Filed Pursuant to Rule 424(b)(3)

Registration No. 333-260849

PROSPECTUS

PHARMACYTE BIOTECH, INC.

8,050,000 SHARES OF COMMON STOCK ISSUED

PURSUANT TO THE EXERCISE OF WARRANTS

This prospectus relates to the resale by the selling stockholders (“Selling Stockholders”) named herein, including their transferees, pledgees or donees, or their respective successors, of up to 8,050,000 shares (“Shares”) of PharmaCyte Biotech, Inc.’s (“Company”) common stock, $.0001 par value (“Common Stock”). For information about the Selling Stockholders, see “Selling Stockholders” on page 30. Our Common Stock offered by the Selling Stockholders will be issued pursuant to the exercise of warrants in accordance with their terms. The Selling Stockholders may sell shares of Common Stock from time to time in the principal market on which the Company’s Common Stock is quoted at the prevailing market price or in negotiated transactions. We are not selling any Common Stock under this prospectus and will not receive any of the proceeds from the sale of Common Stock by the Selling Stockholders. We will pay the expenses of registering these Shares, including legal and accounting fees. All selling and other expenses incurred by the Selling Stockholders will be borne by the Selling Stockholders. See “Plan of Distribution.”

The Shares offered by the Selling Stockholders are issuable pursuant to the exercise of 7,000,000 unregistered warrants (“Series A Warrants”) sold in a private placement and issued under that certain Securities Purchase Agreement dated as of August 19, 2021(“Purchase Agreement”) with each of the Selling Stockholders. Each Series A Warrant has an exercise price of $5.00 per share, is exercisable immediately, and will expire five years following the date of issuance. In addition, the offered Shares include 1,050,00 shares of Common Stock issuable through the exercise of 1,050,000 warrants (“Placement Agent Warrants,” and, together with the Series A Warrants, the “Warrants”) issued to H.C. Wainwright & Co., LLC (“Wainwright”) or its designees as the Company’s exclusive placement agent for the Purchase Agreement and a concurrent Registered Direct Offering (together, “Offerings”). The Placement Agent Warrants have an exercise price of $6.25 per share and will expire five years after the date of commencement of sales in the Offerings. See “Private Placement of Warrants” on page 28.

The timing and amount of any sale of Common Stock is within the sole discretion of each Selling Stockholder.

Our Common Stock is traded on the Nasdaq Stock Market (“Nasdaq”) under the symbol “PMCB”. On November 18, 2021, the closing sales price for our Common Stock on Nasdaq was $2.59 per share.

The purchase of the Common Stock offered through this prospectus involves a high degree of risk. You should consider carefully the risk factors beginning on page 14 of this prospectus before purchasing any of the securities offered by this prospectus.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

Neither the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 19, 2021.

TABLE OF CONTENTS

Page

You should rely only on the information provided in or incorporated by reference in this prospectus, in any prospectus supplement or in a related free writing prospectus, or documents to which we otherwise refer you. We have not authorized anyone else to provide you with different information.

We have not authorized any dealer, agent or other person to give any information or make any representation other than those contained or incorporated by reference in this prospectus and any accompanying prospectus supplement or any related free writing prospectus. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus or an accompanying prospectus supplement or any related free writing prospectus. This prospectus and the accompanying prospectus supplement and any related free writing prospectus, if any, do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor does this prospectus and the accompanying prospectus supplement and any related free writing prospectus, if any, constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus and the accompanying prospectus supplement and any related free writing prospectus, if any, is accurate on any date subsequent to the date set forth on the front of such document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus and any accompanying prospectus supplement and any related free writing prospectus is delivered or securities are sold on a later date.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless otherwise indicated, information contained or incorporated by reference in this prospectus concerning our industry, including our general expectations and market opportunity, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and estimates of our and our industry’s future performance are necessarily uncertain due to a variety of factors, including those described in “Risk Factors” beginning on page 14 of this prospectus. These and other factors could cause our future performance to differ materially from our assumptions and estimates.

In this prospectus the “Company,” “Registrant,” “PharmaCyte,” “we,” “us” and “our” refer to PharmaCyte Biotech, Inc., a Nevada corporation, and, where appropriate, to its subsidiaries.

We license the copyright for Cell-in-a-Box® in the United States from Austrianova Singapore Pte. Ltd. This prospectus contains references to our copyrights. Solely for convenience, copyrights and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other company.

| 1 |

This prospectus contains forward-looking statements. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Forward-looking statements involve risks and uncertainties and include statements regarding, among other things, our projected revenue growth and profitability, our growth strategies and opportunity, anticipated trends in our market and our anticipated needs for working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plans,” “potential,” “projects,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend” or the negative of these words or other variations on these words or comparable terminology. In particular, these include statements relating to future actions, prospective products, market acceptance, future performance or results of current and anticipated products, sales efforts, expenses, and the outcome of contingencies such as legal proceedings and financial results.

Examples of forward-looking statements in this prospectus include, but are not limited to, our expectations regarding our business strategy, business prospects, operating results, operating expenses, working capital, liquidity and capital expenditure requirements. Important assumptions relating to the forward-looking statements include, among others, assumptions regarding whether the United States Food and Drug Administration (“FDA”) approves our Investigational New Drug Application (“IND”) after we submit a response to the FDA’s clinical hold, so that we can commence our planned clinical trial involving locally advanced, inoperable, pancreatic cancer (“LAPC”); the success and timing of our preclinical studies and clinical trials; the potential that results of preclinical studies and clinical trials may indicate that any of our technologies and product candidates are unsafe or ineffective; our dependence on third parties in the conduct of our preclinical studies and clinical trials; the difficulties and expenses associated with obtaining and maintaining regulatory approval of our product candidates; the material adverse impact that the coronavirus pandemic may have on our business, including our planned clinical trial involving LAPC, which could materially affect our operations as well as the business or operations of third parties with whom we conduct business; and whether the FDA will approve our product candidates after our clinical trials are completed, assuming the FDA allows our clinical trials to proceed after submission and review of our response to the FDA’s clinical hold. Additional assumptions relate to the demand for our products, the cost, terms and availability of materials related to biopharma products, pricing levels, the timing and cost of capital expenditures, status of regulatory approvals, competitive conditions and general economic conditions. These statements are based on our management’s expectations, beliefs and assumptions concerning future events affecting us, which in turn are based on currently available information. These assumptions could prove inaccurate. Although we believe that the estimates and projections reflected in the forward-looking statements are reasonable, our expectations may prove to be incorrect.

Important factors that could cause actual results to differ materially from the results and events anticipated or implied by such forward-looking statements include, but are not limited to:

| · | our ability to conduct the preclinical studies and assays and provide the additional information requested by the FDA in order to lift the clinical hold on our IND for LAPC; |

| · | our ability to advance any product candidates into, and successfully complete, clinical studies and obtain regulatory approval for them; |

| · | the timing or likelihood of regulatory filings and approvals; |

| · | the commercialization, marketing and manufacturing of our product candidates, if approved; |

| · | the pricing and reimbursement of our product candidates, if approved; |

| · | the rate and degree of market acceptance and clinical utility of any products for which we receive marketing approval; |

| · | the implementation of our strategic plans for our business, product candidates and technology; |

| 2 |

| · | the scope of protection we have and are able to establish and maintain for intellectual property rights covering our product candidates and technology; |

| · | our expectations related to the use of proceeds from this offering and our existing cash resources, and estimates of our expenses, future revenues, capital requirements and our needs for additional financing; |

| · | our ability to maintain and establish collaborations; |

| · | our financial performance; |

| · | our ability to maintain compliance with Nasdaq listing standards; |

| · | developments relating to our competitors and our industry, including the impact of government regulation; |

| · | our ability to retain and attract senior management and consultants; and |

| · | other risks and uncertainties, including those listed under the caption “Risk Factors” in this prospectus or any other documents incorporated by reference in this prospectus. |

We operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for us to predict all of those risks, nor can we assess the impact of all of those risks on our business or the extent to which any factor may cause actual results to differ materially from those contained in any forward-looking statement. The forward-looking statements in this prospectus are based on assumptions management believes are reasonable. However, due to the uncertainties associated with forward-looking statements, you should not place undue reliance on any forward-looking statements. Further, forward-looking statements speak only as of the date they are made, and unless required by law, we expressly disclaim any obligation or undertaking to publicly update any of them in light of new information, future events, or otherwise.

