Exhibit 3.1

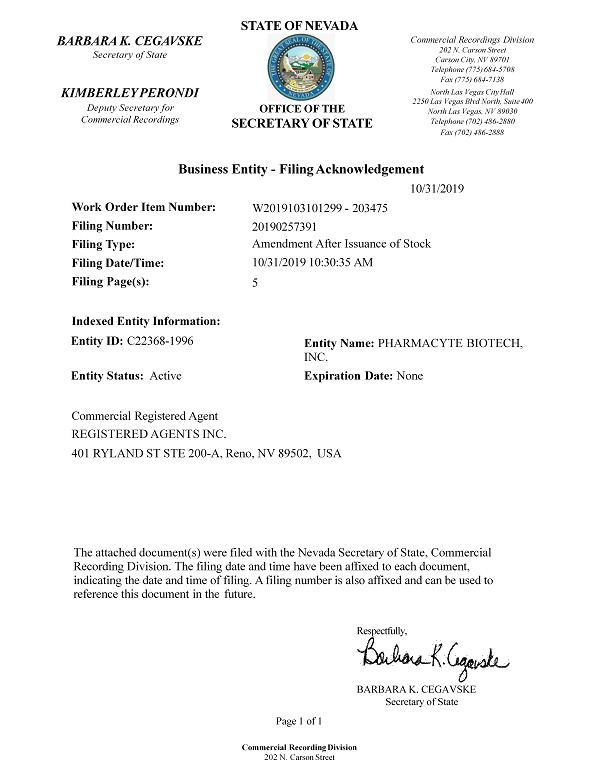

Business Entity - Filing Acknowledgement 10/31/2019 Work Order Item Number: Filing Number: Filing Type: Filing Date/Time: Filing Page(s): W2019103101299 - 203475 20190257391 Amendment After Issuance of Stock 10/31/2019 10:30:35 AM 5 Indexed Entity Information: Entity ID: C22368 - 1996 Entity Status: Active Entity Name: PHARMACYTE BIOTECH, INC. Expiration Date: None Commercial Registered Agent REGISTERED AGENTS INC. 401 RYLAND ST STE 200 - A, Reno, NV 89502, USA BARBARA K. CEGAVSKE Secretary of State KIMBERLEY PERONDI Deputy Secretary for Commercial Recordings STATE OF NEVADA OFFICE OF THE SECRETARY OF STATE Commercial Recordings Division 202 N. Carson Street Carson City, NV 89701 Telephone (775) 684 - 5708 Fax (775) 684 - 7138 North Las Vegas City Hall 2250 Las Vegas Blvd North, Suite 400 North Las Vegas, NV 89030 Telephone (702) 486 - 2880 Fax (702) 486 - 2888 The attached document(s) were filed with the Nevada Secretary of State, Commercial Recording Division. The filing date and time have been affixed to each document, indicating the date and time of filing. A filing number is also affixed and can be used to reference this document in the future. Respectfully, BARBARA K. CEGAVSKE Secretary of State Page 1 of 1 Commercial Recording Division 202 N. Carson Street

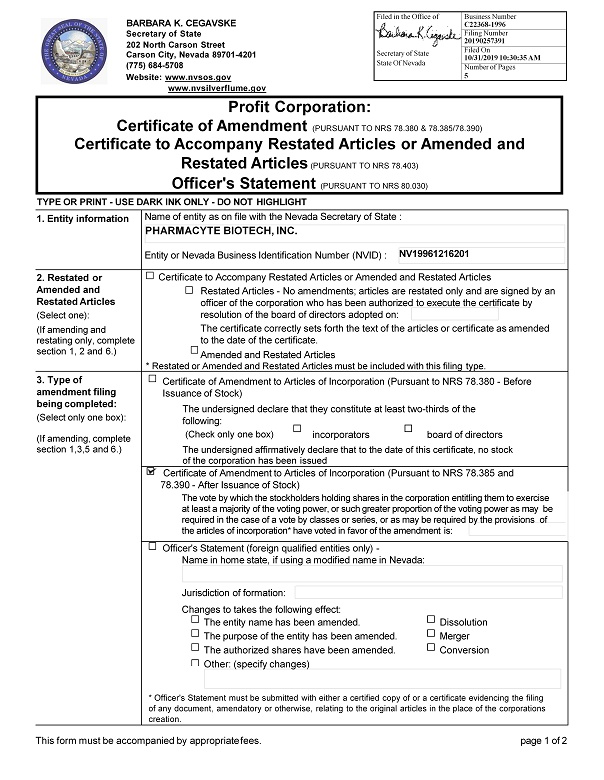

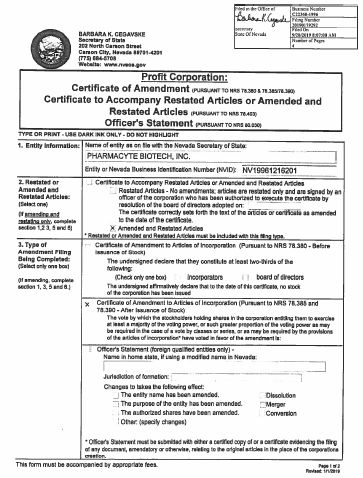

1. Entity information Name of entity as on file with the Nevada Secretary of State : PHARMACYTE BIOTECH, INC. Entity or Nevada Business Identification Number (NVID) : NV19961216201 2. Restated or Amended and Restated Articles Certificate to Accompany Restated Articles or Amended and Restated Articles Restated Articles - No amendments; articles are restated only and are signed by an officer of the corporation who has been authorized to execute the certificate by resolution of the board of directors adopted on: The certificate correctly sets forth the text of the articles or certificate as amended to the date of the certificate. Amended and Restated Articles * Restated or Amended and Restated Articles must be included with this filing type. (Select one): (If amending and restating only, complete section 1, 2 and 6.) 3. Type of amendment filing being completed: Certificate of Amendment to Articles of Incorporation (Pursuant to NRS 78.380 - Before Issuance of Stock) The undersigned declare that they constitute at least two - thirds of the following: (Check only one box) incorporators board of directors The undersigned affirmatively declare that to the date of this certificate, no stock of the corporation has been issued (Select only one box): (If amending, complete section 1,3,5 and 6.) Certificate of Amendment to Articles of Incorporation (Pursuant to NRS 78.385 and 78.390 - After Issuance of Stock) The vote by which the stockholders holding shares in the corporation entitling them to exercise at least a majority of the voting power, or such greater proportion of the voting power as may be required in the case of a vote by classes or series, or as may be required by the provisions of the articles of incorporation* have voted in favor of the amendment is: Officer's Statement (foreign qualified entities only) - Name in home state, if using a modified name in Nevada: Jurisdiction of formation: Changes to takes the following effect: The entity name has been amended. Dissolution The purpose of the entity has been amended. Merger The authorized shares have been amended. Conversion Other: (specify changes) * Officer's Statement must be submitted with either a certified copy of or a certificate evidencing the filing of any document, amendatory or otherwise, relating to the original articles in the place of the corporations creation. BARBARA K. CEGAVSKE Secretary of State 202 North Carson Street Carson City, Nevada 89701 - 4201 (775) 684 - 5708 Website: www.nvsos.gov www.nvsilverflume.gov Profit Corporation: Certificate of Amendment (PURSUANT TO NRS 78.380 & 78.385/78.390) Certificate to Accompany Restated Articles or Amended and Restated Articles (PURSUANT TO NRS 78.403) Officer's Statement (PURSUANT TO NRS 80.030) TYPE OR PRINT - USE DARK INK ONLY - DO NOT HIGHLIGHT Filed in the Office of Secretary of State State Of Nevada Business Number C22368 - 1996 Filing Number 20190257391 Filed On 10/31/2019 10:30:35 AM Number of Pages 5 This form must be accompanied by appropriate fees. page 1 of 2

