Exhibit 99.1

PHARMACYTE BIOTECH, INC.

23046 Avenida de la Carlota, Suite 600

Laguna Hills, California 92653

(917) 595-2850

May 5, 2021

Dear Fellow Stockholder:

You are cordially invited to attend the 2021 Annual Meeting of Stockholders of PharmaCyte Biotech, Inc. (“PharmaCyte,” the “Company,” “we” or “us”) to be held at 11:00 a.m., Pacific Daylight Time, on Wednesday, June 16, 2021.

We are very pleased that this year’s annual meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. In light of the Coronavirus (COVID-19) pandemic, for the safety of our stockholders and in accordance with federal, state and local guidance that has been issued regarding group gatherings, we have decided that the Annual Meeting will be held in a virtual format only, via the Internet, with no physical in-person meeting. You will be able to attend the 2021 Annual Meeting of Stockholders online and submit your questions during the meeting by visiting https://virtualshareholdermeeting.com/PMCB2021. You will also be able to vote your shares electronically at the annual meeting.

We are pleased to use the latest technology to increase access, to improve communication and to obtain cost savings for our stockholders and the Company. Use of a virtual meeting will enable increased stockholder attendance and participation as stockholders can participate from any location.

At the meeting, you will be asked to: (i) elect seven directors as nominated by the Board of Directors, each to serve a one-year term; (ii) approve a Certificate of Amendment to our Articles of Incorporation to increase the number of authorized shares of our common stock; (iii) approve our 2021 Equity Incentive Plan (the “2021 Plan”); (iv) ratify our appointment of Armanino LLP as our independent registered public accounting firm for the fiscal year ending April 30, 2022; and (v) consider and act upon any other business as may properly come before the Annual Meeting or any adjournments thereof. In addition, we will be pleased to report on our affairs and a discussion period will be provided for questions and comments of general interest to stockholders. Detailed information with respect to these matters is set forth in the accompanying Proxy Statement, which we encourage you to carefully read in its entirety.

We look forward to greeting personally those stockholders who are able to attend the meeting online. However, whether or not you plan to join us at the meeting, it is important that your shares be represented. Stockholders of record at the close of business on April 19, 2021 are entitled to notice of and to vote at the meeting. We will be using the “Notice and Access” method of providing proxy materials to you via the Internet. On or about May 5, 2021, we will mail to our stockholders a Notice of Availability of Proxy Materials (“Notice”) containing instructions on how to access our Proxy Statement and our 2020 Annual Report, as amended, and vote electronically via the Internet. The Notice also contains instructions on how to receive a printed copy of your proxy materials.

You may vote over the Internet, as well as by telephone or, if you requested to receive printed proxy materials, you can also vote by mail pursuant to instructions provided on the proxy card. Please review the instructions for each of your voting options described in the Proxy Statement, as well as in the Notice you will receive in the mail.

Thank you for your ongoing support of PharmaCyte.

Very truly yours,

/s/ Kenneth L. Waggoner

Kenneth L. Waggoner

Chairman of the Board, Chief Executive Officer

President and General Counsel

PHARMACYTE BIOTECH, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Notice is hereby given that the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of PharmaCyte Biotech, Inc. (“PharmaCyte” or the “Company”), will be held virtually at https://www.virtualshareholdermeeting.com/PMCB2021 on Wednesday, June 16, 2021 at 11:00 a.m., Pacific Daylight Time, for the following purposes:

| · | to elect seven directors as nominated by the Board of Directors of PharmaCyte, each to serve a one-year term; |

| · | to approve a Certificate of Amendment to PharmaCyte’s Articles of Incorporation to increase the number of our authorized shares of common stock; |

| · | to approve our 2021 Equity Incentive Plan (the “2021 Plan”); |

| · | to ratify our appointment of Armanino LLP as our independent registered public accounting firm for the fiscal year ending April 30, 2022 and |

| · | to consider and act upon any other business as may properly come before the Annual Meeting or any adjournments thereof. |

These matters are more fully described in the accompanying Proxy Statement.

Only stockholders of record at the close of business on April 19, 2021 are entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof. In light of the Coronavirus (COVID-19) pandemic, for the safety of our stockholders and in accordance with federal, state and local guidance that has been issued, we have decided that the Annual Meeting will be held in a virtual format only, via the Internet, with no physical in-person meeting. Stockholders will have the ability to attend, vote and submit questions before and during the virtual meeting from any location via the Internet at https://www.virtualshareholdermeeting.com/PMCB2021.

A complete list of these stockholders will be available in electronic form at the Annual Meeting and will be accessible for ten days prior to the Annual Meeting. All stockholders are cordially invited to virtually attend the Annual Meeting. On or about May 5, 2021, the Company will mail to stockholders a Notice of Availability of Proxy Materials (the “Notice”) containing instructions on how to access our Proxy Statement and our 2020 Annual Report on Form 10-K, how to vote electronically via the Internet or vote by telephone, and how to request printed proxy materials.

Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read the Proxy Statement and submit your proxy or voting instructions as soon as possible by Internet, telephone or mail. For specific instructions on how to vote your shares, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you will receive in the mail, the section entitled “About the Annual Meeting” beginning on page 1 of the Proxy Statement or, if you request to receive printed proxy materials, your enclosed proxy card. Please note that shares held beneficially in street name may be voted by you in person at the Annual Meeting only if you obtain a legal proxy from the broker, bank, trustee, or other nominee that holds your shares giving you the right to vote the shares.

By Order of the Board of Directors,

/s/ Kenneth L. Waggoner

Chairman of the Board, Chief Executive Officer,

President and General Counsel

Laguna Hills, California

May 5, 2021

Important Notice Regarding the Availability

of Proxy Materials

for the Annual Meeting of Stockholders

To Be Held on June 16, 2021

The Proxy Statement, along with our 2020 Annual Report, as amended, is available free of charge at the following website: https://www.virtualshareholdermeeting.com/PMCB2021.

TABLE OF CONTENTS

| PROXY STATEMENT | 6 |

| ABOUT THE ANNUAL MEETING | 6 |

PROPOSAL NO. 1 ELECTION OF DIRECTORS |

13 |

| INFORMATION REGARDING THE BOARD AND CORPORATE GOVERNANCE | 17 |

| MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS | 18 |

| EXECUTIVE COMPENSATION | 20 |

PROPOSAL NO. 2 APPROVAL OF A CERTIFICATE OF AMENDMENT TO THE ARTICLES OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK |

27 |

PROPOSAL NO. 3 APPROVAL OF THE 2021 EQUITY INCENTIVE PLAN |

31 |

PROPOSAL NO. 4 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

37 |

| SECURITY OWNERSHIP | 39 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 40 |

| HOUSEHOLDING OF PROXY MATERIALS | 41 |

| OTHER BUSINESS | 42 |

| WHERE YOU CAN FIND MORE INFORMATION | 43 |

PHARMACYTE

BIOTECH, INC.

23046 Avenida de la Carlota, Suite 600

LAGUNA HILLS, CALIFORNIA 92653

PROXY STATEMENT

Our Board of Directors has made this Proxy Statement and related materials available to you on the Internet, or, upon your request, has delivered printed proxy materials to you by mail, in connection with the Board of Directors’ solicitation of proxies for use at the 2021 Annual Meeting of Stockholders of PharmaCyte Biotech, Inc. to be held online on Wednesday, June 16, 2021, beginning at 11:00 a.m., Pacific Daylight Time, and at any postponements or adjournments of the Annual Meeting. As a stockholder, you are invited to attend the Annual Meeting and are requested to vote on the items of business described in this Proxy Statement.

ABOUT THE ANNUAL MEETING

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

We are providing access to our proxy materials over the Internet. Accordingly, we are sending a Notice Regarding Availability of Proxy Materials (the “Notice”) to our stockholders of record and beneficial owners as of the record date (for more information on the record date, see “- Who is entitled to vote at the Annual Meeting?”). The mailing of the Notice to our stockholders is scheduled to begin on or about May 5, 2021. All stockholders will have the ability to access the proxy materials and our Annual Report on Form 10-K for the fiscal year ended April 30, 2020, as amended (the “Annual Report”) on a website referred to in the Notice or to request to receive a printed set of the proxy materials and the Annual Report. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. Stockholders may also request to receive proxy materials and our Annual Report in printed form by mail or electronically by email on an ongoing basis. The form of the Proxy is attached to this Proxy Statement as Exhibit C.

How do I get electronic access to the proxy materials?