Any of the assumptions underlying the forward-looking statements contained in this prospectus and the documents incorporated herein by reference could prove inaccurate and, therefore, we cannot assure you that the results contemplated in any of such forward-looking statements will be realized. Based on the significant uncertainties inherent in these forward-looking statements, the inclusion of any such statement should not be regarded as a representation or as a guarantee by us that our objectives or plans will be achieved, and we caution you against relying on any of the forward-looking statements contained herein.

This summary highlights certain information about us, this offering and information appearing elsewhere in this prospectus and in the documents we incorporate by reference in this prospectus. This summary is not complete and does not contain all of the information that you should consider before investing in our securities. After you carefully read this summary, to fully understand our Company and this offering and its consequences to you, you should read this entire prospectus and any related free writing prospectus authorized by us, including the information referred to under the heading “Risk Factors” in this prospectus beginning on page 14, and any related free writing prospectus, as well as the other documents that we incorporate by reference into this prospectus, including our financial statements and the notes to those financial statements, which are incorporated herein by reference from our Annual Report on Form 10-K for the year ended April 30, 2021, filed on August 10, 2021, and our Quarterly Report filed on Form 10-Q for the quarter ended July 31, 2021, filed on September 14, 2021. Please read “Where You Can Find More Information” on page 37 of this prospectus.

| 3 |

Overview

We are a biotechnology company focused on developing cellular therapies for cancer and diabetes based upon a proprietary cellulose-based live cell encapsulation technology known as “Cell-in-a-Box®.” The Cell-in-a-Box® technology is intended to be used as a platform upon which therapies for several types of cancer, including locally advanced, inoperable, pancreatic cancer (“LAPC”) will be developed. The current generation of our product candidate is referred to as “CypCaps™.” On October 1, 2020, we submitted an Investigational New Drug Application (“IND”) to the U.S. Food and Drug Administration (“FDA”) for a planned Phase 2b clinical trial in LAPC. On September 1, 2020, the Company received notice from the FDA that it had placed the IND on clinical hold. On October 30, 2020, the FDA sent a letter to us setting forth the reasons for the clinical hold and specific guidance on what we must do to have the clinical hold lifted. To lift the clinical hold, the FDA has informed us that we need to conduct additional preclinical studies and assays. The FDA also requested additional information regarding several topics, including DNA sequencing data, manufacturing information and product release specifications. We are in the process of conducting these studies and assays and gathering additional information to submit to the FDA. See “Our Investigational New Drug Application and the Clinical Hold” below.

The Cell-in-a-Box® encapsulation technology potentially enables genetically engineered live human cells to be used as a means to produce various biologically active molecules. The technology is intended to result in the formation of pinhead sized cellulose-based porous capsules in which genetically modified live human cells can be encapsulated and maintained. In a laboratory setting, this proprietary live cell encapsulation technology has been shown to create a micro-environment in which encapsulated cells survive and flourish. They are protected from environmental challenges, such as the sheer forces associated with bioreactors and passage through catheters and needles, which we believe enables greater growth and production. The capsules are largely composed of cellulose (cotton) and are bio inert.

We are developing therapies for pancreatic and other solid cancerous tumors by using genetically engineered live human cells that we believe are capable of converting a cancer prodrug into its cancer-killing form. We encapsulate those cells using the Cell-in-a-Box® technology and place those capsules in the body as close as possible to the tumor. In this way, we believe that when a cancer prodrug is administered to a patient with a particular type of cancer that may be affected by the prodrug, the killing of the patient’s cancerous tumor may be optimized.

In addition, we have been exploring ways to delay the production and accumulation of malignant ascites fluid that results from many types of abdominal cancerous tumors. Malignant ascites fluid is secreted by abdominal cancerous tumors into the abdomen after the tumors have reached a certain stage of growth. This fluid contains cancer cells that can seed and form new tumors throughout the abdomen. This fluid accumulates in the abdominal cavity, causing swelling of the abdomen, severe breathing difficulties and extreme pain.

We have also been developing a potential therapy for Type 1 diabetes and insulin-dependent Type 2 diabetes. Our product candidate for the treatment of diabetes consists of encapsulated genetically modified insulin-producing cells. The encapsulation will be done using the Cell-in-a-Box® technology. Implanting these cells in the body is designed to function as a bio-artificial pancreas for purposes of insulin production.

We have also been considering ways to exploit the benefits of the Cell-in-a-Box® technology to develop therapies for cancer that involve prodrugs based upon certain constituents of the Cannabis plant; these constituents are of the class of compounds known as “cannabinoids”.

Until: (i) the FDA allows us to commence a clinical trial in LAPC described in our IND for which the FDA has placed a clinical hold; and (ii) we validate our Cell-in-a-Box® encapsulation technology in our planned Phase 2b clinical trial in LAPC, we are not spending any further resources developing this cannabinoid program.

Cancer Therapy

Targeted Chemotherapy

Our live-cell encapsulation technology-based potential therapies consist of encapsulated genetically modified living cells, with the type of encapsulated cell dependent on the disease being treated. For our lead product candidate, a therapy for pancreatic cancer, we propose that approximately 15,000-20,000 genetically modified live cells that produce an enzyme (an isoform of cytochrome P450), which we believe will convert the chemotherapy prodrug ifosfamide into its cancer-killing form, will be encapsulated using the Cell-in-a-Box® technology. In the clinical trial, if the FDA allows us to proceed, approximately 300 of these capsules will be placed in the patients’ blood supply and guided into place using interventional radiography so that they finally reside as close to the tumor in the pancreas as possible. Low doses (one gram per square meter of body surface area of the patient) of the chemotherapy prodrug ifosfamide will then be given to the patient intravenously.

| 4 |

The prodrug ifosfamide is normally activated in the patient’s liver. By activating the prodrug near the tumor using the Cell-in-a-Box® capsules, we believe our cellular therapy will act as a type of “bio-artificial liver.” Using this type of “targeted chemotherapy,” we are seeking to create an environment that enables optimal concentrations of the “cancer-killing” form of ifosfamide at the site of the tumor. Because the cancer-killing form of ifosfamide has a short biological half-life, we believe that this approach will result in little to no collateral damage to other organs in the body. We also believe this treatment will significantly reduce tumor size with no treatment-related side effects.

