® plus low-dose ifosfamide combination in patients with advanced, inoperable pancreatic cancer. In the opinion of the investigators, the results indicate a trend towards efficacy; accordingly, the results should not be viewed as absolute numbers. It should be noted, however, that because the results were not statistically significant, any observations of efficacy must be weighed against the possibility that the results were due to chance alone. The purpose of the clinical trial was not to obtain data so that marketing approval could be obtained from regulatory authorities. Rather, the clinical trial allowed the investigators to determine whether the Cell-in-a- Box® capsules plus low-dose ifosfamide combination holds promise as a therapy for advanced pancreatic cancer. In the cancer arena, Phase 1/2 clinical trials are intended to: (i) establish the safety of the drug or treatment being investigated; and (ii) determine if a trend towards efficacy exists. In accordance with FDA regulations and guidance, as well as similar regulations and guidance from other regulatory authorities in countries other than the U.S., we realize that a large, multicenter, randomized, comparative study needs to be conducted and the results from such a trial would have to confirm the results from this previous Phase 1/2 trial before an application for marketing approval could be filed with the FDA or EMA.

If our product candidate is approved by the regulatory agencies, we believe it could provide a significant benefit to those with this devastating and deadly disease, not only in terms of lifespan but also in terms of increased quality of life. Also, we believe that success of the live cell encapsulation technology in the pancreatic cancer setting may lead to its successful use in developing therapies for other forms of solid cancerous tumors after preclinical studies and clinical trials have been completed.

Phase 2 Clinical Trial

Location of Trial: The clinical trial was opened on November 16, 1999 and closed on December 1, 2000. This clinical trial was carried out at four centers in two countries in Europe. These were in Berne, Switzerland, and in Rostock, Munich and Berlin, Germany.

Trial Sponsor: The clinical trial was sponsored by Bavarian Nordic.

Trial Design: This was an open-label, prospective, single-arm multi-site study.

Patient Information: All 13 patients enrolled in the trial were treated. Twelve patients exhibited Stage 4 disease. The remaining patient had Stage 3 disease. Ten of the 13 patients exhibited metastases.

Duration of Treatment and Dosage Information: The number of capsules implanted varied from 221 to 300 with a mean of 244. On day 1, patients were monitored for any allergic reactions to capsule implantation and/or pancreatitis. The administration schedule of the treatment was the same as in the earlier Phase 1/2 trial, except that in this Phase 2 trial the dose of ifosfamide was doubled to 2 g/m2. In the Phase1/2 trial, it was 1g/m2. On days 2-4, patients received 2 g/m2 in normal saline as a one-hour infusion. The urinary tract protector Mesna was also given as 3 intravenous injections. This regimen was repeated on days 23-25.

Specific Clinical Endpoints: The primary endpoint of the trial was to determine response rate as defined by SD, PR and MR as well as the clinical benefit (Karnofsky score) of the treatment. The timing of the tumor size measurements and determination of tumor sizes by CT scans were done by independent radiologists. A secondary endpoint was to determine time to progression, tumor response, duration of partial or complete remission, length of symptom-free survival, survival time and quality of life. Another secondary endpoint was to evaluate the safety and tolerability of the treatment regimen, with attention being paid to the appearance of pancreatitis or immediate allergic reactions.

Safety Analysis of Angiography, Capsule Implantation and Chemotherapy: On average, angiography took approximately 40 minutes. For 5 of the patients in this clinical trial, more than one blood vessel had to be used for placement of the capsules. The administration of the capsules was well tolerated. There were no signs of allergic reactions or hemorrhagic cystitis after implantation of the capsules. Two patients had increased levels of serum lipase at baseline. After additional measurements, these were not considered to be clinically relevant. The dose of ifosfamide (2 g/m2) used was found to be toxic in most patients. This resulted in one patient having to reduce the ifosfamide dose in the second of the two cycles of treatment with the drug. The most common toxic effects were nausea, vomiting, malaise, anorexia and mild hematuria.

| 24 |

Serious Adverse Events: A total of 16 SAEs were documented in eight patients, including 3 SAEs leading to death. None of these SAEs were attributed to placement of the encapsulated cells. One patient experienced neurological impairment (drowsiness, nocturnal enuresis, mild somnolence) which was attributed to treatment with the 2 g/m2 dose of ifosfamide. All patients experienced between 5 and 19 SAEs. Six SAEs were rated as life-threatening; 10.2% were rated as severe; 28.7% were rated as moderate; and 53.7% were rated as mild. None of the SAEs was thought to be related to placement of the encapsulated cells, but 44% were related to the administration of ifosfamide at the elevated dose given. Most frequent SAEs were alopecia, anemia, leucopenia, nausea and vomiting or encephalopathy. Other SAEs were new or worse symptoms of the patients’ underlying disease. A total of 65 events met the NCI’s common toxicity criteria. Of these, 46.2% had Grade 1, 40% had Grade 2, 9.2% had Grade 3 and 4.6% had Grade 4 toxicities.

Tumor Reductions and Patient Survival Results: The size of the primary tumor was measured before starting the live cell encapsulation plus ifosfamide therapy and at weeks 10 and 20 post-treatment. No PRs were observed, but 4 patients exhibited tumor size reductions, 4 patients showed tumor growth and the remaining 5 patients had SD over the “follow-up” period after chemotherapy.

The median survival of patients was 40 weeks. Most the survival benefit was shown early during the entire observation period. However, as time progressed, these patients succumbed at the same rate as historical controls. This observation suggested to the investigators that prolongation of the survival benefit might be achieved if additional courses of ifosfamide chemotherapy were given. The one-year survival rate was 23%. It was thought that this may be attributable to the higher dose of ifosfamide used in this clinical trial.

Quality of Life: An assessment of the quality of life of the patients was performed in this clinical trial. Quality of life data were available for all the patients. According to this QOL assessment, although pain during the night decreased, patients felt themselves to be less attractive and lost interest in sex. No additional improvements in patients’ quality of life were observed.

Conclusions: The opinions of the investigators were as follows: (i) the lack of “problems” associated with the implanted encapsulated cells was noted as in the Phase 1/2 trial; (ii) administering more than two courses of treatment with ifosfamide might have beneficial effects on survival; and (iii) since doubling the dose of ifosfamide from that used in the Phase 1/2 trial had no beneficial antitumor or survival effect but was associated with increased side effects from the treatment, the dose of ifosfamide to be used in combination with the encapsulated cells for all future trials should be 1 g/m2.

Manufacturing