The Notice will provide you with instructions regarding how you can:

· View our proxy materials for the Annual Meeting and our Annual Report on the Internet; and

· Instruct us to send our future proxy materials to you electronically by email.

Choosing to receive your future proxy materials by email will save us the cost of printing and mailing documents to you and will reduce the impact of printing and mailing these materials on the environment. Stockholders may also request to receive proxy materials and our Annual Report in printed form by mail or electronically by email on an ongoing basis. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials by email will remain in effect until you terminate it.

What is the purpose of the Annual Meeting?

At our Annual Meeting, stockholders will act upon the matters outlined in the notice of meeting accompanying this Proxy Statement, consisting of the following: (i) elect seven directors as nominated by the Board of Directors, each to serve a one-year term; (ii) approve a Certificate of Amendment to our Articles of Incorporation to increase the number of authorized shares of our common stock; (iii) approve our 2021 Equity Incentive Plan (the “2021 Plan”); (iv) ratify our appointment of Armanino LLP as our independent registered public accounting firm for the fiscal year ending April 30, 2022; and (v) consider and act upon any other business as may properly come before the Annual Meeting or any adjournments thereof. In addition, management will report on our performance during the fiscal year ended April 30, 2021 and more recent developments and respond to questions from stockholders. Our Board of Directors is not currently aware of any other matters which will come before the meeting.

| -6- |

How do proxies work and how are votes counted?

The Board of Directors is asking for your proxy. Giving us your proxy means that you authorize us to vote your shares at the Annual Meeting in the manner you direct. You may vote for all of our director nominees or withhold your vote as to some or all of our director nominees. You may also vote for or against, or abstain from voting on the approval of a Certificate of Amendment to our Articles of Incorporation to increase the number of authorized shares of our common stock, approve our 2021 Plan or the ratification of our appointment of Armanino LLP as our independent registered public accounting firm for the fiscal year ending April 30, 2022. If a stockholder of record does not indicate instructions with respect to one or more matters on his, her or its proxy that such stockholder has provided to the Company, the shares represented by that proxy will be voted as recommended by the Board of Directors (for more information, see “- What are the Board of Directors’ recommendations as to the proposals to be voted on?”). If a beneficial owner of shares held in street name does not provide instructions to the bank, broker, or other nominee holding those shares, please see the information below under the caption “- What if I am a beneficial owner and do not give voting instructions to my broker or other nominee?”

Who is entitled to vote at the Annual Meeting?

Only stockholders of record at the close of business on April 19, 2021, the record date for the meeting, are entitled to receive notice of and to participate in the Annual Meeting, or any postponements and adjournments of the meeting. If you were a stockholder of record on that date, you will be entitled to vote all of the shares you held on that date at the meeting, or any postponements or adjournments of the meeting.

On April 19, 2021, the record date for the meeting, there were 2,385,125,674 shares of common stock outstanding. Each outstanding share of common stock is entitled to one vote on each of the matters presented at the Annual Meeting or postponements and adjournments of the meeting.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the outstanding shares of common stock as of the record date will constitute a quorum, permitting the Annual Meeting to conduct its business. As of the record date, 2,385,125,674 shares of common stock, representing the same number of votes, were outstanding. Thus, the presence of holders representing at least 1,192,562,838 shares will be required to establish a quorum.

If a stockholder abstains from voting as to any matter or matters, the shares held by such stockholder shall be deemed present at the Annual Meeting for purposes of determining a quorum. If a bank, broker, or other nominee returns a “broker non-vote” proxy, indicating a lack of voting instructions by the beneficial holder of the shares and a lack of discretionary authority on the part of the bank, broker, or other nominee to vote on a particular matter, then the shares covered by such broker non-vote proxy shall be deemed present at the Annual Meeting for purposes of determining a quorum, but otherwise shall have no effect except as to any proposal with respect to which the bank, broker, or other nominee has discretionary authority to vote the proxy. For more information on discretionary and non-discretionary matters, see “- What if I am a beneficial owner and do not give voting instructions to my broker or other nominee?”

What vote is required to approve each matter and how are votes counted?

Proposal No. 1: Election of Seven Directors as Nominated by the Board of Directors, Each to Serve a One-Year Term

The seven nominees who receive the highest number of affirmative votes of the shares present in person or represented by proxy and entitled to vote on the election of directors will be elected as our directors. Abstentions, broker non-votes and instructions on the accompanying proxy card to withhold authority to vote for one or more nominees will not be counted as votes in favor of the relevant nominee or nominees and will result in the relevant nominee or nominees receiving fewer total votes. Abstentions and broker non-votes will not affect the outcome of the election of directors.

| -7- |

Proposal No. 2: Approval of a Certificate of Amendment to our Articles of Incorporation to increase the number of authorized shares of common stock of PharmaCyte

The affirmative vote of a majority of the outstanding shares of our common stock entitled to vote on this proposal is required for the approval of this proposal. An abstention from voting or broker non-vote by a stockholder has the same legal effect as a vote “against” the matter.

Proposal No. 3: Approval of the 2021 Plan

The affirmative vote of a majority of the votes cast by the stockholders present in person or represented by proxy at the meeting and entitled to vote thereon is required for the approval of this proposal. An abstention from voting or broker non-vote by a stockholder present in person or represented by proxy at the meeting will not affect the outcome of the matter.

Proposal No. 4: Ratification of Appointment of Armanino LLP as PharmaCyte’s Independent Registered Public Accounting Firm for the Fiscal Year Ending April 30, 2022

The affirmative vote of a majority of the votes cast by the stockholders present in person or represented by proxy at the meeting and entitled to vote thereon is required for the approval of this proposal. An abstention from voting or broker non-vote by a stockholder present in person or represented by proxy at the meeting will not affect the outcome of the matter.

How can you attend the Annual Meeting?

We will be hosting the Annual Meeting live via audio webcast. Any stockholder can attend the Annual Meeting live online https://www.virtualshareholdermeeting.com/PMCB2021. If you were a stockholder as of the Record Date, or you hold a valid proxy for the Annual Meeting, you can vote at the Annual Meeting. A summary of the information you need to attend the Annual Meeting online is provided below:

| · | Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at https://www.virtualshareholdermeeting.com/PMCB2021. |

| · | Assistance with questions regarding how to attend and participate via the Internet will be provided at https://www.virtualshareholdermeeting.com/PMCB2021on the day of the Annual Meeting. |

| · | Webcast will start on June 16, 2021, at 11:00 a.m. Pacific Daylight Time. |

| · | You will need your 16-digit control number to enter the Annual Meeting. |

| · | Stockholders may submit questions while attending the Annual Meeting via the Internet. |

| · | Webcast replay of the Annual Meeting will be available until June 16, 2022. |

To attend and participate in the Annual Meeting, you will need the 16-digit control number included in the Notice, on your proxy card, or on the instructions that accompanied your proxy materials. If your shares are held in “street name,” you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker. If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date.

| -8- |

Why hold a virtual meeting?

As part of our effort to maintain a safe and healthy environment for our directors, members of management and stockholders who wish to attend the Annual Meeting, in light of the COVID-19 pandemic, we believe that hosting a virtual meeting is in the best interest of the Company and its stockholders. In addition, we are excited to use the latest technology to provide expanded access, improved communication and cost savings for our stockholders and the Company while providing stockholders the same rights and opportunities to participate as they would have at an in-person meeting. We believe the virtual meeting format enables increased stockholder attendance and participation because stockholders can participate from any location around the world.

How do I ask questions at the virtual Annual Meeting?

During the virtual Annual Meeting, you may only submit questions in the question box provided at https://www.virtualshareholdermeeting.com/PMCB2021. We will respond to as many inquiries at the virtual Annual Meeting as time allows.

What if during the check-in time or during the virtual Annual Meeting I have technical difficulties or trouble accessing the virtual meeting website?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual Annual Meeting during the check-in or meeting time, please call the technical support number that will be posted on the Annual Meeting website log-in page.

How do I attend the Annual Meeting?

The meeting will be held online on June 16, 2021 beginning at 11:00 a.m., Pacific Daylight Time. The information found on, or accessible through, our website is not incorporated into, and does not form a part of, this Proxy Statement or any other report or document we file with or furnish to the SEC due to the inclusion of our website address above or elsewhere in this Proxy Statement. Information on how to vote in person at the Annual Meeting is discussed below under the caption “- How can I vote my shares?”

How can I vote my shares?