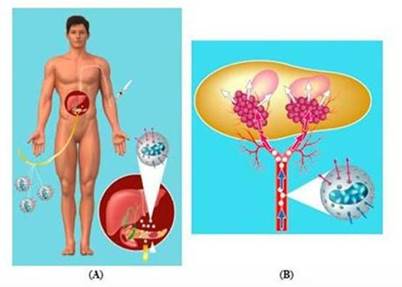

Figure 1: Proposed treatment for pancreatic cancer by targeted deployment and activation of chemotherapy using Cell-in-a-Box® encapsulated cells.

|

Note: Charts A and B are generalized graphic depictions of the principal hypothesized mechanisms of our proposed treatment for pancreatic cancer using our product candidate, the combination of Cell-in-a-Box® encapsulated cells plus low-doses of ifosfamide, under expected conditions. This combination therapy will be the subject of a clinical trial we plan to conduct, subject to FDA approval allowing us to move forward with our clinical trial. No regulatory authority has granted marketing approval for the Cell-in-a-Box® technology, the related encapsulated cells, or Cell-in-a-Box® and encapsulated cells plus low-dose ifosfamide combination. |

|

|

Chart (A)

Cell-in-a-Box® capsules containing

live ifosfamide-activating cells (shown in white) will be implanted in the blood vessels leading to the tumor in the pancreas. Then low

dose ifosfamide will be given intravenously. |

Chart (B)

Chart B shows the human pancreas and generalized depictions of two pancreatic cancer tumors (shown in pink) as examples. In this chart, ifosfamide is converted to its cancer-killing form by the encapsulated live cells implanted near the tumors (shown in maroon).

Legend Blue Arrows: Ifosfamide enters capsules Red Arrows: Conversion to active form White Arrows: Activated ifosfamide targets tumors |

| 5 |

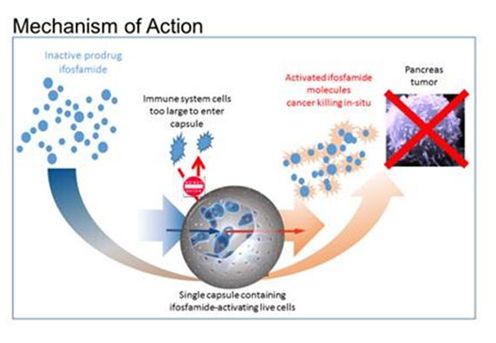

Figure 2: Hypothesized mechanism of action of treatment for pancreatic cancer by targeted deployment of the encapsulated live cells and activation of the chemotherapy prodrug drug ifosfamide. The immune system cells are too large to enter the capsule.

Pancreatic Cancer Therapy

We believe an unmet medical need exists for patients with LAPC whose pancreas tumor no longer responds after 4-6 months of treatment with either Abraxane® plus gemcitabine or the 4-drug combination known as FOLFIRINOX (folinic acid, fluorouracil, irinotecan and oxaliplatin). Both combinations are the current standards of care for pancreatic cancer. We believe that these refractory patients have no effective treatment alternative once their tumors no longer respond to these therapies. Two of the most commonly used treatments for these patients are 5-fluorouiracil (“5-FU”) or capecitabine (a prodrug of 5-FU) plus radiation (chemoradiation therapy). We believe that both treatments are only marginally effective in treating the tumor and both result in serious side effects. More recently, radiation treatment alone is being used at some cancer centers in the United States (“U.S.”).

Other treatments are being tried at various cancer centers in the U.S. in an attempt to address this lack of an effective treatment for many LAPC patients, but their success is far from certain. We are developing a therapy comprised of Cell-in-a-Box® encapsulated live cells implanted near the pancreas tumor followed by the infusion of low doses of the cancer prodrug ifosfamide. We believe that our therapy, if approved, can serve as a “consolidation therapy” that can be used with the current standards of care for LAPC and thus address this critical unmet medical need. Two previous human clinical trials of an encapsulated live cell and ifosfamide combination for LAPC were conducted in Germany by Bavarian Nordic during 1998 – 2000, and such trials were referenced in our IND for LAPC, submitted on October 1, 2020.

Subject to the FDA allowing us to move forward, we plan to commence a clinical trial involving patients with LAPC whose tumors have ceased to respond to either Abraxane® plus gemcitabine or FOLFIRINOX after 4-6 months of either therapy. The trial would initially take place in the U.S. with possible study sites in Europe at a later date.

Our Investigational New Drug Application and the Clinical Hold

On September 1, 2020, we submitted an IND to the FDA for a planned Phase 2b clinical trial in LAPC. Shortly thereafter, we received Information Requests from the FDA related to the IND. We timely responded to all Information Requests.

| 6 |

On October 1, 2020, we received notice that the FDA had placed our IND on clinical hold.

On October 30, 2020, the FDA sent a letter to us setting forth the reasons for the clinical hold and providing specific guidance on what we must do to have the clinical hold lifted.

In order to address the clinical hold, the FDA has requested that we:

| · | Provide additional sequencing data and genetic stability studies; |

| · | Conduct a stability study on the final formulated drug product candidate as well as the cells from our Master Cell Bank; |

| · | Evaluate the compatibility of the delivery devices (the prefilled syringe and the microcatheter used to implant the CypCaps™) with our drug product candidate; |

| · | Provide additional detailed description of the manufacturing process; |

| · | Provide additional product release specifications for our encapsulated cells; |

| · | Demonstrate comparability between the 1st and 2nd generation products and ensure adequate and consistent product performance and safety between the two generations of product; |

| · | Conduct a biocompatibility assessment using the final finished capsules after the entire drug product candidate manufacturing process (but without cells); |

| · | Address insufficiencies in Chemistry, Manufacturing and Controls information in the cross-referenced Drug Master File; |

| · | Conduct an additional nonclinical study in a large animal (such as a pig) to assess the safety, activity and distribution of the drug product candidate; and |

| · | Revise the Investigators Brochure to include any additional preclinical studies conducted in response to the clinical hold and remove any statements not supported by the data. |

The FDA also requested that we address the following issues as an amendment to the IND:

| · | Provide a Certificate of Analysis for pc3/2B1 plasmid that includes tests for assessing purity, safety, and potency; |

| · | Perform qualification studies for the drug substance filling step to ensure that the product candidate remains sterile and stable during the filling process; |

| · | Submit an updated batch analysis for the drug product candidate for the specific lot that will be used for manufacturing all future drug product candidate; |

| · | Provide additional details for the methodology for the Resorufin (CYP2B1) potency and the PrestoBlue cell metabolic assays; |

| · | Provide a few examples of common microcatheters that fit the specifications in our Angiography Procedure Manual; |

| · | Clarify the language in the Pharmacy Manual regarding proper use of the syringe fill with the drug product candidate; and |

| · | Provide a discussion with data for trial of the potential for cellular and humoral immune reactivity against the heterologous rat CYP2B1 protein and potential for induction of autoimmune-mediated toxicities in our study population in the LAPC. |

| 7 |

We have assembled a scientific and regulatory team of experts to address the FDA requests. That team is working to complete the items requested by the FDA. We are in varying stages of addressing the studies and acquiring the information requested by the FDA.