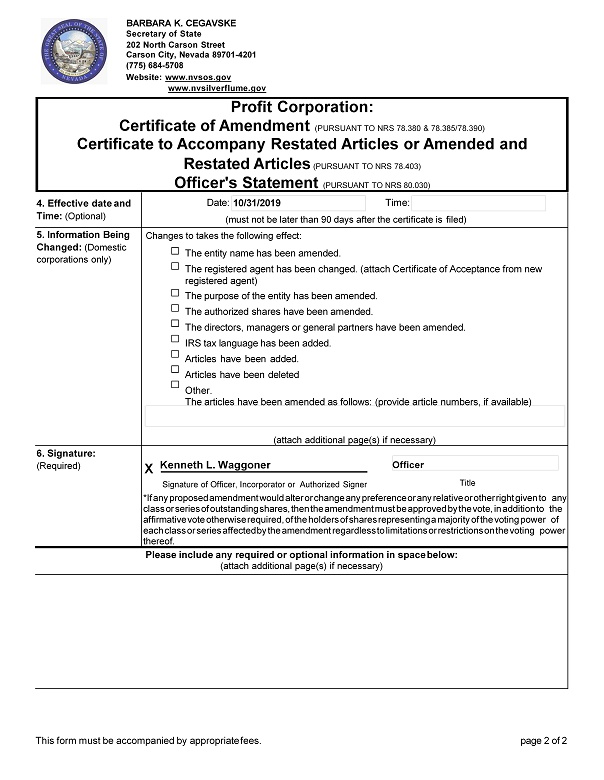

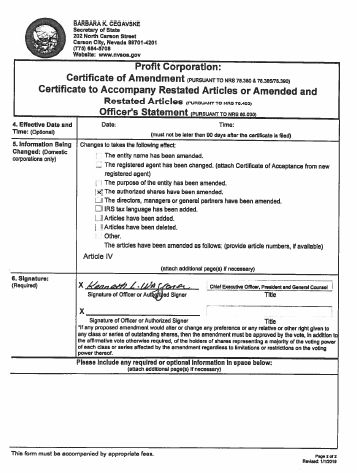

4. Effective date and Time: (Optional) Date: 10/31/2019 Time: (must not be later than 90 days after the certificate is filed) 5. Information Being Changed: (Domestic corporations only) Changes to takes the following effect: The entity name has been amended. The registered agent has been changed. (attach Certificate of Acceptance from new registered agent) The purpose of the entity has been amended. The authorized shares have been amended. The directors, managers or general partners have been amended. IRS tax language has been added. Articles have been added . Articles have been deleted Other . The articles have been amended as follows : (provide article numbers, if available) (attach additional page(s) if necessary) 6. Signature: (Required) X Kenneth L. Waggoner Officer Signature of Officer, Incorporator or Authorized Signer Title *If any proposed amendment would alter or change any preference or any relative or other right given to any class or series of outstanding shares, then the amendment must be approved by the vote, in addition to the affirmative vote otherwise required, of the holders of shares representing a majority of the voting power of each class or series affected by the amendment regardless to limitations or restrictions on the voting power thereof. Please include any required or optional information in space below: (attach additional page(s) if necessary) BARBARA K. CEGAVSKE Secretary of State 202 North Carson Street Carson City, Nevada 89701 - 4201 (775) 684 - 5708 Website: www.nvsos.gov www.nvsilverflume.gov Profit Corporation: Certificate of Amendment (PURSUANT TO NRS 78.380 & 78.385/78.390) Certificate to Accompany Restated Articles or Amended and Restated Articles (PURSUANT TO NRS 78.403) Officer's Statement (PURSUANT TO NRS 80.030) This form must be accompanied by appropriate fees. page 2 of 2

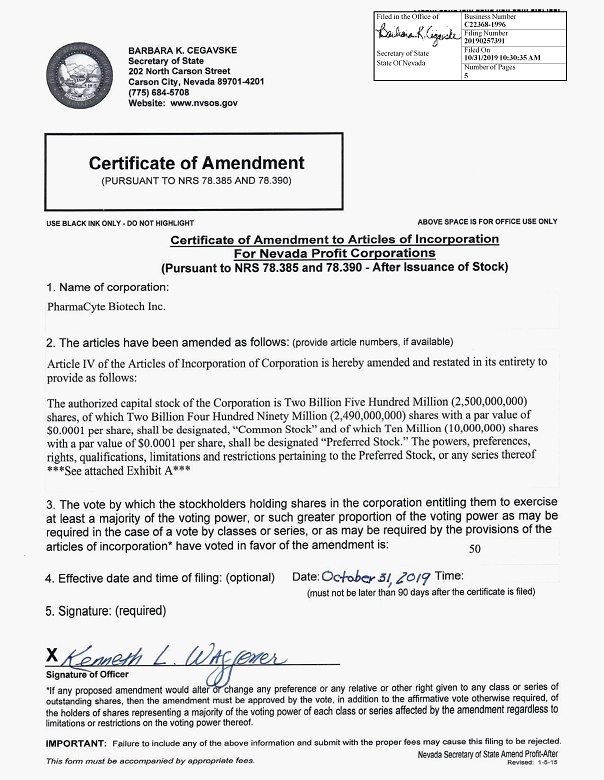

Filed in the Office of Secretary of State State Of Nevada Business Number C22368 - 1996 Filing Number 20190257391 Filed On 10/31/2019 10:30:35 AM Number of Pages 5

CERTIFICATE OF AMENDMENT

(pursuant to NRS 78.385 and 78.390)

Certificate of Amendment to Articles of Incorporation

of

PharmaCyte Biotech, Inc.

PharmaCyte Biotech, Inc., ("Corporation'"), a corporation organized and existing under the laws of the State of Nevada hereby certifies as follows:

| 1. | The name of the Corporation is PharmaCyte Biotech, Inc.. |

| 2. | Article IV of the Articles of Incorporation of Corporation is hereby amended and restated in its entirety to provide as follows: |

The authorized capital stock of the Corporation is Two Billion Five Hundred Million (2,500,000,000) shares, of which Two Billion Four Hundred and Ninety Million (2,490,000,000) shares with a par value of $.0001 per share, shall be designated, “Common Stock” and of which Ten Million (10,000,000) shares with a par value of $.0001 per share, shall be designated “Preferred Stock.” The powers, preferences, rights, qualifications, limitations and restrictions pertaining to the Preferred Stock, or any series thereof, shall be such as may be fixed, from time to time, by the Board of Directors of the Corporation (“Board”) in its sole discretion, authority to do so being hereby expressly vested in the Board. The authority of the Board with respect to each such series of Preferred Stock will include, without limiting the generality of the foregoing, the determination of any or all of the following:

| (i) | The number of shares of any series and the designation to distinguish the shares of such series from the shares of all other series; |

| (ii) | the voting powers, if any, of the shares of such series and whether such voting powers are full or limited and whether the class will vote with the Common Stock of the Corporation as one class, or otherwise; |

| (iii) | the redemption provisions, if any, applicable to such series, including the redemption price or prices to be paid; |

| (iv) | whether dividends, if any, will be cumulative or noncumulative, the dividend rate or rates of such series and the dates and preferences of dividends on such series; |

| (v) | the rights of such series upon the voluntary or involuntary dissolution of, or upon any distribution of the assets of, the Corporation; |

| 1 |

| (vi) | the provisions, if any, pursuant to which the shares of such series are convertible into, or exchangeable for, shares of any other class or classes or of any other series of the same or any other class or classes of stock, or any other security, of the Corporation or any other corporation or other entity, and the rates or other determinants of conversion or exchange applicable thereto; |

| (vii) | the right, if any, to subscribe for or to purchase any securities of the Corporation or any other corporation or other entity; |

| (viii) | the provisions, if any, of a sinking fund applicable to such series; and |

| (ix) | any other relative, participating, optional or other powers, preferences or rights, and any qualifications, limitations or restrictions thereof, of such series. |

| 3. | The vote by which the stockholders holding shares in the Corporation entitling them to exercise at least a majority of the voting power, or such greater proportion of the voting power as may be required in the case of a vote by classes or series, or as may be required by the provisions of the articles of incorporation have voted in favor of the amendment is 50.41%. |

| 4. | This Certificate of Amendment shall be effective upon filing with the Secretary of State of the State of Nevada. |

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be signed by its duly authorized officer as of this 31st day of October, 2019.

|

By: /s/ Kenneth L. Waggoner | |

| Name: Kenneth L. Waggoner | |

| Title: Chief Executive

Officer President and General Counsel |

| 2 |

| 3 |

| 4 |

CERTIFICATE OF DESIGNATIONS OF PREFERENCES AND RIGHTS OF

SERIES A PREFERRED STOCK

of

PharmaCyte Biotech, Inc.

a Nevada corporation

Pursuant to Section 78.1955 of the Nevada Revised Statutes

The undersigned, Kenneth L. Waggoner, hereby certifies that:

| 1. | He is the duly elected Chief Executive Officer, President and General Counsel of PharmaCyte Biotech, Inc., a Nevada corporation (“Corporation”). |

| 2. | A resolution was adopted and approved by the Board of Directors of the Corporation by Unanimous Written Consent on September ___, 2019 authorizing and approving the Certificate of Designation of Preferences and Rights of Series A Preferred Stock of the Corporation set forth below. |

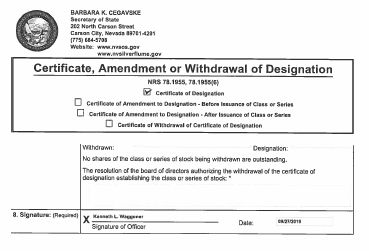

| 3. | No shares of Series A Preferred Stock have been issued as of the date hereof. |

IN WITNESS WHEREOF, the undersigned does hereby execute this Certificate, and does hereby acknowledge that this instrument constitutes his act and deed and that the facts stated herein are true.