Record Owners and Beneficial Owners Who Have Been Provided With a 16 Digit Control Number

If you are a record holder, meaning your shares are registered in your name and not in the name of a broker, trustee, or other nominee, or a beneficial owner who has been provided by your broker with a 16 digit control number, you may vote:

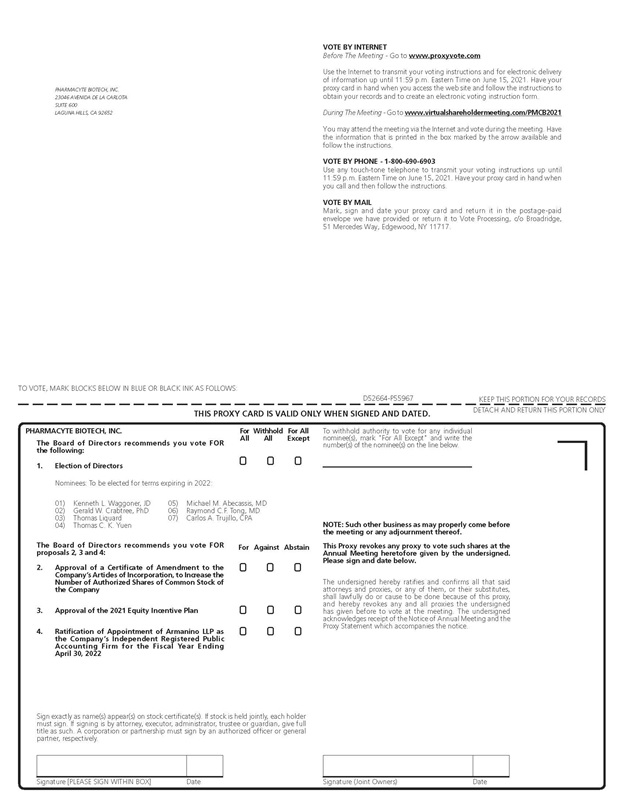

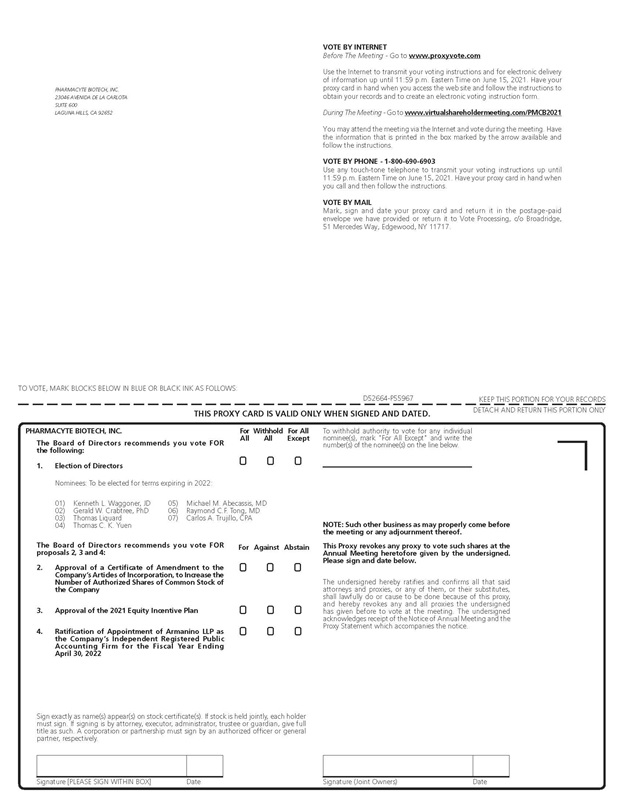

1. Over the Internet – If you have Internet access, you may authorize the voting of your shares by accessing www.proxyvote.com and following the instructions set forth in the Proxy Materials. You must specify how you want your shares voted or your vote will not be completed and you will receive an error message. Your shares will be voted according to your instructions. You can also vote during the meeting by visiting https://www.virtualshareholdermeeting.com/PMCB2021 and having available the control number included on your proxy card or on the instructions that accompanied your Proxy Materials.

2. By Telephone – If you are a registered stockholder, you may call toll-free 1-800-690-6903 to vote by telephone. If you are a beneficial owner who has been provided with a control number on the voting instruction form that accompanied your Proxy Materials, you may call toll-free 1-800-690-6903 to vote by telephone. Your shares will be voted according to your instructions.

| -9- |

3. By Mail If You Are a Record Owner – Complete and sign the attached WHITE proxy card and mail it in the enclosed postage prepaid envelope. Your shares will be voted according to your instructions. If you sign your WHITE proxy card but do not specify how you want your shares voted, they will be voted as recommended by our Board of Directors (“Board”). Unsigned proxy cards will not be voted.

Beneficial Owners

As the beneficial owner, you have the right to direct your broker, trustee, or other nominee on how to vote your shares. In most cases, when your broker provides you with proxy materials, they will also provide you with a 16 digit control number, which will allow you to vote as described above or at the Annual Meeting. If your broker has not provided you with a 16 digit control number, please contact your broker for instructions on how to vote your shares.

Stockholders who submit a proxy by Internet or telephone need not return a proxy card or any form forwarded by your broker, bank, trust or nominee. Stockholders who submit a proxy through the Internet or telephone should be aware that they may incur costs to access the Internet or telephone, such as usage charges from telephone companies or Internet service providers, and that these costs must be borne by the stockholder.

What am I voting on at the Annual Meeting?

The following proposals are scheduled for a vote at the Annual Meeting:

| · | Proposal No. 1: to elect seven directors as nominated by the Board of Directors, each to serve a one-year term; |

| · | Proposal No. 2: to approve a Certificate of Amendment to PharmaCyte’s Articles of Incorporation to increase the number of authorized shares of common stock of PharmaCyte; |

| · | Proposal No. 3: for the approval of the 2021 Plan; and |

| · | Proposal No. 4: to ratify the appointment of Armanino LLP as PharmaCyte’s independent registered public accounting firm for the fiscal year ending April 30, 2022. |

Each of these proposals is described in further detail below.

What happens if additional matters are presented at the Annual Meeting?

Other than the items of business described in this Proxy Statement, we are not currently aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy, the persons named as proxy holders, Mr. Kenneth L. Waggoner and Mr. Carlos A. Trujillo, will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting. If for any reason any of the nominees is not available as a candidate for director, the persons named as proxies will vote your proxy for such other candidate or candidates as may be nominated by the Board of Directors.

How does the Board of Directors’ recommend that I vote?

As to the proposals to be voted on at the Annual Meeting, the Board of Directors unanimously recommends that you vote:

| · | FOR Proposal No. 1, for the election of seven directors as nominated by the Board of Directors, each to serve a one-year term; |

| -10- |

| · | FOR Proposal No. 2, for the approval of a Certificate of Amendment to PharmaCyte’s Articles of Incorporation, to increase the number of authorized shares of common stock of PharmaCyte; |

| · | FOR Proposal No. 3, for the approval of the 2021 Plan; and |

| · | FOR Proposal No. 4, for the ratification of the appointment of Armanino LLP as PharmaCyte’s independent registered public accounting firm for the fiscal year ending April 30, 2022. |

What if I am a stockholder of record and do not indicate voting instructions on my proxy?

If you are a stockholder of record and provide specific instructions on your proxy with regard to certain items, your shares will be voted as you instruct on such items. If no instructions are indicated on your proxy for one or more of the proposals to be voted on, the shares will be voted as recommended by the Board of Directors: (i) in favor of each of our director nominees, (ii) for the approval of a Certificate of Amendment to PharmaCyte’s Articles of Incorporation to increase the number of authorized shares of common stock of PharmaCyte, (iii) for the approval of the 2021 Plan, (iv) for the ratification of the appointment of Armanino LLP as PharmaCyte’s independent registered public accounting firm for the fiscal year ending April 30, 2022 and (v) for such other business that may properly come before the Annual meeting or any adjournments thereof. If any other matters are properly presented for consideration at the meeting, the individuals named as proxy holders, Mr. Kenneth L. Waggoner and Mr. Carlos A. Trujillo, will vote the shares that they represent on those matters as recommended by the Board of Directors. If the Board of Directors does not make a recommendation, then they will vote in accordance with their best judgment.

What if I am a beneficial owner and do not give voting instructions to my broker or other nominee?