The following provides a summary of the activities in which we are engaged to have the clinical hold lifted:

| · | We have completed a 3, 6, 9, 12 and 18-month product stability study of our clinical trial product (CypCaps™), including container closure integrity testing for certain timepoints; the next time point in this ongoing study will be at 24 months of product stability. |

| · | We are involved in various additional studies required by the FDA. These include (i) a stability study on the cells from our Master Cell Bank (“MCB”) used to make the CypCaps™, which are already at the 3-year stability timepoint; (ii) further sequence analysis of the DNA encoding of the Cyp2B1 gene in the cells in the CypCaps™; and (iii) collated existing information on the reproducibility and quality of the filling of the MCB cells into vials ready for CypCaps™ manufacturing. |

| · | We are also involved in a (i) Subchronic and Chronic Toxicity study (ii) a Skin Sensitization study; (iii) an Acute Systematic Toxicity study; (iv) an Ames test (Genotoxicity Bacteria and Reverse Mutation tests); (v) an Intracutaneous test; (vi) a Complement Activation test; (vii) a Hemolysis test; (viii) an In Vitro Cytotoxicity test; and (ix) an In Vivo Micronucleus assay. Some of the data being generated by these studies will also be used to demonstrate comparability with the CypCaps™ that were used in the two earlier German clinical trials over twenty years ago conducted by Bavarian Nordic. |

| · | To enable the biocompatibility studies to be performed, we had Austrianova manufacture and deliver an additional 400 syringes of empty capsules. |

| · | We have commenced studies to show that CypCaps™ are not in any way adversely affected by the catheters used by interventional radiologists to deliver them, nor by the contract media used to visualize the blood vessels during implantation of the CypCaps™. |

| · | We have commenced studies to demonstrate how robust the CypCaps™ are during delivery and use as well as to document that the syringes used to deliver the CypCaps™ will allow delivery consistently, smoothly and safely. |

| · | With our support, Austrianova is providing additional detailed confidential information to the FDA on the manufacturing process, including information on the improvements made to the live cell encapsulated product since the last clinical trials with respect to reproducibility and safety of the CypCaps™. |

| · | We plan to update our IND submission documents to include: (i) more pre-clinical data as discussed above, (ii) some additional parameters for release of the CypCaps™, (iii) a recommendation of the catheters and contrast medium to be used to deliver the CypCaps™; and (iv) an extensive discussion of the potential for cellular and humoral immune reactivity against the heterologous rat CYP2B1 protein and potential for induction of autoimmune-mediated toxicities in our study population in the LAPC. |

| · | We have designed an abbreviated study in pigs to address biocompatibility and long-term implantation of the capsules. This animal study will complement the positive data already available from the previous human clinical trials conducted by Bavarian Nordic showing the safety of CypCaps™ implantation for up to two years in humans. |

| · | We have completed the complement activation study. The study results demonstrated that the capsule material we use does not activate a major line of the human body’s innate defense – the complement system. |

| 8 |

| · | Another positive result from a completed biocompatibility showed that the empty capsule material is “non-hemolytic.” |

| · | Another completed biocompatibility study showed that the empty capsule material is not “mutagenic.” |

Malignant Ascites Fluid Therapy

We have been exploring ways to delay the production and accumulation of malignant ascites fluid that results from many types of abdominal tumors. Malignant ascites fluid is secreted by an abdominal tumor into the abdomen after the tumor reaches a certain stage of growth. This fluid contains cancer cells that can seed and form new tumors throughout the abdomen. As this ascites fluid accumulates in the abdominal cavity, it can cause gross swelling of the abdomen, severe breathing difficulties and extreme pain.

Once an abdominal tumor reaches a certain stage of development, the tumor secretes malignant ascites fluid into the abdominal cavity. When that occurs, malignant ascites fluid must be removed by paracentesis on a periodic basis. This procedure is painful and costly. We know of no available therapy that prevents or delays the production and accumulation of malignant ascites fluid.

Preclinical studies were conducted by Translational Drug Development (“TD2”), an early-stage Clinical Research Organization (“CRO”) specializing in oncology, to examine whether the combination of Cell-in-a-Box® encapsulated cells plus low doses of ifosfamide can delay the production and accumulation of malignant ascites fluid. We believe the data from these studies support our plans to further explore whether the treatment might play a role in malignant ascites fluid production and accumulation. However, the conclusions were difficult to interpret with certainty. As a result, we plan to conduct another preclinical study in Germany to determine if our conclusions from the TD2 studies are valid. If this study is successful, and subject to discussions with the FDA, we plan to submit an IND to seek approval from the FDA to conduct a Phase 1 clinical trial in the U.S. to determine if our drug product candidate can delay the production and accumulation of malignant ascites fluid.

Diabetes Therapy

A Bio-Artificial Pancreas to Treat Diabetes

We are developing a therapy for Type 1 diabetes and insulin-dependent Type 2 diabetes based upon the encapsulation of a human liver cell line genetically engineered to produce, store and secrete insulin at levels in proportion to the levels of blood sugar in the human body. We are also considering an alternative route to bringing a biological treatment for diabetes into the clinic. We are exploring the possibility of encapsulating human insulin-producing cells and then transplanting them into a diabetic patient. Our plans are subject to discussions with the FDA.

The cell line we select will be encapsulated using the Cell-in-a-Box® encapsulation technology. If appropriate animal testing is completed successfully, and subject to discussions with the FDA, we intend to submit an IND to seek the FDA’s approval to transplant encapsulated insulin-producing cells into diabetic patients. The goal for these approaches is to develop a bio-artificial pancreas for purposes of insulin production for diabetics who are insulin-dependent.

Our diabetes program began with two of the most critical components of a biological diabetes therapy - a line of human cells which release insulin in response to the blood glucose level in their environment and a technology to protect the cells from an attack by the immune system once they are transplanted into a patient’s body to replace the patient’s own destroyed insulin-producing cells. This technology is the Cell-in-a-Box® encapsulation technology. The cells used are called Melligen cells. They are patent-protected and have been licensed to us by University of Technology Sydney (“UTS”).

Regulations for the use of living cells as a medical product require that the potential of the cells to grow and form a tumor in a patient be assessed. This so-called “tumorigenicity study” has been completed by the University of Veterinary Medicine Vienna (“VetMed”). Melligen cells showed very low tumorigenicity at a level we believe would expect to pass regulatory scrutiny, although this is subject to discussions with the FDA.

| 9 |

Putting Melligen cells and the Cell-in-a-Box® technology together, we conducted the first functional study in diabetic mice. The results did not meet our expectations. We discovered that, contrary to what we had expected and what we had read in published scientific papers on the Melligen cells published by UTS, the cells are not stable. With extensive testing and experiments, we discovered that the Melligen cells lose some of their specific beneficial properties over time.

We entered into a new research agreement with UTS to create an advanced version of the Melligen cells for the treatment of diabetes. Under the new research agreement, improvements will be made to the Melligen cells that we believe will increase their stability, increase their insulin production and increase the bioactivity of the produced insulin.

Prof. Ann Simpson, who created the Melligen cells, and her team of research scientists at UTS have been conducting this research project. The work is being funded by the Company and UTS. Our portion of the funding was previously paid to UTS. The research to date has not produced the results we had anticipated and is taking longer than we anticipated. It remains to be seen whether the Melligen cells are capable of producing the required insulin to be a viable cell line for the treatment of diabetes.

Cannabinoids to Treat Cancer

Numerous studies have demonstrated the therapeutic potential of certain cannabinoids (constituents of Cannabis) in patients with cancer. Two of the most widely studied cannabinoids in this regard are tetrahydrocannabinol (“THC”) and cannabidiol (“CBD”). Cannabinoids are potentially: (i) anti-proliferative (slow tumor growth); (ii) anti-metastatic (slow tumor spread); (iii) anti-angiogenic (slowing blood vessel development); and (iv) pro-apoptotic (initiate programmed cell death). In in vitro and in vivo models, the therapeutic potential of cannabinoids is broad. Results support the therapeutic potential in lung, brain, thyroid, lymphoma, liver, skin, pancreas, uterus breast and prostate cancers. In a review of 51 scientific studies, among other properties, it was observed that cannabinoids can regulate cellular signaling pathways critical for cell growth and survival. These properties indicate that cannabinoids could be useful in the treatment of cancer.