PharmaCyte Biotech, Inc.

By: /s/ Kenneth L. Waggoner

Printed Name: Kenneth L. Waggoner

Chief Executive Officer

President and General Counsel

Dated: September 26, 2019

| 5 |

CERTIFICATE OF DESIGNATIONS OF PREFERENCES AND RIGHTS OF

SERIES A PREFERRED STOCK

of

PharmaCyte Biotech, Inc.

a Nevada corporation

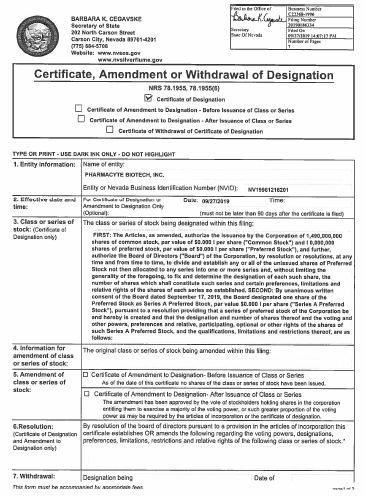

The undersigned Chief Executive Officer, President and General Counsel of PharmaCyte Biotech, Inc. (“Corporation”), a corporation organized and existing under the laws of the State of Nevada, does hereby certify that, pursuant to the authority contained in the Corporation’s Articles of Incorporation (“Articles”) and pursuant to Section 78.1955 of the Nevada Revised Statutes (“NRS”), and in accordance with the provisions of the resolution creating a series of the class of the Corporation’s authorized preferred stock designated as Series A Preferred Stock as follows:

FIRST: The Articles, as amended, authorize the issuance by the Corporation of 1,490,000,000 shares of common stock, par value of $0.0001 per share (“Common Stock”) and 10,000,000 shares of preferred stock, par value of $0.0001 per share (“Preferred Stock”), and further, authorize the Board of Directors (“Board”) of the Corporation, by resolution or resolutions, at any time and from time to time, to divide and establish any or all of the unissued shares of Preferred Stock not then allocated to any series into one or more series and, without limiting the generality of the foregoing, to fix and determine the designation of each such share, the number of shares which shall constitute such series and certain preferences, limitations and relative rights of the shares of each series so established.

SECOND: By unanimous written consent of the Board dated September 17, 2019, the Board designated one share of the Preferred Stock as Series A Preferred Stock, par value $0.0001 per share (“Series A Preferred Stock”), pursuant to a resolution providing that a series of preferred stock of the Corporation be and hereby is created and that the designation and number of shares thereof and the voting and other powers, preferences and relative, participating, optional or other rights of the shares of such Series A Preferred Stock, and the qualifications, limitations and restrictions thereof, are as follows:

SERIES A PREFERRED STOCK

Section 1. Powers and Rights of Series A Preferred Stock. There is hereby designated a class of Preferred Stock of the Corporation as the Series A Preferred Stock, par value $0.0001 per share of the Corporation (“Series A Preferred Stock”). The number of shares, powers, terms, conditions, designations, preferences and privileges, relative, participating, optional and other special rights, and qualifications, limitations and restrictions, if any, of the Series A Preferred Stock shall be as set forth in this Certificate of Designations of Preferences and Rights of Series A Preferred Stock (“Certificate of Designations”). For purposes hereof, the holder of the share of Series A Preferred Stock shall be referred to as a “Series A Holder.”

(a) Number. The number of authorized shares of the Series A Preferred Stock is one (1) share.

(b) Vote. Other than as set forth in Section 1(h) and Section 1(i), the share of Series A Preferred Stock shall have a number of votes at any time equal to: (i) the number of votes then held or entitled to be made by all other equity securities of the Corporation, including, without limitation, the common stock, par value $0.0001 per share, of the Corporation (“Common Stock”), debt securities of the Corporation or pursuant to any other agreement, contract or understanding of the Corporation; plus (ii) one (1). The Series A Preferred Stock shall vote on any matter submitted to the holders of the Common Stock, or any class thereof, for a vote, and shall vote together with the Common Stock, or any class thereof, as applicable, on such matter for as long as the share of Series A Preferred Stock is issued and outstanding and shall constitute the same class as the Common Stock for the purposes of any such vote. The Series A Preferred Stock shall not have the right to vote on any matter as to which solely another class of Preferred Stock of the Corporation is entitled to vote pursuant to the certificate of designations of such other class of Preferred Stock of the Corporation.

| 6 |

(c) No Transfer; Redemption. The share of Series A Preferred Stock may not be transferred by the original Series A Holder to whom the share of Series A Preferred Stock is initially issued by the Corporation, and any attempted transfer of such shares of Series A Preferred Stock, whether voluntary or by operation of law or otherwise, shall be void ab initio and of no force or effect and the Corporation shall not recognize the purposed transferee thereof as the holder of the share of Series A Preferred Stock, and such share of Series A Preferred Stock shall be deemed automatically redeemed by the Corporation as of immediately prior to any such transfer or attempted transfer, and the Series A Holder shall thereafter be entitled to receive solely a redemption price of $1.00 therefor. The Corporation may redeem the share of Series A Preferred Stock at any time for a redemption price of $1.00 paid to the Series A Holder.

(d) No Conversion. The Series A Preferred Stock shall not be convertible into shares of any other class of stock of the Corporation.

(e) No Dividends. The Series A Preferred Stock shall not be entitled to receive any dividends paid on any other class of stock of the Corporation.

(f) No Preferences upon Liquidation. In the event of any liquidation, dissolution or winding up of the Corporation, either voluntarily or involuntarily, a merger or consolidation of the Corporation wherein the Corporation is not the surviving entity, or a sale of all or substantially all of the assets of the Corporation, the Series A Preferred Stock shall not be entitled to receive any distribution of any of the assets or surplus funds of the Corporation and shall not participate with the Common Stock or any other class of stock of the Corporation therein.

(g) No Participation. The Series A Preferred Stock shall not participate in any distributions or payments to the holders of the Common Stock or any other class of stock of the Corporation.

(h) Amendment. The Corporation may not, and shall not, amend this Certificate of Designations without the prior written consent of the Series A Holder, voting separately as a single class, in person or by proxy, either in writing without a meeting or at an annual or a special meeting of the Corporation.

(i) Protective Provisions. In addition to any other rights and restrictions provided under applicable law, without first obtaining the affirmative vote or written consent of the Series A Holder, with the share of Series A Preferred Stock having one (1) vote on such matter, the Corporation shall not amend or repeal any provision of this Certificate of Designations, including by merger, consolidation or otherwise, and any such act or transaction entered into without such vote or consent shall be null and void ab initio, and of no force or effect. In addition to any other rights and restrictions provided under applicable law, without first obtaining the affirmative vote or written consent of the Series A Holder, with the share of Series A Preferred Stock having one vote on such matter, the Corporation shall not amend or repeal any provision of, or add any provision to, the Articles or bylaws of the Corporation if such action would adversely alter or change the preferences, rights, privileges, or powers of, or restrictions provided for the benefit of, the Series A Preferred Stock, as reasonably determined by the Series A Holder, and any such act or transaction entered into without such vote or consent shall be null and void ab initio, and of no force or effect.

Section 2. Miscellaneous.