As a beneficial owner, in order to ensure your shares are voted in the way you would like, you must provide voting instructions to your bank, broker, or other nominee by the deadline provided in the materials you receive from your bank, broker, or other nominee or vote by mail, telephone or Internet according to instructions provided by your bank, broker, or other nominee. If you do not provide voting instructions to your bank, broker, or other nominee, whether your shares can be voted by such person or entity depends on the type of item being considered for vote.

| · | Non-Discretionary Items. (i) the election of seven directors as nominated by the Board of Directors, each to serve a one-year term, and (ii) the approval of the 2021 Plan, are non-discretionary items and may not be voted on by brokers, banks or other nominees who have not received specific voting instructions from beneficial owners. A broker non-vote occurs when a broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting authority and has not received voting instructions from the beneficial owner. |

| · | Discretionary Items. (i) the approval of a Certificate of Amendment to our Articles of Incorporation, to increase the number of our authorized shares of common stock, and (ii) the ratification of our appointment of Armanino LLP as our independent registered public accounting firm for the fiscal year ending April 30, 2022 are each a discretionary item. Generally, brokers, banks and other nominees that do not receive voting instructions from beneficial owners may vote on these proposals in their discretion. |

We encourage you to provide instructions to your broker regarding the voting of your shares.

Can I change my vote or revoke my proxy?

Yes. (1) If you are a stockholder of record, you may revoke your proxy by: (i) following the instructions on the Notice and entering a new vote by telephone or over the Internet up until 11:59 P.M. Pacific Daylight Time on June 15, 2021, (ii) attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself revoke a proxy) or (iii) entering a new vote by mail. Any written notice of revocation or subsequent proxy card must be received by the Secretary of the Company prior to the holding of the vote at the Annual Meeting at 11:00 AM, Pacific Daylight Time, on June 16, 2021. Such written notice of revocation or subsequent proxy card should be hand delivered to the Secretary of the Company or sent to the Company’s principal executive offices at 23046 Avenida de la Carlota, Suite 600, Laguna Hills, California 92653, Attention: Corporate Secretary. (2) If a broker, bank, or other nominee holds your shares, you must contact them in order to find out how to change your vote.

| -11- |

The last proxy or vote that we receive from you will be the vote that is counted.

Who will bear the cost of soliciting votes for the Annual Meeting?

We will pay the entire cost of preparing, assembling, printing, mailing, and distributing these proxy materials and soliciting votes. If you choose to access the proxy materials and/or vote over the Internet, you are responsible for Internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges you may incur. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone, or by electronic communication by our directors, officers, and employees, who will not receive any additional compensation for such solicitation activities. We have engaged Kingsdale Shareholder Services US LLC (“Kingsdale Advisors”) to assist in soliciting proxies on our behalf. Kingsdale Advisors may solicit proxies personally, electronically or by telephone. We have agreed to pay Kingsdale Advisors a fee of $9,500 plus $6.00 per telephone call or QuickVote for its services. QuickVote is a service that allows Kingsdale Advisers to record the votes of certain of our stockholders. We have also agreed to reimburse Kingsdale Advisors for its reasonable out-of-pocket expenses and to indemnify Kingsdale Advisors and its employees against certain liabilities arising from or in connection with the engagement.

What is “householding” and where can I get additional copies of proxy materials?

For information about householding and how to request additional copies of proxy materials, please see the section captioned “Householding of Proxy Materials.”

Whom may I contact if I have other questions about the Annual Meeting or voting?

You may contact the Company at 23046 Avenida de la Carlota, Suite 600, Laguna Hills, California 92653, Attention: Kenneth L. Waggoner, or by telephone at 917-595-2850 or you may contact Kingsdale Advisors by telephone at 1-866-851-3212.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. Voting results will be disclosed on a Form 8-K filed with the SEC within four business days after the Annual Meeting, which will also be available on our website.

We encourage you to vote by proxy over the Internet by following the instructions provided in the Notice, or, if you requested to receive printed proxy materials, you can also vote by mail or telephone pursuant to instructions provided on the proxy card.

| -12- |

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our Board currently has seven members. Based on the recommendation of the Board’s Nominating Committee, the Board has nominated each of the following seven directors to serve until the 2022 Annual Meeting of Stockholders or until their successors are duly elected and qualified: Kenneth L. Waggoner, Gerald W. Crabtree, PhD, Thomas Liquard, Thomas C. K. Yuen, Michael M. Abecassis, MD, Raymond C.F. Tong, MD and Carlos A. Trujillo. Each of the nominees currently serves as a director.

Each of the nominees has agreed to serve as a director if elected. If, for any reason, any nominee becomes unable to serve before the election, the persons named as proxies will vote your shares for a substitute nominee if one is selected by the Board. Alternatively, the Board, at its option, may reduce the number of directors that are nominated for election.

Our by-laws require directors to be elected by a plurality of the votes cast by the shares entitled to vote in the election at a meeting at which a quorum is present (with “abstentions” and “broker non-votes” not counted as a vote cast with respect to that director). Accordingly, the seven nominees for election as directors at the Annual Meeting who receive the greatest number of votes cast for election will be the duly elected directors.

Below is biographical information for each of the director nominees.

Director Nominees

Kenneth L. Waggoner. Mr. Waggoner, age 73, has been a member of the Board since September 2014. He has served as our Chief Executive Officer and President since November 2013. Shortly thereafter, Mr. Waggoner assumed the additional position of General Counsel. In April 2014, Mr. Waggoner became a full-time employee as the Chief Executive Officer, President and General Counsel. Mr. Waggoner has been a member of the Board since September 2014. Mr. Waggoner has over forty-five years of experience in management, business, operations and the practice of law. It was his education, training, experience and leadership skills that led us to elect him to the Board and appoint him Chairman.

Mr. Waggoner began his professional career as an attorney in private practice. From 1986 to 2003, he was a senior partner with Brobeck, Phleger and Harrison (“Brobeck”), where he was the Managing Partner of Brobeck’s Los Angeles office. While at Brobeck, Mr. Waggoner served as a member of the Executive Committee and on the Policy Committee. Mr. Waggoner was the co-Chairman of Brobeck’s worldwide Environmental Law Group.

Mr. Waggoner’s career included leadership and legal positions with Fortune 100 companies most of his professional career. From 2003 to 2005, Mr. Waggoner served as the Vice President and General Counsel of Chevron’s global downstream operations where he was responsible for the overall management of legal services to the North American, Latin American, European and Asian Products Companies. While at Chevron, Mr. Waggoner led the successful restructuring of Chevron’s global Legal Department following Chevron’s acquisition of Texaco.

From 2005 until September 2013, Mr. Waggoner was the principal of the Law Offices of Kenneth L. Waggoner & Associates. During that time, he held leadership and legal positions with several start-up companies and provided legal counsel and business advice to his clients.

Mr. Waggoner received his Juris Doctorate with honors from Loyola University School of Law in Los Angeles in 1973.

Gerald W. Crabtree, PhD. Dr. Crabtree, age 80, is our Chief Scientific Officer and has been a member of the Board since February 2013. He has served in his position of Chief Scientific Officer since October 14, 2020. Prior to that, Dr. Crabtree was our Chief Operating Officer. Given the major importance to developing treatments for cancer and diabetes coupled with Dr. Crabtree’s education, training and experience, Dr. Crabtree was appointed to the Board.

| -13- |

Dr. Crabtree’s background in the biomedical sciences has been substantial, having been involved with various biopharmaceutical companies where he has alternatively supervised and coordinated the development of multiple drug candidates, prepared clinical protocols, investigator brochures, monographs, and research and review articles.

Dr. Crabtree has over 50 years of experience in the biomedical sciences sector with the majority of that being in the cancer area. Dr. Crabtree served as the Director of Project Planning and Management (Oncology and Immunology) at Bristol-Myers Squibb (“BMS”) from 1990 to 1997. While at BMS, Dr. Crabtree established and directed the department that coordinated the development of all oncologic and immunologic drugs from initial discovery through regulatory approval. He also served as Project Manager for the development of the major anticancer agent, Taxol. Taxol ultimately became a multi-billion-dollar drug for BMS and is still widely used to treat a variety of cancers. From 1985 to 1990, Dr. Crabtree was the Director of Pharmacology at Viratek, a subsidiary of ICN Pharmaceuticals, in Costa Mesa, California, where he worked on the development of anticancer drugs first developed at the Nucleic Acid Research Institute, a joint venture between Eastman Kodak and ICN Pharmaceuticals. He also helped coordinate the development of ribavirin, Viratek's landmark antiviral drug. From 1970 through 1985, Dr. Crabtree was a member of the faculty of Brown University where he was involved in both basic and clinical cancer research.