We have many competitors that are developing Cannabis-based treatments for cancer. Jazz Pharmaceuticals has acquired GW Pharmaceuticals, PLC who had an approved cannabinoid product for the treatment of multiple sclerosis spasticity and was developing a product portfolio to treat a variety of illnesses, including glioblastoma (brain cancer). Cannabis Science, Inc. has been developing topical cannabinoid treatments for basal and squamous cell skin cancers and Kaposi’s sarcoma, and is exploring pre-clinical development of cannabinoid-based anti-cancer drugs in a collaborative agreement with other entities. OWC Pharmaceutical Research Corp. is developing Cannabis-based products targeting a variety of indications and has a collaborative agreement with an academic medical center in Israel to study the effects of cannabinoids on multiple myeloma (a cancer of plasma cells). Cannabis Pharmaceuticals, Inc. is developing personalized anti-cancer and palliative Cannabis-based treatments aimed mainly at improving the cachexia, anorexia syndrome and quality-of-life issues that are often characteristic of patients with devastating diseases like cancer.

In contrast to the work being done by these companies, we plan to focus on developing specific therapies based on chosen molecules rather than using complex Cannabis extracts. We intend to use the Cell-in-a-Box® technology in combination with genetically modified cell lines designed to activate cannabinoid molecules for the treatment of diseases and their related symptoms. Our initial target will be glioblastoma, a very difficult-to treat form of brain cancer.

In May 2014, we entered into a research agreement with the University of Northern Colorado (“UNC”). The goal of the original research was to develop methods for the identification, separation and quantification of constituents of Cannabis, some of which are prodrugs, which could potentially be used in combination with the Cell-in-a-Box® technology to treat cancer.

In January 2017, we entered into a second research agreement with UNC. The goal of this research is to assess the synthesis of the patG gene and its incorporation into a vector, transfection of human embryonic kidney cells using this vector and assessment of cannabinoic acid decarboxylase activity.

| 10 |

During 2017, UNC identified an organism whose genome contains the genetic code for production of an enzyme capable of activating a cannabinoid prodrug into its active cancer-killing form. Our Cannabis program now has two primary areas of focus. The first is evaluating the therapeutic potential of cannabinoids, such as THC and CBD, particularly in our main “target” tumor – glioblastoma. UNC’s laboratory research has confirmed that a purified cannabinoid showed a potent dose-dependent decrease in cell viability for various cancers, suggesting that this cannabinoid exhibits significant anti-proliferative effects (stops the growth and multiplication of cancer cells). This activity has been demonstrated in brain (glioblastoma), pancreas, breast, lung, colon and melanoma cancer cells. The second area of focus is in finding an enzyme capable of converting an inactive, side-effect-free, cannabinoid prodrug into its active cancer-killing form.

Clinically, targeted cannabinoid-based chemotherapy would be accomplished by implanting the encapsulated bio-engineered cells near the site of a tumor, along with administration of a cannabinoid prodrug which would become activated at the site of the tumor by an enzyme produced by the encapsulated cells. We believe this could lead to better efficacy than existing therapies with minimal treatment related adverse events.

Until: (i) the FDA allows us to commence a clinical trial in LAPC described in our IND for which the FDA has placed a clinical hold; and (ii) we validate our Cell-in-a-Box® encapsulation technology in our planned Phase 2b clinical trial in LAPC, we are not spending any further resources developing this program.

Impact of the COVID-19 Pandemic on our Operations

The coronavirus SARS-Cov2 pandemic (“COVID-19”) is causing significant, industry-wide delays in clinical trials. Although we are not yet in a clinical trial, we have filed an IND with the FDA to commence a clinical trial in LAPC. While the IND has been placed on clinical hold by the FDA, we have assessed the impact of COVID-19 on our operations. Currently, many clinical trials are being delayed due to COVID-19. There are numerous reasons for these delays. For example, patients have shown a reluctance to enroll or continue in a clinical trial due to fear of exposure to COVID-19 when they are in a hospital or doctor’s office. There are local, regional and state-wide orders and regulations restricting usual normal activity by people. These discourage and interfere with patient visits to a doctor’s office if the visit is not COVID-19 related. Healthcare providers and health systems are shifting their resources away from clinical trials toward the care of COVID-19 patients. The FDA and other healthcare providers are making product candidates for the treatment of COVID-19 a priority over product candidates unrelated to COVID-19. As of the date of this prospectus, the COVID-19 pandemic has had an impact upon our operations, although we believe that impact is not material. The impact primarily relates to delays in tasks associated with the preparation of the Company’s responses to the clinical hold, including all requested preclinical studies. There may be further delays in generating responses to the requests from the FDA related to the clinical hold.

As a result of the COVID-19 pandemic, commencement of our planned clinical trial to treat LAPC may be delayed beyond the lifting of the clinical hold by the FDA should that occur. Also, enrollment may be difficult for the reasons discussed above. In addition, after enrollment in the trial, if patients contract COVID-19 during their participation in the trial or are subject to isolation or shelter in place restrictions, this may cause them to drop out of our clinical trial, miss scheduled therapy appointments or follow-up visits or otherwise fail to follow the clinical trial protocol. If patients are unable to follow the clinical trial protocol or if the trial results are otherwise affected by the consequences of the COVID-19 pandemic on patient participation or actions taken to mitigate COVID-19 spread, the integrity of data from the clinical trial may be compromised or not be accepted by the FDA. This could further adversely impact or delay our clinical development program if the FDA allows it to proceed.

It is highly speculative in projecting the effects of COVID-19 on our proposed clinical development program and the Company generally. The effects of COVID-19 quickly and dramatically change over time. Its evolution is difficult to predict, and no one is able to say with certainty when the pandemic will subside.

Recent Developments

Certificate of Amendment to Articles of Incorporation

On June 30, 2021, at our Annual Meeting of Stockholders, our stockholders approved a Certificate of Amendment to our Articles of Incorporation to increase the number of authorized shares of Common Stock from 2,500,000,000 shares to 50,000,000,000 shares. Upon effectiveness of the 1:1,500 reverse stock split on July 12, 2021, the number of authorized shares of our Common Stock was reduced proportionately to 33,333,334 shares by operation of Nevada law and the number of outstanding shares of our Common Stock was reduced to 1,591,420 shares. As of the date of this prospectus, and giving effect to the offerings discussed below, the Company had 20,715,804 shares of Common Stock outstanding.

| 11 |

Reverse Stock Split

On June 30, 2021, our Board of Directors (“Board”) approved a reverse stock split of 1:1,500 of our authorized and our issued and outstanding shares of Common Stock effective on July 12, 2021 pursuant to a Certificate of Change filed in Nevada. Except as otherwise indicated, all share and per share information in this prospectus gives effect to the reverse stock split of the Company’s outstanding Common Stock, which was effected at a ratio of 1-for-1,500 shares as of 12:01 a.m. Eastern Time on Monday, July 12, 2021.

Nasdaq Listing

Our Common Stock began trading on Nasdaq on August 10, 2021, under the symbol “PMCB.” Prior to that, our Common Stock was quoted on the OTCQB Market under the symbol “PMCB,” and following the reverse stock split of our Common Stock effective as of July 12, 2021, and until August 6, 2021, the OTCQB Market Symbol for our Common Stock had temporarily been PMCBD.