(a) Legend. Any certificates representing the Series A Preferred Stock shall bear a restrictive legend in substantially the following form (and a stop transfer order may be placed against transfer of such stock certificates):

THE SECURITIES REPRESENTED BY THIS AGREEMENT HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, NOR REGISTERED NOR QUALIFIED UNDER ANY STATE SECURITIES LAWS. SUCH SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, DELIVERED AFTER SALE, TRANSFERRED, PLEDGED, OR HYPOTHECATED UNLESS QUALIFIED AND REGISTERED UNDER APPLICABLE STATE AND FEDERAL SECURITIES LAWS OR UNLESS, IN THE OPINION OF COUNSEL REASONABLY SATISFACTORY TO THE COMPANY, SUCH QUALIFICATION AND REGISTRATION IS NOT REQUIRED. ANY TRANSFER OF THE SECURITIES REPRESENTED BY THIS CERTIFICATE IS FURTHER SUBJECT TO OTHER RESTRICTIONS, TERMS AND CONDITIONS WHICH ARE SET FORTH HEREIN.

| 7 |

(b) Lost or Mutilated Series A Preferred Stock Certificate. If the certificate for the Series A Preferred Stock held by the Series A Holder becomes mutilated, lost, stolen or destroyed, the Corporation shall execute and deliver, in exchange and substitution for and upon cancellation of a mutilated certificate, or in lieu of or in substitution for a lost, stolen or destroyed certificate, a new certificate for the share of Series A Preferred Stock so mutilated, lost, stolen or destroyed, but only upon receipt of evidence of such loss, theft or destruction of such certificate and of the ownership thereof, and indemnity, if requested, all reasonably satisfactory to the Corporation.

(c) Interpretation. If the Series A Holder shall commence a lawsuit, action or proceeding to enforce any provisions of this Certificate of Designations, then the prevailing party in such lawsuit, action or proceeding shall be reimbursed by the other party for its or his reasonable attorney’s fees and other costs and expenses incurred with the investigation, preparation and prosecution of such lawsuit, action or proceeding.

(d) Waiver. Any waiver by the Corporation of the Series A Holder of a breach of any provision of this Certificate of Designations shall not operate as or be construed to be a waiver of any other breach of such provision or of any breach of any other provision of this Certificate of Designations. The failure of the Corporation or the Series A Holder to insist upon strict adherence to any term of this Certificate of Designations on one or more occasions shall not be considered a waiver or deprive that party of the right thereafter to insist upon strict adherence to that term or any other term of this Certificate of Designations. Any waiver must be in writing.

(e) Severability. If any provision of this Certificate of Designations is invalid, illegal or unenforceable, the balance of this Certificate of Designations shall remain in effect, and if any provision is inapplicable to any person or circumstance, it shall nevertheless remain applicable to all other persons and circumstances. If it shall be found that any interest or other amount deemed interest due hereunder violates applicable laws governing usury, the applicable rate of interest due hereunder shall automatically be lowered to equal the maximum permitted rate of interest.

IN WITNESS WHEREOF, PharmaCyte Biotech, Inc. has caused this Certificate of Designations to be signed by a duly authorized officer on this 26th day of September 2019.

PharmaCyte Biotech, Inc.

By: /s/ Kenneth L. Waggoner

Printed Name: Kenneth L. Waggoner

Title: Chief Executive Officer

President and General Counsel

| 8 |

| 9 |

CERTIFICATE OF AMENDMENT

(pursuant to NRS 78.385 and 78.390)

Certificate of Amendment to Articles of Incorporation

of

PharmaCyte Biotech, Inc.

PharmaCyte Biotech, Inc., (“Corporation”), a corporation organized and existing under the laws of the State of Nevada hereby certifies as follows:

| 1. | The name of the Corporation is PharmaCyte Biotech, Inc. |

| 2. | Article IV of the Articles of Incorporation of Corporation is hereby amended and restated in its entirety to provide as follows: |

The authorized capital stock of the Corporation is One Billion Five Hundred Million (1,500,000,000) shares, of which One Billion Four Hundred Ninety Million (1,490,000,000) shares with a par value of $0.0001 per share, shall be designated, “Common Stock” and of which Ten Million (10,000,000) shares with a par value of $0.0001 per share, shall be designated “Preferred Stock.” The powers, preferences, rights, qualifications, limitations and restrictions pertaining to the Preferred Stock, or any series thereof, shall be such as may be fixed, from time to time, by the Board of Directors of the Corporation (“Board”) in its sole discretion, authority to do so being hereby expressly vested in the Board. The authority of the Board with respect to each such series of Preferred Stock will include, without limiting the generality of the foregoing, the determination of any or all of the following:

| (i) | The number of shares of any series and the designation to distinguish the shares of such series from the shares of all other series; |

| (ii) | the voting powers, if any, of the shares of such series and whether such voting powers are full or limited and whether the class will vote with the Common Stock of the Corporation as one class, or otherwise; |

| (iii) | the redemption provisions, if any, applicable to such series, including the redemption price or prices to be paid; |

| (iv) | whether dividends, if any, will be cumulative or noncumulative, the dividend rate or rates of such series and the dates and preferences of dividends on such series; |

| (v) | the rights of such series upon the voluntary or involuntary dissolution of, or upon any distribution of the assets of, the Corporation; |

| (vi) | the provisions, if any, pursuant to which the shares of such series are convertible into, or exchangeable for, shares of any other class or classes or of any other series of the same or any other class or classes of stock, or any other security, of the Corporation or any other corporation or other entity, and the rates or other determinants of conversion or exchange applicable thereto; |

| 10 |

| (vii) | the right, if any, to subscribe for or to purchase any securities of the Corporation or any other corporation or other entity; |

| (viii) | the provisions, if any, of a sinking fund applicable to such series; and |

| (ix) | any other relative, participating, optional or other powers, preferences or rights, and any qualifications, limitations or restrictions thereof, of such series. |

| 3. | The vote by which the stockholders holding shares in the Corporation entitling them to exercise at least a majority of the voting power, or such greater proportion of the voting power as may be required in the case of a vote by classes or series, or as may be required by the provisions of the articles of incorporation have voted in favor of the amendment is 53.7%. |

| 4. | This Certificate of Amendment shall be effective upon filing with the Secretary of State of the State of Nevada. |

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be signed by its duly authorized officer as of this 17th day of September 2019.

| By: /s/ Kenneth L. Waggoner | |

| Name: Kenneth L. Waggoner | |

| Title: Chief Executive Officer | |

| President and General Counsel | |

| 11 |

|

ROSS MILLER Secretary of State 204 North Carson Street, Suite 1 Carson City, Nevada 89701-4520 (775) 684-5708 Website: www.nvsos.gov |

| Articles of Merger (PURSUANT TO NRS 92A.200) Page 1 |

| USE BLACK INK ONLY - DO NOT HIGHLIGHT | ABOVE SPACE IS FOR OFFICE USE ONLY |

Articles of Merger

(Pursuant to NRS Chapter 92A)

| 1) | Name and jurisdiction of organization of each constituent entity (NRS 92A.200): |

| o | If there are more than four merging entities, check box and attach an 8 1/2" x 11" blank sheet containing the required information for each additional entity from article one. |

| PharmaCyte Biotech, Inc. | ||

| Name of merging entity | ||

| Nevada | Corporation | |

| Jurisdiction | Entity type * | |

| Name of merging entity | ||

| Jurisdiction | Entity type * | |

| Name of merging entity | ||

| Jurisdiction | Entity type * | |

| Name of merging entity | ||

| Jurisdiction | Entity type * | |

| Nuvilex, Inc. | ||

| Name of surviving entity | ||

| Nevada | Corporation | |

| Jurisdiction | Entity type * | |

* Corporation, non-profit corporation, limited partnership, limited-liability company or business trust.