Dr. Crabtree received his PhD in Biochemistry from the University of Alberta, Edmonton, Alberta, Canada, and has published over 80 articles in peer-reviewed journals. He was a National Cancer Institute of Canada Research Fellow, is currently a member of the American Society of Clinical Oncology and was a member of the American Association for Cancer Research from the early 1990s until recently and has served on research grant review committees for the National Institutes of Health and the American Cancer Society.

Carlos A. Trujillo, CPA. Mr. Trujillo, 63, has been our Chief Financial Officer and a member of the Board since March 2017. He began working for us as an independent contractor in September 2014. In January 2015, Mr. Trujillo became a full-time employee as our Vice President of Finance. Mr. Trujillo has over three decades of experience in management, business, operations and financial accounting. It was his education, experience and leadership skills that led us to elect him to the Board.

Mr. Trujillo is a Certified Public Accountant with an active license from the State of California. He has more than three decades of experience in finance, accounting and management. Mr. Trujillo started his career in public accounting and was the manager of an audit department a large regional public accounting firm. Mr. Trujillo then established a consulting and accounting practice which he operated for ten years and provided services as the Chief Financial Accountant to numerous organizations in several different industries. His experience has extended to companies in the biotechnology, telecommunications, manufacturing, construction and real estate development sectors.

For the last thirteen years, Mr. Trujillo has been the Chief Financial Officer for both privately held and publicly traded and multinational companies. From June 2008 through September 2014, Mr. Trujillo was the Chief Financial Officer of VelaTel Global Communications, Inc. As a result, he brings extensive experience to us in preparing and filing periodic reports with the Commission, in mergers and acquisitions and in the filing of comprehensive financial statements.

Mr. Trujillo received his Bachelor of Accounting degree from California State University, Fullerton in 1982.

Thomas Liquard. Mr. Liquard, age 48, has been a member of the Board since April 2015. Mr. Liquard has more than a decade of experience in the pharmaceutical industry, having held various commercialization, product development and leadership roles with large pharmaceutical and biotechnology companies. It was his education, experience in the biotechnology and pharmaceutical industry and leadership skills that led us to elect him to the Board. We believe that his seven year tenure with Pfizer, one of the world’s leading pharmaceutical companies, where he played leading roles in the development of that company’s portfolio development, is a needed asset to us.

| -14- |

Since 2017, Mr. Liquard has served as Senior Vice President of Corporate Development at Neurelis, Inc and Executive Director at Bastion Biologics. From August 2015 to August 2017, Mr. Liquard was the Chief Executive Officer of Immuron, a Melbourne, Australia-based pharmaceutical company. Prior to Immuron, Mr. Liquard served as the Chief Executive Officer and Chief Operating Officer of Alchemia, a major Australian pharmaceutical company. Mr. Liquard worked for Alchemia from October 2013 to November 2014. Mr. Liquard spent the previous seven years with Pfizer, Inc. based in New York, where he held various senior commercial positions. His last was as Senior Director, Portfolio Development Leader and Emerging Markets for the Established Products portfolio. In that role, Mr. Liquard drove business development (M&A, licensing, partnerships) and internal product development initiatives.

Mr. Liquard received his Master of Business Administration in Finance and Strategy from the Columbia Business School and a Bachelor of Science degree from the University of Southern California.

Thomas C. K. Yuen. Mr. Yuen, age 69, was appointed to the Board in May 2017. Mr. Yuen has more than three decades of experience in entrepreneurship and business leadership, including in the biotech industry. It was his career in business, leadership skills and business acumen and experience that led us to elect him to the Board.

Mr. Yuen’s career is exemplified by his global entrepreneurial experience. He co-founded Irvine-based AST Research, Inc. (“AST”) in 1981. AST was an early pioneer of the computer industry, and the company has been referred to as “the flagship of innovation in the PC era.” Mr. Yuen served as AST's Co-Chairman and Chief Operating Officer from August 1987 to June 1992. Under his leadership, AST became a Fortune 500 company in 1991, and its stock was named the “Best Performing NASDAQ Stock” of that year.

Mr. Yuen left AST in 1992 and focused his efforts on investing in new projects. Mr. Yuen served in various engineering and project management positions with Hughes Aircraft Company, Sperry Univac and Computer Automation. Later in his career, Mr. Yuen became Chairman and CEO of SRS Labs, a world leader in audio and voice technology. Currently, Mr. Yuen is Chairman and Chief Executive Officer of PrimeGen Biotech, LLC, a private cell therapy company he founded in 2002.

Mr. Yuen has held numerous director positions. He served as a Director of AST from 1981 to June 1992. He served as a Director of Valence Technology, Inc., an energy storage company, from March 1998 to March 2000 and a Director of DTS, Inc., an audio technology company, from April 2012 to July 2013. Mr. Yuen has served as a Director of SRS Labs since January 1994. He is also an Honorary Professor of China Nationality University in Beijing.

In 1988 and 1991, the Computer Reseller News Magazine named Mr. Yuen one of the top 25 executives of the computer industry. In 1997, he received the Director of the Year Award from the Orange County Foundation of Corporate Directors. Mr. Yuen is the recipient of several awards from the University of California, Irvine (“UCI”), including the UCI Medal in 1990, the Outstanding Engineering Alumni Award in 1987 and the Distinguished Alumnus Award in 1986. Also, Mr. Yuen has received the prestigious UCI Extraordinarious Award for his exemplary career in business and his philanthropic and volunteer activities.

Mr. Yuen received his Bachelor of Science degree in Electrical Engineering from the University of California, Irvine.

Michael M. Abecassis, MD. Dr. Abecassis, age 63, was appointed to the Board in July 2017. Since November 2019, Dr. Abecassis has been Dean of the University of Arizona College of Medicine – Tucson. Prior to that and since 1992, Dr. Abecassis was a transplantation surgeon at the Northwestern University Feinberg School of Medicine Dr. Abecassis was appointed to the Board because of his demonstrated leadership qualities in academia, in the clinic and throughout his career in medicine. These attributes and his extensive experience in the medical field translates directly to the work being undertaken by us in the cancer arena.

At Northwestern, Dr. Abecassis was the Director of the Comprehensive Transplant Center of the Feinberg School of Medicine. He was also the Chief of Transplant Surgery in the Department of Surgery at Feinberg and a James Roscoe Miller Distinguished Professor of Medicine at Feinberg.

| -15- |

Dr. Abecassis received his Medical Degree from the University of Toronto in 1983 and was awarded a Master of Business Administration degree from the Kellogg School of Management at Northwestern University in 2000. After his postgraduate tenure in Toronto, Dr. Abecassis began his clinical career as Assistant Professor of Surgery and Director of Liver Transplantation and Hepatobiliary Surgery at the University of Iowa. In 1993, Dr. Abecassis became Northwestern University’s Director of Liver Transplantation, where he initiated Northwestern’s liver transplant program. In 2004, Dr. Abecassis was named Chief of the Division of Transplantation at the Feinberg School of Medicine. He became Founding Director of the Comprehensive Transplant Center at Northwestern in 2009 and was appointed Dean for Clinical Affairs at the Feinberg School of Medicine in 2008, serving until 2011.

Dr. Abecassis has received continuous funding from the National Institutes of Health (“NIH”) for the past 23 years. He is the principal investigator in research that includes both laboratory and clinical studies. He is also the principal investigator of the clinical core of the NIH Genomics of Transplantation Cooperative Research Program. Dr. Abecassis has trained numerous clinical and research fellows.

Dr. Abecassis is a member of the Society of University Surgeons and the American Surgical Association and was President of the American Society of Transplant Surgeons 2010-2011. He has served and continues to serve on the Editorial Boards of major scientific journals (Hepatology, Surgery, Transplantation and Liver Transplantation) and is a reviewer for all major journals related to surgery and transplantation. He has served as a member of NIH grant study sections and special emphasis panels relating to both transplantation and virology. He is a permanent member of the National Institute of Allergy and Infectious Diseases study section for career development and training grants.

Dr. Abecassis has been a course director for the American Society of Transplant Surgeons Leadership Development Program since 2010 and was course director for the Advanced Leader Development Program in 2013 at Northwestern’s Kellogg School of Management. He was a voting member of the Medicare Coverage Advisory Committee and served on the United HealthCare Group Physician Advisory Board on Healthcare Performance and Quality. Dr. Abecassis has been a member of various local, regional and national regulatory committees and has published seminal papers on both the regulatory and financial aspects of transplantation, including the Healthcare Reform and the Affordable Care Act.