August 2021 Underwritten Offering

On August 9, 2021, we entered into an underwriting agreement with Wainwright as underwriter in connection with a public offering of an aggregate of (i) 2,630,385 shares of Common Stock and 899,027 pre-funded warrants (“August 9 Pre-funded Warrants”) to purchase Common Stock, and (ii) Common Stock warrants (the “August Common Warrants”) to purchase 3,529,412 shares of Common Stock. Each share of Common Stock (or pre-funded warrant in lieu thereof) was sold together with an August Common Warrant to purchase one share of Common Stock at an effective combined public offering price of $4.25 per share of Common Stock and accompanying August Common Warrant, less underwriting discounts and commissions. The August Common Warrants have an exercise price of $4.25 per share, are exercisable immediately, and will expire five years following the date of issuance. The August Pre-funded Warrants have an exercise price of $0.001 per share, are exercisable immediately, and do not have an expiration date. In addition, the Company granted Wainwright a 30-day option (“Option”) to purchase up to 529,411 shares and/or August Common Warrants at the public offering price, less the underwriting discounts and commissions. The offering of such securities pursuant to the underwriting agreement (“August 2021 Offering”) closed on August 12, 2021, and at closing, Wainwright partially exercised its Option for warrants to purchase an aggregate of up to 499,116 shares of Common Stock. At the closing, we received net proceeds from the offering of approximately $13.6 million, after deducting underwriting discounts and commissions and estimated offering expenses.

August 2021 Registered Direct Offering

Pursuant to the August 19, 2021 Purchase Agreement, the Company agreed to sell in a registered direct offering (“Registered Direct Offering”) 8,430,000 shares (“Shares”) of the Company’s Common Stock and pre-funded warrants (“August 19 Pre-Funded Warrants”) to purchase up to 5,570,000 shares of Common Stock. The Pre-Funded Warrants have an exercise price of $0.001 per share and are immediately exercisable and can be exercised at any time after their original issuance until such August 19 Pre-Funded Warrants are exercised in full. The Registered Direct Offering of the Shares and the August 19 Pre-Funded Warrants was made pursuant to the Company’s shelf registration statement on Form S-3 (File No. 333-255044), declared effective by the Securities and Exchange Commission on April 14, 2021, and a related registration statement (File No. 333-258921) filed on August 19, 2021 in accordance with Rule 462(b) under the Securities Act of 1933, as amended (“Securities Act”), and a prospectus supplement that the Company has filed with the Securities and Exchange Commission relating to such securities. At closing, we received net proceeds of approximately $64 million after deducting placement fees and estimated offering expenses.

August 2021 Warrant Exercises

As of August 18, 2021, all 899,027 of the August 9 Pre-funded Warrants have been exercised.

| 12 |

As of August 31, 2021, 2,522,387 of the August Common Warrants have been exercised, for aggregate gross proceeds to the Company of $10,720,145.

As of August 31, 2021, 4,620,000 of the August 19 Pre-funded Warrants have been exercised for aggregate gross proceeds to the Company of $4,620.

Summary of Risks Associated with Our Business

Our business is subject to numerous risks and uncertainties that you should consider before investing in our company. These risks are described more fully in the section titled “Risk Factors” in this prospectus. These risks include, but are not limited to, the following:

| · | We are a biotechnology company with limited resources, a limited operating history and have no products approved for clinical trials or commercial sale, which may make it difficult to evaluate our current business and predict our future success and viability. |

| · | As a result of the clinical hold that has been placed on our IND by the FDA, it has taken and may continue to take considerable time and expense to respond to the FDA and no assurance can be given that the FDA will remove the clinical hold in which case our business and prospects will likely suffer material adverse consequences. |

| · | The recent and ongoing COVID-19 pandemic has affected and could continue to affect our operations, as well as the business or operations of third parties with whom we conduct business. Our business could be adversely affected by the effects of other future health pandemics in regions where we or third parties on which we rely have significant business operations. |

| · | If we are unable to successfully raise additional capital, our future clinical trials and product development could be limited and our long-term viability may be threatened. |

| · | Due to the significant resources required for the development of our programs, and depending on our ability to access capital, we must prioritize development of certain product candidates. We may expend our resources on programs that do not yield a successful product candidate and fail to capitalize on product candidates or indications that may be more profitable or for which there is a greater likelihood of success. |

| · | We currently have no commercial revenue and may never become profitable. |

| · | If we are unable to obtain, or if there are delays in obtaining, required approval from the applicable regulatory agencies, we will not be able to commercialize our product candidates and our ability to generate revenue will be materially impaired. |

| · | If allowed to proceed with our clinical development program, we intend to conduct clinical trials for certain of our product candidates at sites outside of the U.S., and the U.S. regulatory agencies may not accept data from trials conducted in such locations. |

| · | Promising results in previous clinical trials of our encapsulated live cell and ifosfamide combination for LAPC may not be replicated in future clinical trials which could result in development delays or a failure to obtain marketing approval. |

| · | We may not be able to protect our intellectual property rights throughout the world. |

| 13 |

| · | We rely and expect to continue to rely heavily on third parties to conduct our preclinical studies and clinical trials, if we are allowed to proceed with our planned clinical trial, and those third parties may not perform satisfactorily, including failing to meet deadlines for the completion of such studies and trials. |

| · | There was no consistent active trading market for our Common Stock prior to August 10, 2021, and public trading of our Common Stock may continue to fluctuate substantially. |

| · | A large number of shares of Common Stock may be issued and subsequently sold upon the exercise of existing options and warrants. |

| · | As a result of our Nasdaq listing, we will incur materially increased costs and become subject to additional regulations and requirements. |

| · | We may not be able to meet the continued listing requirements for Nasdaq or another nationally recognized stock exchange, which could limit investors’ ability to make transactions in our securities and subject us to additional trading restrictions. |

| · | We are a “smaller reporting company” under the SEC’s disclosure rules and have elected to comply with the reduced disclosure requirements applicable to smaller reporting companies. |

| · | As a non-accelerated filer, we are not required to comply with the auditor attestation requirements of the Sarbanes-Oxley Act. |

| · | Following the reverse stock split, the resulting market price of our Common Stock may not attract new investors, including institutional investors, and may not satisfy the investing requirements of those investors. Consequently, the trading liquidity of our Common Stock may not improve. |

Our Corporate Information

We are a Nevada corporation incorporated in 1996. In 2013, we restructured our operations to focus on biotechnology. The restructuring resulted in the Company focusing all of its efforts upon the development of a novel, effective and safe way to treat cancer and diabetes. In January 2015, the Company changed its name from Nuvilex, Inc. to PharmaCyte Biotech, Inc. to reflect the nature of its current business.

Our corporate headquarters are located at 3960 Howard Hughes Parkway, Suite 500, Las Vegas, Nevada 89169, and our telephone number is (917) 595-2850. We maintain a website at www.pharmacyte.com, to which we regularly post copies of our press releases as well as additional information about us. Our filings with the SEC will be available free of charge through the website as soon as reasonably practicable after being electronically filed with or furnished to the SEC. Information contained in our website is not a part of, nor incorporated by reference into, this prospectus or our other filings with the SEC, and should not be relied upon.

To date, we have had a limited operating history with our current business model and have not produced any revenues.