Filing Fee: $350.00

| This form must be accompanied by appropriate fees. | Nevada Secretary of State 92A Merger Page 1 Revised: 8-31-11 |

| 12 |

|

ROSS MILLER Secretary of State 204 North Carson Street, Suite 1 Carson City, Nevada 89701-4520 (775) 684-5708 Website: www.nvsos.gov |

| Articles of Merger (PURSUANT TO NRS 92A.200) Page 2 |

| USE BLACK INK ONLY - DO NOT HIGHLIGHT | ABOVE SPACE IS FOR OFFICE USE ONLY |

| 2) | Forwarding address where copies of process may be sent by the Secretary of State of Nevada (if a foreign entity is the survivor in the merger - NRS 92A.190): |

| Attn: |

| c/o: | |

| 3) | Choose one: |

| o | The undersigned declares that a plan of merger has been adopted by each constituent entity (NRS 92A.200). |

| x | The undersigned declares that a plan of merger has been adopted by the parent domestic entity (NRS 92A.180). |

| 4) | Owner's approval (NRS 92A.200) (options a, b or c must be used, as applicable, for each entity): |

| o | If there are more than four merging entities, check box and attach an 8 1/2" x 11" blank sheet containing the required information for each additional entity from article one. | |

| (a) | Owner's approval was not required from |

| Name of merging entity, if applicable | ||

| Name of merging entity, if applicable | ||

| Name of merging entity, if applicable | ||

| Name of merging entity, if applicable | ||

| and, or; | ||

| Nuvilex, Inc. | ||

| Name of surviving entity, if applicable | ||

* Corporation, non-profit corporation, limited partnership, limited-liability company or business trust.

| This form must be accompanied by appropriate fees. | Nevada Secretary of State 92A Merger Page 2 Revised: 8-31-11 |

| 13 |

|

ROSS MILLER Secretary of State 204 North Carson Street, Suite 1 Carson City, Nevada 89701-4520 (775) 684-5708 Website: www.nvsos.gov |

| Articles of Merger (PURSUANT TO NRS 92A.200) Page 3 |

| USE BLACK INK ONLY - DO NOT HIGHLIGHT | ABOVE SPACE IS FOR OFFICE USE ONLY |

| (b) | The plan was approved by the required consent of the owners of *: |

| PharmaCyte Biotech, Inc. | ||

| Name of merging entity, if applicable | ||

| Name of merging entity, if applicable | ||

| Name of merging entity, if applicable | ||

| Name of merging entity, if applicable | ||

| and, or; | ||

| Name of surviving entity, if applicable | ||

* Unless otherwise provided in the certificate of trust or governing instrument of a business trust, a merger must be approved by all the trustees and beneficial owners of each business trust that is a constituent entity in the merger.

| This form must be accompanied by appropriate fees. | Nevada Secretary of State 92A Merger Page 3 Revised: 8-31-11 |

| 14 |

|

ROSS MILLER Secretary of State 204 North Carson Street, Suite 1 Carson City, Nevada 89701-4520 (775) 684-5708 Website: www.nvsos.gov |

| Articles of Merger (PURSUANT TO NRS 92A.200) Page 4 |

| USE BLACK INK ONLY - DO NOT HIGHLIGHT | ABOVE SPACE IS FOR OFFICE USE ONLY |

| (c) | Approval of plan of merger for Nevada non-profit corporation (NRS 92A.160): |

| Name of merging entity, if applicable | ||

| Name of merging entity, if applicable | ||

| Name of merging entity, if applicable | ||

| Name of merging entity, if applicable | ||

| and, or; | ||

| Name of surviving entity, if applicable | ||

| This form must be accompanied by appropriate fees. | Nevada Secretary of State 92A Merger Page 4 Revised: 8-31-11 |

| 15 |

|

ROSS MILLER Secretary of State 204 North Carson Street, Suite 1 Carson City, Nevada 89701-4520 (775) 684-5708 Website: www.nvsos.gov |

| Articles of Merger (PURSUANT TO NRS 92A.200) Page 5 |

| USE BLACK INK ONLY - DO NOT HIGHLIGHT | ABOVE SPACE IS FOR OFFICE USE ONLY |

| 5) | Amendments, if any, to the articles or certificate of the surviving entity. Provide article numbers, if available. (NRS 92A.200)*: |

| Amendment to Article I. - Name of Corporation The new name of the Corporation shall be: PharmaCyte Biotech, Inc. |

| 6) | Location of Plan of Merger (check a or b): |

| x | (a) The entire plan of merger is attached; | |

| or, |

| o | (b) The entire plan of merger is on file at the registered office of the surviving corporation, limited-liability company or business trust, or at the records office address if a limited partnership, or other place of business of the surviving entity (NRS 92A.200). |

| 7) | Effective date and time of filing: (optional) (must not be later than 90 days after the certificate is filed) |

| Date: | Time: | ||

* Amended and restated articles may be attached as an exhibit or integrated into the articles of merger. Please entitle them "Restated" or "Amended and Restated," accordingly. The form to accompany restated articles prescribed by the secretary of state must accompany the amended and/or restated articles. Pursuant to NRS 92A.180 (merger of subsidiary into parent - Nevada parent owning 90% or more of subsidiary), the articles of merger may not contain amendments to the constituent documents of the surviving entity except that the name of the surviving entity may be changed.

| This form must be accompanied by appropriate fees. | Nevada Secretary of State 92A Merger Page 5 Revised: 8-31-11 |

| 16 |

|

ROSS MILLER Secretary of State 204 North Carson Street, Suite 1 Carson City, Nevada 89701-4520 (775) 684-5708 Website: www.nvsos.gov |

| Articles of Merger (PURSUANT TO NRS 92A.200) Page 6 |

| USE BLACK INK ONLY - DO NOT HIGHLIGHT | ABOVE SPACE IS FOR OFFICE USE ONLY |

| 8) | Signatures - Must be signed by: An officer of each Nevada corporation; All general partners of each Nevada limited partnership; All general partners of each Nevada limited-liability limited partnership; A manager of each Nevada limited-liability company with managers or one member if there are no managers; A trustee of each Nevada business trust (NRS 92A.230)* |

| o | If there are more than four merging entities, check box and attach an 8 1/2" x 11" blank sheet containing the required information for each additional entity from article eight. |

| PharmaCyte Biotech, Inc. | ||||

| Name of merging entity | ||||

| /s/ Kenneth L. Waggoner | Chief Executive Officer | January 9, 2015 | ||

| Signature | Title | Date | ||

| Name of merging entity | ||||

| X | ||||

| Signature | Title | Date | ||

| Name of merging entity | ||||

| X | ||||

| Signature | Title | Date | ||

| Name of merging entity | ||||

| X | ||||

| Signature | Title | Date | ||

| Name of merging entity | ||||

| X | ||||

| Signature | Title | Date | ||

| and, | ||||

| Nuvilex, Inc. | ||||

| Name of surviving entity | ||||

| /s/ Kenneth L. Waggoner | Chief Executive Officer | January 9, 2015 | ||

| Signature | Title | Date | ||

* The articles of merger must be signed by each foreign constituent entity in the manner provided by the law governing it (NRS 92A.230). Additional signature blocks may be added to this page or as an attachment, as needed.

IMPORTANT: Failure to include any of the above information and submit with the proper fees may cause this filing to be rejected.

| This form must be accompanied by appropriate fees. | Nevada Secretary of State 92A Merger Page 6 Revised: 8-31-11 |

| 17 |

Agreement of Merger

of

Nuvilex, Inc.

and

PharmaCyte Biotech, Inc.

This Agreement of Merger (“Agreement”) is entered into by and between Nuvilex, Inc., a Nevada corporation (“Company”) and PharmaCyte Biotech, Inc., a Nevada corporation, (“Subsidiary”) as of January 2, 2015.

WHEREAS the boards of directors of the Company and Subsidiary have declared it advisable and in the best interests of the corporations and their respective stockholders to merge Subsidiary with and into Company pursuant Section 92A.180 of the Nevada Revised Statutes (“NRS”) upon the terms and conditions hereinafter set forth.