Raymond C.F Tong, MD. Dr. Tong, age 62, serves as Chief Executive Officer of Harmony Medical Inc., an Asian investment group active in the introduction and distribution of medical and healthcare products and services in China and throughout Asia. He is also Chairman of the Business Development Committee of Shanghai Kedu Healthcare Group, the largest medical equipment third-party service provider in China, representing products from GE, Philips, Siemens, Kodak and other multi-nationals as well as local companies. He was appointed to the Board in October 2017. It was his career in the medical field, as well as his significant connections to the investment community throughout Asia, leadership skills and business acumen and experience that caused us to elect him to the Board.

Dr. Tong has been a Director of Medifocus Inc. since January 27, 2015. He was also a Director of Shanghai CP Guojian Pharmaceutical, one of the first and largest bio-pharmaceutical manufacturers in China. In addition, Dr. Tong is the founding Director and Chief Executive Officer of VetCell Therapeutics Asia, a cell therapy company focused on providing cell-based treatments for use in veterinary medicine in Asia.

Dr. Tong’s earlier career includes senior management positions in China with Pfizer and Ball Corporation. He was also responsible for the Healthcare Investment Division of CITIC in Hong Kong. CITIC is the largest conglomerate in China and an established global player, with businesses covering healthcare, financial services, resources, energy, manufacturing, engineering and many others.

Dr. Tong received his medical degree from the University of Toronto in Ontario, Canada in 1983. He also received a PhD degree in neurophysiology and an MBA degree. After receiving his medical degree, Dr. Tong founded a chain of medical clinics in the Province of Ontario where he served as Medical Director and Chief Physician. During this period, he also served as a consultant and an investigator in several clinical trials. In 1989, Dr. Tong returned to Hong Kong, where he was born and resided before medical school, and spent the next 19 years in prominent corporate appointments with several multinational medical and pharmaceutical companies discussed above.

| -16- |

Board Recommendation

The Board recommends a vote FOR the election of Kenneth L. Waggoner, JD, Gerald W. Crabtree, PhD., Thomas Liquard, Thomas C. K. Yuen, Michael M. Abecassis, MD, Raymond C.F. Tong, MD and Carlos A. Trujillo, CPA. Proxies will be voted FOR the election of the seven nominees, unless otherwise specified.

Vote Required

The seven nominees who receive the highest number of affirmative votes of the shares present in person or represented by proxy and entitled to vote on the election of directors, a quorum being present, will be elected as our directors. Abstentions, broker non-votes and instructions on the accompanying proxy card to withhold authority to vote for one or more nominees will not be counted as votes in favor of the relevant nominee or nominees and will result in the relevant nominee or nominees receiving fewer total votes. However, the number of votes cast in favor of such nominee will not be reduced by any abstention, broker non-vote or instructions to withhold authority. The approval of Proposal No. 1 is a non-discretionary item. Brokers, banks, and other nominees that do not receive voting instructions from beneficial owners of our common stock may generally not vote on this proposal in their discretion. The Company intends that the proxy in the form presented will be voted, unless otherwise indicated, for the election of these nominees. In the absence of instructions to the contrary, the shares represented by the accompanying proxy card will be voted “FOR” all the nominees named above.

The Board of Directors unanimously recommends

a vote “FOR” the election of

each of the nominees to the Board of Directors named in this Proposal No. 1.

INFORMATION REGARDING THE BOARD AND CORPORATE GOVERNANCE

Code of Business Conduct and Ethics

Our Board has adopted a written Code of Business Conduct and Ethics, an Insider Trading Policy and Software Policies that apply to our directors, officers, employees (including those employees responsible for financial reporting), and contractors. These documents can be viewed and downloaded from the “Corporate Governance” dropdown menu of our website under the “Investor Relations” tab. The content of these documents is not incorporated into this Proxy Statement.

Director Independence

The Board has determined that Mr. Waggoner, Dr. Crabtree and Mr. Trujillo do not satisfy the definition of Independent Director as established in the OTCQB Standards. The Board has determined Dr. Abecassis, Dr. Tong, Mr. Yuen and Mr. Liquard to be Independent Directors.

Under the OTCQB Standards, a director does not qualify as independent unless the Board affirmatively determines that such person does not have a relationship which, in the opinion of the Company's board of directors, would interfere with the exercise of independent judgment in carrying out their responsibilities as a director.

In assessing the independence of our directors, the Board considers all of the business relationships between PharmaCyte and our directors and their respective affiliated companies. This review is based primarily on PharmaCyte’s review of its own records and on responses of the directors to questions in a questionnaire regarding employment, business, familial, compensation and other relationships with PharmaCyte and our management. Where relationships exist, the Board determines whether the relationship between PharmaCyte and the directors or the directors’ affiliated companies impairs the directors’ independence. After consideration of the directors’ relationships with PharmaCyte, the Board has affirmatively determined that none of the individuals serving as non-employee directors during the fiscal year ended April 30, 2021 had a material relationship with us and that each of such non-employee directors is independent.

| -17- |

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

Our directors are expected to attend meetings of the Board as frequently as necessary to properly discharge their responsibilities and to spend the time needed to prepare for each such meeting. If an annual meeting of stockholders is held, our directors are expected to attend that meeting, but we do not have a formal policy requiring them to do so. We last held a meeting of stockholders in September 2019.

The Board held seven meetings during the fiscal year ended April 30, 2021. Each of our current directors attended 100% of the aggregate number of the meetings of the Board and meetings of the committees on which he served.

Our Board currently has three committees: (i) the Audit Committee; (i) the Compensation Committee; and (iii) the Nominating Committee.

Audit Committee

The Audit Committee is currently comprised of Dr. Abecassis, Dr. Tong, Mr. Yuen and Mr. Liquard. Mr. Liquard was appointed to be the Chairperson of the Audit Committee in March 2021. From July 2017 until March 2021, Dr. Abecassis served as Chairperson of the Audit Committee. The primary purposes of our Audit Committee are to assist the Board in fulfilling its legal and fiduciary obligations with respect to matters involving the accounting and financial reporting processes of the Company and the audits of its financial statements, including, assisting the Board’s oversight of: (i) the integrity of the Company’s financial statements; (ii) the qualifications and independence of the Company’s independent auditors; (iii) the performance of the Company’s internal audit function and independent auditors; and (iv) the compliance by the Company with legal and regulatory requirements.

Our Board has determined that each member of our Audit Committee is independent within the meaning of the OTCQB Standards.

Our Audit Committee charter can be viewed and downloaded from the “Corporate Governance” dropdown menu of our website under the “Investor Relations” tab.

Compensation Committee

The Compensation Committee is currently comprised of a majority of independent directors within the meaning of the OTCQB Standards, Mr. Liquard, Mr. Waggoner and Mr. Yuen. The Chairperson of the Compensation Committee is Mr. Liquard. The primary purposes of our Compensation Committee is to review, at least annually, and recommend for Board approval (or approve, where applicable) the compensation of the Company’s directors and executive officers, including incentive compensation plans and equity-based plans. The Compensation Committee also provides overall guidance for our executive compensation policies.

Our Compensation Committee charter can be viewed and downloaded from the “Corporate Governance” dropdown menu of our website under the “Investor Relations” tab.

Nominating Committee

The Nominating Committee is currently comprised of Dr. Crabtree, Dr. Tong and Mr. Liquard. The Chairperson of the Nominating Committee is Dr. Crabtree.

The primary purposes of the Nominating Committee are to assist the Board in its selection of individuals: (i) as nominees for election to the Board at the next annual meeting of the stockholders of the Company; or (ii) to fill any vacancies or newly created directorships on the Board.

The Nominating Committee does not set specific, minimum qualifications that nominees for director must meet in order for the Nominating Committee to recommend them to the Board, but rather believes that each nominee should be evaluated based on his or her individual merits, taking into account our needs and the composition of the Board. Members of the Nominating Committee discuss and evaluate possible candidates in detail and suggest individuals to explore in more depth. The Board is authorized to use, as it deems appropriate or necessary, an outside consultant to identify and screen potential director candidates. No outside consultants were used during the fiscal year ended April 30, 2021 to identify or screen potential director candidates. The Nominating Committee will annually review the performance and contributions made by each director to the overall goals and objectives of the Company prior to the time such directors normally would be nominated for reelection.

| -18- |

Procedures for Contacting the Board

We have a process for shareholders who wish to communicate with our Board. Shareholders who wish to communicate with our Board may write to the Board at our address set forth at the beginning of this Proxy Statement. These communications will be reviewed by our Chief Executive Officer and Chief Financial Officer. They will determine whether the communications should be presented to our Board. The purpose of this screening is to allow the Board to avoid having to consider irrelevant or inappropriate communications.