Investing in our Common Stock involves a high degree of risk. Before investing in our Common Stock, you should carefully consider the risks described below, together with all of the other information contained in this prospectus and incorporated by reference herein, including from our Annual Report on Form 10-K for the fiscal year ended April 30, 2021, as well as any amendment or update to our risk factors reflected in subsequent filings with the SEC. Some of these factors relate principally to our business and the industry in which we operate. Other factors relate principally to your investment in our securities. The risks and uncertainties described therein and below are not the only risks facing us. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also materially and adversely affect our business and operations.

| 14 |

If any of the matters included in the following risks were to occur, our business, financial condition, results of operations, cash flows or prospects could be materially and adversely affected. In such case, you may lose all or part of your investment.

We are a biotechnology company with limited resources, a limited operating history and have no products approved for clinical trials or commercial sale, which may make it difficult to evaluate our current business and predict our future success and viability.

We are a biotechnology company focused on developing cellular therapies for cancer based upon a proprietary cellulose-based live cell encapsulation technology known as “Cell-in-a-Box®.” In recent years, we have devoted substantially all our resources to the development of our product candidate for LAPC. We have limited resources, a limited operating history, no products approved for clinical trials or commercial sale and therefore have not produced any revenues. We have generated significant operating losses since our inception. Our net losses for the years ended April 30, 2021 and 2020 were approximately $3.6 million and $3.8 million, respectively. As of July 31, 2021, we had an accumulated deficit of approximately $108.4 million. Substantially all our losses have resulted from expenses incurred relating to our research and development programs and from general and administrative expenses and operating losses associated with our business.

We expect to continue to incur significant expenses and operating losses for the foreseeable future. We anticipate these losses will increase as we continue our research and development of, and, if approved by the FDA, commence clinical trials for, our product candidates. In addition to budgeted expenses, we may encounter unforeseen expenses, difficulties, complications, delays and other unknown factors that may adversely affect our business.

We have no facilities to conduct fundamental research and we have performed our research and development activities by collaboration with contract service providers and contract manufacturers, and by designing and developing research programs in collaboration with university-based experts who work with us to evaluate mechanism(s) of disease for which we have designed and developed product candidates. We have not maintained a principal laboratory or primary research facility for the development of our product candidates.

Biotechnology product development is a highly uncertain undertaking and involves a substantial degree of risk. We have not commenced or completed clinical trials for any of our product candidates, obtained marketing approval for any product candidates, manufactured a commercial scale product, or arranged for a third party to do so on our behalf, or conducted sales and marketing activities necessary for successful product commercialization. Given the highly uncertain nature of biotechnology product development, we may never commence or complete clinical trials for any of our product candidates, obtain marketing approval for any product candidates, manufacture a commercial scale product or arrange for a third party to do so on our behalf, or conduct sales and marketing activities necessary for successful product commercialization.

Our limited operating history as a company makes any assessment of our future success and viability subject to significant uncertainty. We will encounter risks and difficulties frequently experienced by early-stage biotechnology companies in rapidly evolving fields, and we have not yet demonstrated an ability to successfully overcome such risks and difficulties. If we do not address these risks and difficulties successfully, our business, operating results and financial condition will suffer.

As a result of the clinical hold that has been placed on our IND by the FDA, it has taken and may continue to take considerable time and expense to respond to the FDA and no assurance can be given that the FDA will remove the clinical hold in which case our business and prospects will likely suffer material adverse consequences.

On October 1, 2020, we received notice from the FDA that it had placed our IND for a planned Phase 2b clinical trial in LAPC on clinical hold. As part of the clinical hold process, the FDA has asked for additional information, tasks to be performed by us and new preclinical studies and assays. It has taken and may continue to take a considerable period of time, the length of which is not certain at this time, for us to conduct such tasks and preclinical studies and to generate and prepare the requested information. It is possible that the service providers that we will utilize for such work may have considerable backlogs and/or are suffering from slowdowns as a result of COVID-19 and may not be able to perform such work for an extended period of time. Even if we are able to fully respond to the FDA’s requests, they may subsequently make additional requests that we would need to fulfill prior to the lifting of the clinical hold and we may never be able to begin our clinical trial in LAPC, obtain regulatory approval or successfully commercialize our product candidates. An inability to conduct our clinical trial in LAPC as a result of the clinical hold or otherwise, would likely force us to terminate our clinical development plans. It is possible that we will be unable to fully respond to the FDA in a satisfactory manner, and as a result the clinical hold may never be lifted. If the clinical hold is not lifted or if the lifting takes an extended period of time, our business and prospects will likely suffer material adverse consequences

| 15 |

The recent and ongoing COVID-19 pandemic could materially affect our operations, as well as the business or operations of third parties with whom we conduct business. Our business could be adversely affected by the effects of other future health pandemics in regions where we or third parties on which we rely have significant business operations.

Our business and its operations, including, but not limited to, our proposed clinical development program, supply chain operations, research and development activities and fundraising activities, has been and could continue to be adversely affected by the COVID-19 pandemic in areas where we have business operations, including the U.S., India, Europe, Singapore and Thailand. Also, this pandemic could cause significant disruption in the operations of third parties upon whom we rely on to conduct the Company’s business. In March 2020, the World Health Organization declared the COVID-19 outbreak a pandemic. Shortly thereafter, the U.S. government-imposed restrictions on travel between the U.S., Europe, and certain other countries. The President of the U.S. declared the COVID-19 pandemic a national emergency. Since March 2020, numerous state, regional and local jurisdictions, including the jurisdictions where our headquarters are located, as well as foreign jurisdictions, have imposed, and others in the future may impose, quarantines, shelter-in-place orders, executive, and similar government orders for their residents to control the spread of COVID-19. The COVID-19 pandemic has had an impact upon our operations.

The effects of the executive orders, the shelter-in-place orders and our work-from-home policies has and may continue to negatively impact productivity, disrupt our business, and delay our proposed clinical development program and timeline, the magnitude of which will depend, in part, on the length and severity of the restrictions and other limitations on our ability to conduct our business in the ordinary course. These and similar, and perhaps more severe, disruptions in our operations could negatively impact our business, operating results and financial condition.

Quarantines, shelter-in-place, executive, and similar government orders, or the perception that such orders, shutdowns or other restrictions on the conduct of business operations could occur, related to COVID-19, could impact personnel at our third-party manufacturing facilities in Thailand, or the availability or cost of materials we use or require to conduct our business, including product development, which would disrupt our supply chain. Some of our suppliers and vendors of certain materials used in our operations and research and development activities are located in areas that are subject to executive orders and shelter-in-place orders. While many of these materials may be obtained from more than one supplier, port closures and other restrictions resulting from the COVID-19 pandemic may disrupt our supply chain or limit our ability to obtain sufficient materials to operate our business. To date, we are aware of certain suppliers for our research and development activities that have experienced operational delays directly related to the COVID-19 pandemic.