NOW, THEREFORE, in consideration of the premises and the mutual covenants contained in this Agreement, the parties agree as follows:

| 1. | Merger. |

Subsidiary shall, pursuant to the provisions of the NRS, be merged with and into Company. The Company shall be the surviving corporation from and after the date on which the articles of merger are filed with the Secretary of State of the State of Nevada (“Effective Time”) and shall change its name, and continue to exist under the name PharmaCyte Biotech, Inc., a Nevada corporation (“Surviving Corporation”). The separate existence of Subsidiary shall cease at the Effective Time in accordance with the provisions of the NRS.

| 2. | Articles of Incorporation. |

The Articles of Incorporation (as amended from time to time, “Articles of Incorporation”) of Company, as now in force and effect, shall continue to be the Articles of Incorporation of the Surviving Corporation, except that Article First of the Articles of Incorporation is hereby amended and restated in its entirety as follows:

“The name of the corporation is PharmaCyte Biotech, Inc.”

and such Articles of Incorporation as herein amended and changed shall continue in full force and effect until further amended and changed in the manner prescribed by the provisions of the NRS and the Articles of Incorporation.

| 3. | Bylaws. |

The Amended and Restated Bylaws of Company (“Bylaws”), as now in force and effect, shall continue to be the Bylaws of the Surviving Corporation and shall continue in full force and effect until changed, altered, or amended in the manner prescribed by the provisions of the NRS and the Bylaws.

| 18 |

| 4. | Directors and Officers. |

The directors and officers of the Company in office at the Effective Time shall be the directors and officers of the Surviving Corporation in office at the Effective Time, all of whom shall hold their offices until the election and qualification of their respective successors or until their earlier removal, resignation or death in accordance with the Bylaws of the Surviving Corporation.

| 5. | Exchange of Capital Stock. |

At the Effective Time, each issued and outstanding share of common stock, $0.001 par value per share of Subsidiary shall not be converted or exchanged in any manner into shares of the Surviving Corporation and shall be cancelled. Each issued and outstanding equity share of Company shall not be converted or exchanged in any manner, but as of the Effective Time shall represent equivalent equity shares of the Surviving Corporation.

| 6. | Execution, Filing and Recordation. |

Company and Subsidiary agree that they will cause to be executed and filed and recorded any document or documents prescribed by the laws of the State of Nevada, and that they will cause to be performed all necessary acts within the State of Nevada and elsewhere to effectuate the merger provided for in this Agreement.

| 7. | Termination. |

This Agreement may be terminated at any time prior to the Effective Time upon a vote of the directors of either Company or Subsidiary. In the event of such termination, this Agreement shall forthwith become void and neither party nor their respective officers, directors or stockholders shall have any liability hereunder.

[The remainder of this page is intentionally blank]

| 19 |

IN WITNESS WHEREOF, the undersigned have executed this Agreement of Merger as of the date first written above.

COMPANY:

Nuvilex, Inc.

By: /s/ Kenneth L. Waggoner

Name: Kenneth L. Waggoner

Title: Chief Executive Officer, President and General Counsel

SUBSIDIARY

PharmaCyte Biotech, Inc.

By: /s/ Kenneth L. Waggoner

Name: Kenneth L. Waggoner

Title: Chief Executive Officer, President and General Counsel

[Signature Page to Short-Form Agreement of Merger]

| 20 |

Ross Miller

Secretary of State

204 North Carson Street

Carson City, Nevada 89701-4201

(775) 684-5708

Websire: www.nvsos.gov

| Filed in the office of | Business Number C22368-1996.. | ||

| Certificate of Designation for | /s/ Barbara K. Cegavske | Filing Number | |

| Nevada Profit Corporations | Barbara K. Cegavske | 2011046379-76 | |

| (PURSUANT TO NRS 78.1955) | Secretary of State | Filed On | |

| State of Nevada | 06/23/2011 |

1. Name of Corporation:

NUVILEX, INC.

2. By resolution of the board of directors pursuant to a provision in the articles of incorporation this certificate establishes the following regarding the voting powers, designations, preferences, limitations, restrictions and relative rights of the following class or series of stock.

The Board of Directors has designated 13,500 shares of Series E Preferred Stock, par value $.0001.

“See attached”

| 3. Effective date of filing: (optional) | March 1, 2011 | |

| (must not be later than 90 days after the certificate is filed) |

4. Signature: (required)

| Patricia Gruden, CFO | ||

| Signature of Officer |

| 21 |

CERTIFICATE OF DESIGNATIONS, PREFERENCES

AND RIGHTS

OF

SERIES E CONVERTIBLE PREFERRED STOCK

OF

NUVILEX, INC.

Nuvilex, Inc. (the "Company"), a corporation organized and existing under Chapter 78 of the Nevada Revised Statutes, does hereby certify that, pursuant to authority conferred upon the Board of Directors of the Company by the Certificate of Incorporation of the Company, and pursuant to Section 78.196 of the Nevada Revised Statutes, the Board of Directors of the Company at a meeting duly held, adopted resolutions (i) authorizing a series of the Company's authorized preferred stock, $.0001 par value per share, and (ii) providing for the designations, preferences, and relative, participating, optional, or other rights, and the qualifications, limitations, or restrictions of thirteen thousand five hundred (13,500) shares of Series E Convertible Preferred Stock of the Company.

RESOLVED, that the Company is authorized to issue thirteen thousand five hundred (13,500) shares of Series E Convertible Preferred Stock (the "Series E Preferred Shares" or "Preferred Stock"), 5.0001 par value per share, which shall have the following powers, designations, preferences, and other special rights:

Section 1. Dividends. The Series E Preferred Shares shall not bear any dividends.

Section 2. Holder's Conversion of Series E Preferred Shares. A holder of Series E Preferred Shares shall have the right, at such holder's option, to convert Series E Preferred Shares into shares of the Company's common stock, 5.0001 par value per shares (the "Common Stock"), on the following terms and conditions:

| (a) | Conversion Right. Subject to the provisions of Section 3(a) below, at any time or times on or after the earlier of: (i) 30 days after the Issuance Date (as defined herein), (ii) the date that a registration statement covering the resale of Commons Stock issued upon conversion of the Series E Preferred Stock is declared effective by the Securities and Exchange Commission (the "SEC") ("Scheduled Effective Date"), any holder of Series E Preferred Shares shall be entitled to convert any Series E Preferred Shares into fully paid and non-assessable shares (rounded to the nearest whole share in accordance with Section 2(t) below) of Common Stock, at the Conversion Rate (as defined below). |

| (b) | Conversion Rate. The number of shares of Common Stock issuable upon conversion of each of the Series E Preferred Shares pursuant to Section (2)(a) shall be determined according to the following formula (the "Conversion Rate"); |

the average Closing Bid Price (as defined below) for the Company's common stock for the five (5) trading days prior to the Conversion Date (as defined below) (hereinafter sometimes called the "Fixed Conversion Price").

For purposes of this Certificate of Designations, the following terms shall have the following meanings:

| (i) | "Average Market Price" means, with respect to any security for any period, that price which shall be computed as the arithmetic average of the Closing Bid Prices (as defined below) for such security for each trading day in such period; |

| (ii) | "Closing Bid Price" means, for any security as of any date, the last closing bid price on Nasdaq as reported by Bloomberg Financial Markets ("Bloomberg"), or, if the Nasdaq is not the principal trading market for such security, the last closing bid price of such security on the principal securities exchange or trading market where such security is listed or traded as reported by Bloomberg, or if the foregoing do not apply, the last closing bid price of such security in the over-the-counter market or the pink sheets or the bulletin board for such security as reported by Bloomberg, or, if no closing bid price is reported for such security by Bloomberg, the last closing trade price of such security as reported by Bloomberg. If the Closing Bid Price cannot be calculated for such security on such date on any of the foregoing bases, the Closing Bid Price of such security on such date shall be the fair market value as reasonably determined in good faith by the Board of Directors of the Company (all as appropriately adjusted for any stock dividend, stock split, or other similar transaction during such period); |

| 22 |

| (iii) | "Issuance Date" means the date of issuance of the Series E Preferred Shares. |

| (c) | Adjustment to Conversion Price — Dilution and Other Events. In order to prevent dilution of the rights granted under this Certificate of Designations, the Conversion Price will be subject to adjustment from time to time as provided in this Section 2(c). |

| (i) | Adjustment of Fixed Conversion Price upon Subdivision or Combination of Common Stock. If the Company at any time subdivides (by any stock split, stock dividend, recapitalization, or otherwise) one or more classes of its outstanding shares of Common Stock into a greater number of shares, the Fixed Conversion Price in effect immediately prior to such subdivision will be proportionately reduced. If the Company at any time combines (by combination, reverse stock split, or otherwise) one or more classes of its outstanding shares of Common Stock into a smaller number of shares, the Fixed Conversion Price in effect immediately prior to such combination will be proportionately increased. |