Procedures for Recommending and Nominating Director Candidates

Recommending Director Candidates for Nomination by the Board

The Board will consider director candidates recommended by stockholders. A stockholder who wishes to recommend a director candidate for nomination by the Board at an annual meeting of stockholders or for vacancies of the Board that arise between annual meetings must provide the Board with sufficient written documentation to permit a determination by the Board whether such candidate meets the required and desired director selection criteria set forth in our by-laws. Such documentation and the name of the director candidate should be sent by U.S. mail to the Board at PharmaCyte’s address set forth at the beginning of this Proxy Statement.

Director Compensation

The following table sets forth information concerning compensation paid or to our directors, other than our Named Executive Officers (as hereinafter defined) who also serve as directors, during the year ended April 30, 2021.

2021 Director Compensation

| Name | Fees Earned or Paid in Cash ($) |

Stock Awards ($)(1) |

Option Awards ($)(1) |

Total ($) | ||||||||||||

| Thomas Liquard | $ | 50,000 | 12,000 | (2) | 6,293 | (2) | $ | 68,293 | ||||||||

| Thomas C.K Yuen | $ | 50,000 | 12,000 | (3) | 6,293 | (3) | $ | 68,293 | ||||||||

| Michael M. Abecassis, MD | $ | 50,000 | 12,350 | (4) | 6,615 | (4) | $ | 68,965 | ||||||||

| Raymond C.F. Tong, MD | $ | 50,000 | 5,250 | (5) | 2,943 | (5) | $ | 58,193 | ||||||||

| (1) | The amounts in the columns titled “Stock Awards” and “Option Awards” reflect the grant date fair values of awards made during the fiscal year ended April 30, 2021, as computed in accordance with FASB ASC Topic 718 and the assumptions stated in Note 4 and Note 5 of the Consolidated Financial Statements to our quarterly report in the Form 10-Q, filed with the Securities Exchange Commission on March 12, 2021. |

| (2) | As of April 30, 2021, Mr. Liquard held unexercised options to purchase an aggregate of 2,000,000 shares. |

| (3) | As of April 30, 2021, Mr. Yuen held unexercised options to purchase an aggregate of 2,000,000 shares. |

| (4) | As of April 30, 2021, Dr. Abecassis held unexercised options to purchase an aggregate of 3,200,000 shares. |

| (5) | As of April 30, 2021, Dr. Tong held unexercised options to purchase an aggregate of 2,000,000 shares. |

| -19- |

Each non-employee director is party to an agreement to serve as a director and to receive $12,500 in cash payments per quarter (paid on a pro-rated basis for periods of less than a quarter). In addition, we will annually grant each non-employee director: (i) 500,000 shares of our restricted common stock; and (ii) a stock option to purchase 500,000 shares of our restricted common stock exercisable over a five-year term at an exercise price per share equal to the closing price of the common stock on the date of grant, both of which will be fully vested at the time of grant.

Other than as described above, directors do not receive any additional compensation for participation in either Board or Committee meetings of the Board.

EXECUTIVE COMPENSATION

This section discusses the material components of the executive compensation program for our executive officers who are named in the “Summary Compensation Table” below (each, a “Named Executive Officer”). As a smaller reporting company, we are not required to include a Compensation Discussion and Analysis and have elected to comply with the scaled disclosure requirements applicable to smaller reporting companies.

For our fiscal year ended April 30, 2021, our Named Executive Officers and their positions were as follows:

| · | Kenneth L. Waggoner, JD, Chief Executive Officer, President, General Counsel and Chairman of the Board; |

| · | Gerald W. Crabtree, PhD, Chief Scientific Officer and Director; and |

| · | Carlos A. Trujillo, CPA, Chief Financial Officer and Director. |

The following tables provide information about all compensation earned during our fiscal years ended April 30, 2021 and 2020 by our Named Executive Officers.

2021 Summary Compensation Table

| Name | Principal Position | Fiscal Year |

Salary ($) |

Stock Awards ($)(1) |

Option Awards ($)(1) |

Total ($) |

||||||||||||||||

| Kenneth L. Waggoner, JD(2) | Chief Executive Officer, | 2021 | $ | 433,333 | $ | 24,120 | $ | 77,212 | $ | 534,665 | ||||||||||||

| President and | 2020 | $ | 316,667 | $ | 201,600 | $ | 148,508 | $ | 666,775 | |||||||||||||

| General Counsel | ||||||||||||||||||||||

| Gerald W. Crabtree, PhD(2) | Chief Operating/Scientific Officer | 2021 | $ | 94,333 | $ | 4,020 | $ | 25,738 | $ | 124,091 | ||||||||||||

| 2020 | $ | 109,667 | $ | 33,600 | $ | 49,503 | $ | 192,770 | ||||||||||||||

| Carlos A. Trujillo, CPA (2) | Chief Financial Officer | 2021 | $ | 300,000 | $ | 16,080 | $ | 51,474 | $ | 367,554 | ||||||||||||

| 2020 | $ | 250,000 | $ | 134,400 | $ | 99,006 | $ | 483,406 | ||||||||||||||

(1) The amounts in the columns titled “Stock Awards” and “Option Awards” reflect the grant date fair values of awards made during the identified fiscal year, as computed in accordance with FASB ASC Topic 718 and the assumptions stated in Note 4 and Note 5 of the Consolidated Financial Statements to PharmaCyte’s annual report on Form 10-K for the fiscal year ended April 30, 2021, as filed with the SEC.

| -20- |

Narrative to Summary Compensation Table

The base salary rates and the material terms of the stock awards and option awards received by the Named Executive Officers during the fiscal year ended April 30, 2021, are described below in the section entitled “Employment Arrangements.” Other than the payment of base salary and the grant of these equity awards, our Named Executive Officers did not earn additional compensation for their services during such fiscal year.

We currently maintain the PharmaCyte Biotech, Inc 401(k) Plan (“Plan”). The Plan is a safe harbor plan that allows eligible employees to contribute a portion of their salaries into the Plan. We are not required to and do not contribute to the highly compensated employees’ accounts and we do not match the contributions of the Named Executive Officers.

Outstanding Equity Awards at 2021 Fiscal Year End

| Option Awards | Stock Awards |

| Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable(1) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#)(2) | Market Value of Shares or Units of Stock That Have Not Vested ($)(3) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) | ||||||||||||||||||||||||

| Kenneth L. Waggoner | 4,500,000 | – | $ | 0.104 | 03/09/2022 | – | $ | – | – | $ | – | |||||||||||||||||||||

| 4,500,000 | – | $ | 0.054 | 12/31/2023 | – | $ | – | – | $ | – | ||||||||||||||||||||||

| 4,500,000 | – | $ | 0.0495 | 03/20/2024 | – | $ | – | – | $ | – | ||||||||||||||||||||||

| 4,500,000 | – | $ | 0.0408 | 01/02/2025 | – | $ | – | – | $ | – | ||||||||||||||||||||||

| 1,500,000 | 3,000,000 | $ | 0.0067 | 12/31/2025 | – | $ | – | – | $ | – | ||||||||||||||||||||||

| – | – | $ | – | – | 2,400,000 | $ | 42,648 | – | $ | – | ||||||||||||||||||||||

| Gerald W. Crabtree | 1,500,000 | – | $ | 0.104 | 03/09/2022 | – | $ | – | – | $ | – | |||||||||||||||||||||

| 1,500,000 | – | $ | 0.054 | 12/31/2023 | – | $ | – | – | $ | – | ||||||||||||||||||||||

| 1,500,000 | – | $ | 0.0495 | 03/20/2024 | – | $ | – | – | $ | – | ||||||||||||||||||||||

| 1,500,000 | – | $ | 0.0408 | 01/02/2025 | – | $ | – | – | $ | – | ||||||||||||||||||||||

| 500,000 | 1,000,000 | $ | 0.0067 | 12/31/2025 | – | $ | – | – | $ | – | ||||||||||||||||||||||

| – | – | $ | – | – | 400,000 | 7,108 | – | $ | – | |||||||||||||||||||||||

| Carlos A. Trujillo | 3,000,000 | – | $ | 0.104 | 03/09/2022 | – | $ | – | – | $ | – | |||||||||||||||||||||

| 3,000,000 | – | $ | 0.054 | 12/31/2023 | – | $ | – | – | $ | – | ||||||||||||||||||||||

| 3,000,000 | – | $ | 0.0495 | 03/20/2024 | – | $ | – | – | $ | – | ||||||||||||||||||||||

| 3,000,000 | – | $ | 0.0408 | 01/02/2025 | – | $ | – | – | $ | – | ||||||||||||||||||||||

| 1,000,000 | 2,00,000 | $ | 0.0067 | 12/31/2025 | – | $ | – | – | $ | – | ||||||||||||||||||||||

| – | – | $ | – | – | 1,600,000 | $ | 28,432 | – | $ | – | ||||||||||||||||||||||