Depending upon the length of the COVID-19 pandemic and whether the FDA lifts the clinical hold on our IND, we anticipate our planned clinical trial in LAPC may be affected by the COVID-19 pandemic. If COVID-19 continues to spread in the U.S. and elsewhere, we may experience additional disruptions that could adversely impact our business and proposed clinical trial, including: (i) delays or difficulties in enrolling patients in our Phase 2b clinical trial if the FDA allows us to go forward with such trial; (ii) delays or difficulties in clinical site activation, including difficulties in recruiting clinical site investigators and clinical site personnel; (iii) delays in clinical sites receiving the supplies and materials needed to conduct our clinical trial, including interruption in global shipping that may affect the transport of our clinical trial product; (iv) changes in local regulations as part of a response to the COVID-19 pandemic which may require us to change the ways in which our clinical trial is to be conducted, which may result in unexpected costs, or to discontinue the clinical trial altogether, if allowed to proceed; (v) diversion of healthcare resources away from the conduct of clinical trials, including the diversion of hospitals serving as our clinical trial sites and hospital staff supporting the conduct of our clinical trial; (vi) interruption of key clinical trial activities, such as clinical trial site monitoring, due to limitations on travel imposed or recommended by federal or state governments, employers and others, or interruption of clinical trial subject visits and study procedures, the occurrence of which could affect the integrity of clinical trial data; (vii) risk that participants enrolled in our proposed clinical trials will acquire COVID-19 while the clinical trial is ongoing, which could impact the results of the clinical trial, including by increasing the number of observed adverse events; (viii) delays in necessary interactions with local regulators, ethics committees, and other important agencies and contractors due to limitations in employee resources or forced furlough of government employees; (ix) limitations in employee resources that would otherwise be focused on the conduct of our clinical trial because of sickness of employees or their families or the desire of employees to avoid contact with large groups of people; (x) refusal of the FDA to accept data from clinical trials in affected geographies; and (xi) interruption or delays to our clinical trial activities.

| 16 |

The spread of COVID-19, which has caused a widespread impact throughout the world, may materially affect us economically. The potential economic impact brought about by the COVID-19 pandemic, and the duration of such impact, is difficult to assess or predict. The pandemic has resulted in significant disruption of global financial markets, which could reduce our ability to access capital and negatively affect our future liquidity. Also, a recession or market correction resulting from the spread of COVID-19 and related government orders and restrictions could materially affect our business and the value of our Common Stock. The COVID-19 pandemic continues to evolve. The ultimate impact of the COVID-19 pandemic and the mitigation efforts to address it is highly uncertain and subject to change. We do not yet know the full extent of potential delays or impacts on our business, our proposed clinical trial, healthcare systems or the global economy.

If we are unable to successfully raise additional capital, our future clinical trials and product development could be limited and our long-term viability may be threatened.

We have experienced negative operating cash flows since our inception and have funded our operations primarily through sales of our equity securities. We may need to seek additional funds in the future through equity or debt financings, or strategic alliances with third parties, either alone or in combination with equity financings to complete our product development initiatives. These financings could result in substantial dilution to the holders of our Common Stock, or require contractual or other restrictions on our operations or on alternatives that may be available to us. If we raise additional funds by issuing debt securities, these debt securities could impose significant restrictions on our operations. Any such required financing may not be available in amounts or on terms acceptable to us, and the failure to procure such required financing could have a material and adverse effect on our business, financial condition and results of operations, or threaten our ability to continue as a going concern.

Our operating and capital requirements during this fiscal year and thereafter will vary based on several factors, including whether the FDA allows us to commence our planned clinical trial for LAPC, how quickly enrollment of patients in our such trial can be commenced, the duration of the clinical trial and any change in the clinical development plans for our product candidates and the outcome, timing and cost of meeting regulatory requirements established by the FDA and the EMA or other comparable foreign regulatory authorities.

Our present and future capital requirements will be significant and will depend on many factors, including:

| · | whether the FDA lifts the clinical hold on our IND filing for LAPC; |

| · | the progress and results of our development efforts for our product candidates; |

| · | the costs, timing and outcome of regulatory review of our product candidates; |

| · | the costs and timing of preparing, filing and prosecuting patent applications, maintaining and enforcing our intellectual property rights and defending any intellectual property-related claims; |

| · | the effect of competing technological and market developments; |

| · | market acceptance of our product candidates; |

| 17 |

| · | the rate of progress in establishing coverage and reimbursement arrangements with domestic and international commercial third-party payors and government payors; |

| · | the extent to which we acquire or in-license other products and technologies; and |

| · | legal, accounting, insurance and other professional and business-related costs. |

We may not be able to acquire additional funds on acceptable terms, or at all. If we are unable to raise adequate funds, we may have to liquidate some or all of our assets, or delay or reduce the scope of or eliminate some or all of our development programs. Further, if we do not have, or are not able to obtain, sufficient funds, we may be required to delay development or commercialization of our product candidates. We also may have to reduce the resources devoted to our product candidates or cease operations. Any of these factors could harm our operating results.

Due to the significant resources required for the development of our programs, and depending on our ability to access capital, we must prioritize development of certain product candidates. We may expend our resources on programs that do not yield a successful product candidate and fail to capitalize on product candidates or indications that may be more profitable or for which there is a greater likelihood of success.

We seek to maintain a process of prioritization and resource allocation to maintain an optimal balance between aggressively advancing lead programs and ensuring replenishment of our portfolio. Until such time, if ever, as the FDA lifts its clinical hold on our IND related to our planned Phase 2b clinical trial in LAPC and our Cell-in-a-Box® encapsulation technology is validated in our planned Phase 2b clinical trial, we have halted spending on behalf of our development program with respect to cannabinoids.

Due to the significant resources required for the development of our programs, we must focus our programs on specific diseases and decide which product candidates to pursue and advance and the amount of resources to allocate to each. Our decisions concerning the allocation of research, development, collaboration, management and financial resources toward particular product candidates or therapeutic areas may not lead to the development of any viable commercial product and may divert resources away from better opportunities. Similarly, our potential decisions to delay, terminate or collaborate with third parties in respect of certain programs may subsequently also prove to be suboptimal and could cause us to miss valuable opportunities. We may fail to capitalize on viable commercial products or profitable market opportunities, be required to forego or delay pursuit of opportunities with other product candidates or other diseases that may later prove to have greater commercial potential than those we choose to pursue, or relinquish valuable rights to such product candidates through collaboration, licensing or other royalty arrangements in cases in which it would have been advantageous for us to invest additional resources to retain sole development and commercialization rights. If we make incorrect determinations regarding the viability or market potential of any or all of our programs or product candidates or misread trends in the biotechnology industry, our business, prospects, financial condition and results of operations could be materially adversely affected.

We currently have no commercial revenue and may never become profitable.

Even if we can successfully achieve regulatory approval for our product candidates, we do not know what the reimbursement status of our product candidates will be or when any of these products will generate revenue for us, if at all. We have not generated, and do not expect to generate, any product revenue for the foreseeable future. We expect to continue to incur significant operating losses for the foreseeable future due to the cost of our research and development, preclinical studies and clinical trials and the regulatory approval process for our product candidates. The amount of future losses is uncertain and will depend, in part, on the rate of growth of our expenses.

Our ability to generate revenue from our product candidates also depends on numerous additional factors, including our ability to:

| · | successfully complete development activities, including the remaining preclinical studies and planned clinical trials for our product candidates; |

| 18 |

| · | complete and submit NDAs or BLAs to the FDA and MAAs to the EMA, and obtain regulatory approval for indications for which there is a commercial market; |

| · | complete and submit applications to, and obtain regulatory approval from, other foreign regulatory authorities; |

| · | manufacture any approved products in commercial quantities and on commercially reasonable terms; |

| · | develop a commercial organization, or find suitable partners, to market, sell and distribute approved products in the markets in which we have retained commercialization rights; |

| · | achieve acceptance among patients, clinicians and advocacy groups for any products we develop; |

| · | obtain coverage and adequate reimbursement from third parties, including government payors; and |

| · | set a commercially viable price for any products for which we may receive approval. |

We are unable to predict the timing or amount of increased expenses, or when or if we will be able to achieve or maintain profitability. Even if we can complete the processes described above, we anticipate incurring significant costs associated with commercializing our product candidates.

We face substantial competition, which may result in others discovering, developing or commercializing competing products before or more successfully than we do.