| (ii) | Reorganization, Reclassification, Consolidation, Merger, or Sale. Any recapitalization, reorganization, reclassification, consolidation, merger, sale of all or substantially all of the Company's assets to another Person (as defined below), or other similar transaction which is effected in such a way that holders of Common Stock are entitled to receive (either directly or upon subsequent liquidation) stock, securities, or assets with respect to or in exchange for Common Stock is referred to herein as an "Organic Change." Prior to the consummation of any Organic Change, the Company will make appropriate provision (in form and substance satisfactory to the holders of a majority of the Series E Preferred Shares then outstanding) to insure that each of the holders of the Series E Preferred Shares will thereafter have the right to acquire and receive in lieu of, or in addition to, (as the case may be) the shares of Common Stock immediately theretofore acquirable and receivable upon the conversion of such holder's Series E Preferred Shares, such shares for stock, securities, or assets as may be issued or payable with respect to, or in exchange for, the number of shares of Common Stock immediately theretofore acquirable and receivable upon the conversion of such holder's Series E Preferred Shares had such Organic Change not taken place. In any such case, the Company will make appropriate provision (in form and substance satisfactory to the holders of a majority of the Series E Preferred Shares then outstanding) with respect to such holders' rights and interests to insure that the provisions of this Section 2(c) and Section 2(d) below will thereafter be applicable to the Series E Preferred Shares. The Company will not effect any such consolidation, merger, or sale, unless prior to the consummation thereof the successor entity (if other than the Company) resulting from consolidation or merger or the entity purchasing such assets assumes, by written instrument (in form and substance satisfactory to the holders of a majority of the Series E Preferred Shares then outstanding), the obligation to deliver to each holder of Series E Preferred Shares such shares of stock, securities, or assets as, in accordance with the foregoing provisions, such holder may be entitled to acquire. For purposes of this Agreement, "Person" shall mean an individual, a limited liability company, a partnership, a joint venture, a corporation, a trust, an unincorporated organization, and a government or any department or agency thereof. |

| (iii) | Notices. |

| (A) | Immediately upon any adjustment of the Conversion Price, the Company will give written notice thereof to each holder of the Series E Preferred Shares, setting forth in reasonable detail and certifying the calculation of such adjustment. |

| (B) | The Company will give written notice to each holder of Series E Preferred Shares at least twenty (20) days prior to the date on which the Company closes its books or takes a record (i) with respect to any dividend or distribution upon the Common Stock, (ii) with respect to any pro rata subscription offer to holders of Common Stock or (iii) for determining rights to vote with respect to any Organic Change, dissolution, or liquidation. |

| (C) | The Company will also give written notice to each holder of Series E Preferred Shares at least twenty (20) days prior to the date on which any Organic Change, Major Transaction (as defined below), dissolution, or liquidation will take place. |

| 23 |

| (d) | Purchase Rights. If at any time the Company grants, issues, or sells any Options, Convertible Securities, or rights to purchase stock, warrants, securities, or other property pro rata to the record holders of any class of Common Stock (the "Purchase Rights"), then the holders of Series E Preferred Shares will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights which such holder could have acquired if such holder had held the number of shares of Common Stock acquirable upon complete conversion of the Series E Preferred Shares immediately before the date as of which a record is taken for the grant, issuance or sale of such Purchase Rights, or, if no such record is taken, the date as of which the record holders of Common Stock are to be determined for the grant, issue, or sale of such Purchase Rights. |

| (e) | Mechanics of Conversion. Subject to the Company's inability to fully satisfy its obligations under a Conversion Notice (as defined below) as provided for in Section 5 below: |

| (i) | Holder's Delivery Requirements. To convert Series E Preferred Shares into full shares of Common Stock on any date (the "Conversion Date"), the holder thereof shall (A) deliver or transmit by facsimile, for receipt on or prior to 11:59 P.M., Eastern Standard Time, on such date, a copy of a fully executed notice of conversion in the form attached hereto as Exhibit 7 (the "Conversion Notice") to the Company or its designated transfer agent (the "Transfer Agent"), and (B) surrender to a common carrier for delivery to the Company or the Transfer Agent as soon as practicable following such date, the original certificates representing the Series E Preferred Shares being converted (or an indemnification undertaking with respect to such shares in the case of their loss, theft, or destruction) (the "Preferred Stock Certificates") and the originally executed Conversion Notice. |

| (ii) | Company's Response. Upon receipt by the Company of a facsimile copy of a Conversion Notice, the Company shall immediately send, via facsimile, a confirmation of receipt of such Conversion Notice to such holder. Upon receipt by the Company or the Transfer Agent of the Preferred Stock Certificates to be converted pursuant to a Conversion Notice. together with the originally executed Conversion Notice, the Company or the Transfer Agent (as applicable) shall, within five (5) business days following the date of receipt, (A) issue and surrender to a common carrier for overnight delivery to the address as specified in the Conversion Notice, a certificate, registered in the name of the holder or its designee, for the number of shares of Common Stock to which the holder shall be entitled or (B) credit the aggregate number of shares of Common Stock to which the holder shall be entitled to the holder's or its designee's balance account at The Depository Trust Company. |

| (iii) | Dispute Resolution. In the case of a dispute as to the determination of the Average Market Price or the arithmetic calculation of the Conversion Rate, the Company shall promptly issue to the holder the number of shares of Common Stock that is not disputed and shall submit the disputed determinations or arithmetic calculations to the holder via facsimile within three (3) business days of receipt of such holder's Conversion Notice. if such holder and the Company are unable to agree upon the determination of the Average Market Price or arithmetic calculation of the Conversion Rate within two (2) business days of such disputed determination or arithmetic calculation being submitted to the holder, then the Company shall within one (1) business day submit via facsimile (A) the disputed determination of the Average Market Price to an independent, reputable investment bank or (B) the disputed arithmetic calculation of the Conversion Rate to its independent, outside accountant. The Company shall cause the investment bank or the accountant, as the case may be, to perform the determinations or calculations and notify the Company and the holder of the results no later than forty-eight (48) hours from the time it receives the disputed determinations or calculations. Such investment bank's or accountant's determination or calculation, as the case may be, shall be binding upon all parties absent manifest error. |

| (iv) | Record Holder. The person or persons entitled to receive the shares of Common Stock issuable upon a conversion of Series E Preferred Shares shall be treated for all purposes as the record holder or holders of such shares of Common Stock on the Conversion Date. |

| (v) | Company's Failure to Timely Convert. If the Company shall fail to issue to a holder within five (5) business days following the date of receipt by the Company or the Transfer Agent of the Preferred Stock Certificates to be converted pursuant to a Conversion Notice, a certificate for the number of shares of Common Stock to which such holder is entitled upon such holder's conversion of Series E Preferred Shares, in addition to all other available remedies which such holder may pursue hereunder, the Company shall pay additional damages to such holder on each day after the fifth (5th) business day following the date of receipt by the Company or the Transfer Agent of the Preferred Stock Certificates to be converted pursuant to the Conversion Notice, for which such conversion is not timely effected, an amount equal to 1.0% of the product of (A) the number of shares of Common Stock not issued to the holder and to which such holder is entitled and (B) the Closing Bid Price of the Common Stock on the business day following the date of receipt by the Company or Transfer Agent of the Preferred Stock Certificates to be converted pursuant to the Conversion Notice. |

| 24 |

| (f) | Fractional Shares. The Company shall not issue any fraction of a share of Common Stock upon any conversion. All shares of Common Stock (including fractions thereof) issuable upon conversion of more than one share of the Series E Preferred Shares by a holder thereof shall be aggregated for purposes of determining whether the conversion would result in the issuance of a fraction of a share of Common Stock. If, after the aforementioned aggregation, the issuance would result in the issuance of a fraction of its share of Common Stock, the Company shall round such fraction of a share of Common Stock up or down to the nearest whole share. |

| (g) | Taxes. The Company shall pay any and all taxes which may be imposed upon it with respect to the issuance and delivery of Common Stock upon the conversion of the Series E Preferred Shares. |

Section 3. Company's Right to Redeem at its Election.