_______________________

| (1) | Subject generally to the Named Executive Officer’s continued employment, the unvested portion of these options will vest in 750,000 monthly installments on the first day of each month between May of 2021 and thirty-first day of December 2021. |

| (2) | Subject generally to the Named Executive Officer’s continued employment, these shares will vest in 550,000 monthly installments on the first day of each month between May of 2021 and thirty-first day of December 2021. |

| (3) | The market value is based on the closing stock price of $0.0177 on April 30, 2021, the last day of trading in this fiscal year. |

| -21- |

Employment Arrangements

Kenneth L. Waggoner, JD

We have entered into an Executive Compensation Agreement with Mr. Waggoner (“Waggoner Compensation Agreement”). The term of the Waggoner Compensation Agreement extends until December 31, 2018 with annual extensions at the end of the term or any extension of the term, unless we or Mr. Waggoner provide 90-days written notice of termination. The Waggoner Compensation Agreement has been extended through December 31, 2021. The Waggoner Compensation Agreement provides that Mr. Waggoner will be employed as a member of our Board, as our Chief Executive Officer, President and General Counsel and as the Chief Executive Officer and General Counsel of our subsidiary Viridis Biotech. Under this agreement, Mr. Waggoner is paid a base salary of $375,000 subject to annual increases in the discretion of our Compensation Committee. Mr. Waggoner’s base salary rate for the fiscal year ended April 30, 2021, was $433,333. The Waggoner Compensation Agreement also provides that, during his continued employment, Mr. Waggoner receives an annual stock grant of 3,600,000 shares of restricted common stock, vesting at the rate of 300,000 shares per month, and an annual stock option grant to purchase 4,500,000 shares of common stock with a five-year term at an exercise price per share equal to the closing price of the common stock on the date of grant, vesting at the rate of 375,000 option shares per month. During the fiscal year ended April 30, 2021, Mr. Waggoner received these annual grants on January 1, 2021.

If Mr. Waggoner’s employment is terminated by us without “Cause” or by him for “Good Reason” (as such terms are defined in the Waggoner Compensation Agreement), then subject to his execution of a timely release, he is entitled to: (i) base salary continuation for 2 years, (ii) payment of the annual bonus, if any, earned by Mr. Waggoner for the year preceding the year of termination, or, if greater, the target bonus, if any, for the year of termination, (iii) accelerated vesting of any unvested stock or option awards and (iv) continued health coverage for Mr. Waggoner and his family and life insurance coverage for Mr. Waggoner, if any, for 12 months at PharmaCyte’s expense.

Notwithstanding the foregoing, if Mr. Waggoner’s employment is terminated by us without Cause or by him for Good Reason because of a “Change in Control” (as such term is defined in the Waggoner Compensation Agreement), then the base salary and bonus, if any, component of severance would be paid in lump sum. If a “Change of Control” occurs and any Company equity awards (“Transaction Date Equity Awards”) are not assumed or converted into comparable awards with respect to stock of the acquiring or successor company (or parent thereof), then, immediately prior to the “Change of Control”, each such Transaction Date Equity Award, whether or not previously vested, shall be converted into the right to receive cash or, at the election of Mr. Waggoner, consideration in a form that is pari passu with the form of the consideration payable to the Company’s stockholders in exchange for their shares, in an amount or having a value equal to the product of (i) the per share fair market value of the Company’s common stock (based upon the consideration payable to the Company’s stockholders), less, if applicable, the per share exercise price under such Transaction Date Equity Award, multiplied by (ii) the number of shares of Common Stock covered by such Transaction Date Equity Award. Also, Mr. Waggoner would be entitled to receive a full Code Section 280G tax gross-up, with respect to any amounts that may be subject to the excise tax provisions under Code Section 280G.

| -22- |

If Mr. Waggoner’s employment is terminated due to death or “Disability” (as such term is defined in the Waggoner Compensation Agreement) he (in the case of disability) or his designated beneficiary or estate (in the case of death) would receive the severance benefits set forth above, excluding the base salary and bonus continuation and life insurance premium continuation in the case of death, however, his estate would receive the proceeds, if any, from any life insurance.

Additionally, Mr. Waggoner is bound by confidentiality and non-disparagement provisions as well as non-solicitation and non-competition covenants that prohibit him from such actions during the term of his employment and for twenty-four months after termination of his employment.

Gerald W. Crabtree, PhD

We have entered into an Executive Compensation Agreement with Dr. Crabtree (“Crabtree Compensation Agreement”). The term of the Crabtree Compensation Agreement extends until December 31, 2018 with annual extensions at the end of the term or any extension of the term unless we or Dr. Crabtree provide 90-days written notice of termination. The Crabtree Compensation Agreement has been extended through December 31, 2021. The Crabtree Compensation Agreement provides that Dr. Crabtree will be employed as a member of our Board, as our Chief Operating Officer and as the Chief Operating Officer of our subsidiary Viridis Biotech. Dr. Crabtree is paid a base salary of $84,000 subject to annual increases in the discretion of our Compensation Committee. Dr. Crabtree’s base salary rate for the fiscal year ended April 30, 2021 was $94,333. The Crabtree Compensation Agreement also provides that, during his continued employment, Dr. Crabtree will receive annual stock grants of 600,000 shares of restricted common stock, vesting at the rate of 50,000 shares per month, and an annual stock option grant to purchase 1,500,000 shares of common stock with a five-year term at an exercise price per share equal to the closing price of the common stock on the date of grant, vesting at the rate of 125,000 option shares per month. During the fiscal year ended April 30, 2021, Dr. Crabtree received these annual grants on January 1, 2021.

If Dr. Crabtree’s employment is terminated by us without “Cause” or by him for “Good Reason” (as such terms are defined in the Crabtree Compensation Agreement), then subject to his execution of a timely release, he is entitled to: (i) base salary continuation for 2 years, (ii) payment of the annual bonus, if any, earned by Dr. Crabtree for the year preceding the year of termination, or, if greater, the target bonus, if any, for the year of termination, (iii) accelerated vesting of the any unvested stock or option awards and (iv) continued health coverage for Dr. Crabtree and his family and life insurance coverage for Dr. Crabtree, if any, for 12 months at our expense.

Notwithstanding the foregoing, if Dr. Crabtree’s employment is terminated by us without Cause or by him for Good Reason because of a “Change in Control” (as such term is defined in the Crabtree Compensation Agreement), then the base salary and bonus, if any, component of severance would be paid in lump sum. If a “Change of Control” occurs and any Company equity awards (“Transaction Date Equity Awards”) are not assumed or converted into comparable awards with respect to stock of the acquiring or successor company (or parent thereof), then, immediately prior to the “Change of Control”, each such Transaction Date Equity Award, whether or not previously vested, shall be converted into the right to receive cash or, at the election of Dr. Crabtree, consideration in a form that is pari passu with the form of the consideration payable to the Company’s stockholders in exchange for their shares, in an amount or having a value equal to the product of (i) the per share fair market value of the Company’s common stock (based upon the consideration payable to the Company’s stockholders), less, if applicable, the per share exercise price under such Transaction Date Equity Award, multiplied by (ii) the number of shares of Common Stock covered by such Transaction Date Equity Award. Also, Dr. Crabtree would be entitled to receive a full Code Section 280G tax gross-up, with respect to any amounts that may be subject to the excise tax provisions under Code Section 280G.

| -23- |

If Dr. Crabtree’s employment is terminated due to death or “Disability” (as such term is defined in the Crabtree Compensation Agreement) he (in the case of disability) or his designated beneficiary or estate (in the case of death) would receive the severance benefits set forth above, excluding the base salary and bonus continuation and life insurance premium continuation in the case of death, however, his estate would receive the proceeds, if any, from any life insurance.

Also, Dr. Crabtree is bound by confidentiality and non-disparagement provisions as well as non-solicitation and non-competition covenants that prohibit him from such actions during the term of his employment and for twenty-four months after termination of employment.

Carlos A. Trujillo, CPA