| (a) | At any time, commencing One Hundred Ten (110) days after the Issuance Date, as long as the Company has not breached any of the representations, warrants, and covenants contained herein or in any related agreements, the Company shall have the right, in it sole discretion., to redeem ("Redemption at Company's Election"), from time to time, all of the Series E Preferred Stock: provided Company shall first provide thirty (30) days advance written notice as provided in subparagraph 3(a)(ii) below (which can be given any time on or after 80 days after the Issuance Date). |

| (i) | Redemption Price at Company's Election. The "Redemption Price at Company's Election" shall be calculated as Stated Value, as that term is defined below, of the Series E Preferred Stock. For purposes hereto, "Stated Value" shall mean the par value of the shares of Series E Preferred Stock. |

| (ii) | Mechanics. of Redemption at Company's Election. The Company shall effect each such redemption by giving at least thirty (30) days prior written notice("Notice of Redemption at Company's Election") to (A) the holders of Series E Preferred Stock selected for redemption at the address and facsimile number of such Holder appearing in the Company's Series E Preferred Stock register and (B) the Transfer Agent, which Notice of Redemption at Company's Election shall be deemed to have been delivered three (3) business days after the Company's mailing (by overnight or two (2) day courier, with a copy by facsimile) of such Notice of Redemption at Company's Election. Such Notice of Redemption at Company's Election shall indicate (i) the number of shares of Series E Preferred Stock that have been selected for redemption, (ii) the date which such redemption is to become effective (the "Date of Redemption at Company's Election"), and (iii) the applicable Redemption Price at Company's Election, as defined in subsection (a)(i) above. Notwithstanding the above, the holder may convert into Common Stock, prior to the close of business on the Date of Redemption at Company's Election, any Series E Preferred Stock which it is otherwise entitled to convert, including Series E Preferred Stock that has been selected for Redemption at Company's Election pursuant to this subsection 3(b). |

| (b) | Payment of Redemption Price. Each holder submitting Preferred Stock being redeemed under this Section 3 shall send the Series E Preferred Stock Certificates to be redeemed by the Company or its Transfer Agent, and the Company shall pay the applicable redemption price to that holder within five (5) business days of the Date of Redemption at Company's Election. |

Section 4. Voting Rights. At every meeting of stockholders of the Company every holder of Series E Preferred Stock shall be entitled to fifty thousand votes for each share of Series E Preferred Stock standing in his name on the books of the Company, with the same and identical voting rights, except as expressly provided herein, as a holder of a share of Common Stock. The Series E Preferred Stock Holders shall vote together as one class, except as provided by law, and voting as a class are entitled to elect one director of the Company.

Section 5. Reissuance of Certificates. In the event of a conversion or redemption pursuant to this Certificate of Designations of less than all of the Series E Preferred Shares represented by a particular Preferred Stock Certificate, the Company shall promptly cause to be issued and delivered to the holder of such Series E Preferred Shares a Preferred stock certificate representing the remaining Series E Preferred Shares which have not been so converted or redeemed.

| 25 |

Section 6. Reservation of Shares. The Company shall, so long as any of the Series E Preferred Shares are outstanding, reserve and keep available out of its authorized and unissued Common Stock, solely for the purpose of effecting the conversion of the Series E Preferred Shares, such number of shares of Common Stock as shall from time to time be sufficient to affect the conversion of all of the Series E Preferred Shares then outstanding; provided that the number of shares of Common Stock so reserved shall at no time be less than 200% of the number of shares of Common Stock for which the Series E Preferred Shares are at any time convertible.

Section 7. Liquidation, Dissolution, or Winding-Up. In the event of any voluntary or involuntary liquidation, dissolution, or winding up of the Company, the holders of the Series E Preferred Shares shall be entitled to receive in cash out of the assets of the Company, whether from capital or from earnings available for distribution to its stockholders (the "Preferred Funds"), before any amount shall be paid to the holders of any of the capital stock of the Company of any class junior in rank to the Series E Preferred Shares in respect of the preferences as to the distributions and payments on the liquidation, dissolution, and winding up of the Company, an amount per Series E Preferred Share equal to the Stated Value as defined above. The purchase or redemption by the Company of stock of any class in any manner permitted by law shall not for the purpose hereof be regarded as a liquidation, dissolution, or winding up of the Company. Neither the consolidation nor merger of the Company with or into any other Person, nor the sale or transfer by the Company of less than substantially all of its assets, shall, for the purposes hereof be deemed to be a liquidation, dissolution, or winding up of the Company. No holder of Series E Preferred Shares shall be entitled to receive any amounts with respect thereto upon any liquidation, dissolution, or winding up of the Company other than the amounts provided for herein.

Section 8. Preferred Rate. All shares of Common Stock shall be of junior rank to all Series E Preferred Shares in respect to the preferences as to distributions and payments upon the liquidation, dissolution, and winding up of the Company. The rights of the shares of Common Stock shall be subject to the preferences and relative rights of the Series E Preferred Shares. The Series E Preferred Shares shall be greater than any Series of Common or Preferred Stock hereinafter issued by the Company. Without the prior express written consent of the holders of not less than two-thirds (2/3) of the then outstanding Series E Preferred Shares, the Company shall not hereafter authorize or issue additional or other capital stock that is of senior or equal rank to the Series E Preferred Shares in respect of the preferences as to distributions and payments upon liquidation, dissolution and winding up of the Company. Without the prior express written consent of the holders of not less than two-thirds (213) of the then outstanding Series E Preferred Shares, the Company shall not hereafter authorize or make any amendment to the Company's Certificate of Incorporation or Bylaws, or make any resolution of the board of directors with the Nevada Secretary of State containing any provisions which would adversely affect or otherwise impair the rights or relative priority of the holders of the Series E Preferred Shares relative to the holders of the Common Stock or the holders of any other class of capital stock. In the event of the merger or consolidation of the Company with or into another corporation, the Series E Preferred Shares shall maintain their relative powers, designations, and preferences provided for herein and no merger shall result inconsistent therewith.

Section 9. Vote to Change the Terms of the Series E Preferred Shares. The affirmative vote at a meeting duly called for such purpose or the written consent without a meeting, of the holders of not less than two-thirds (2/3) of the then outstanding Series E Preferred Shares shall be required for any change to this Certificate of Designations or the Company's Certificate of Incorporation which would amend, alter, change, or repeal any of the powers, designations, preferences, and rights of the Series E Preferred Shares.

Section 10. Lost or Stolen Certificates. Upon receipt by the Company of evidence satisfactory to the Company of the loss, theft, destruction, or mutilation of any Preferred Stock Certificates representing the Series E Preferred Shares, and, in the case of loss, theft, or destruction, of any indemnification undertaking by the holder to the Company and, in the case of mutilation, upon surrender and cancellation of the Preferred Stock Certificate(s), the Company shall execute and deliver new preferred stock certificate(s) of like tenor and date; provided however, the Company shall not be obligated to re-issue preferred stock certificates if the holder contemporaneously requests the Company to convert such Series E Preferred Shares into Common Stock.

Section 11. Withholding Tax Obligations. Notwithstanding anything herein to the contrary, to the extent that the Company receives advice in writing from its counsel that there is a reasonable basis to believe that the Company is required by applicable federal laws or regulations, and delivers a copy of such written advice to the holders of the Series E Preferred Shares so effected, the Company may reasonably condition the making of any distribution (as such term is defined under applicable federal tax law and regulations) in respect of any Series E Preferred Share on the holder of such Series E Preferred Shares depositing with the Company an amount of cash sufficient to enable the Company to satisfy its withholding tax obligations (the "Withholding Tax") with respect to such distribution_ Notwithstanding the foregoing or anything to the contrary, if any holder of the Series E Preferred Shares so affected receives advice in writing from the holder's counsel that there is a reasonable basis to believe that the Company is not so required by applicable federal laws or regulations and delivers a copy of such written advice to the Company, the Company shall not be permitted to condition the making of any such distribution in respect of any Series E Preferred Share on the holder of such Series E Preferred Shares depositing with the Company any Withholding Tax with respect to such distribution, provided however, the Company may reasonably condition the making of any such distribution in respect of any Series E Preferred Share on the holder of such Series E Preferred Shares executing and delivering to the Company, at the election of the holder, either: (a) if applicable, a properly completed Internal Revenue Service Form 4224, or (b) an indemnification agreement in reasonably acceptable form with respect to any federal tax liability, penalties, and interest that may be imposed upon the Company by the Internal Revenue Service as a result of the Company's failure to withhold in connection with such distribution to such holder. If the conditions in the preceding two sentences are fully satisfied, the Company shall not be required to pay any additional damages set forth in Section 2(eXv) of this Certificate of Designations if its failure to timely deliver any Conversion Shares results solely from the holder's failure to deposit any withholding tax hereunder or to provide to the Company an executed indemnification agreement in the form reasonably satisfactory to the Company.

| 26 |

IN WITNESS WHEREOF, the Company has caused this Certificate of Designations to be signed by Patricia Gruden, its Chairman and Chief Financial Officer, as of the 1st day of March, 2011.

| NUVILEX,INC. | |

|

| 27 |

![[exhibit39001.jpg]](exhibit39001.jpg)

| 28 |

| 29 |

| 30 |

| 31 |

| 32 |

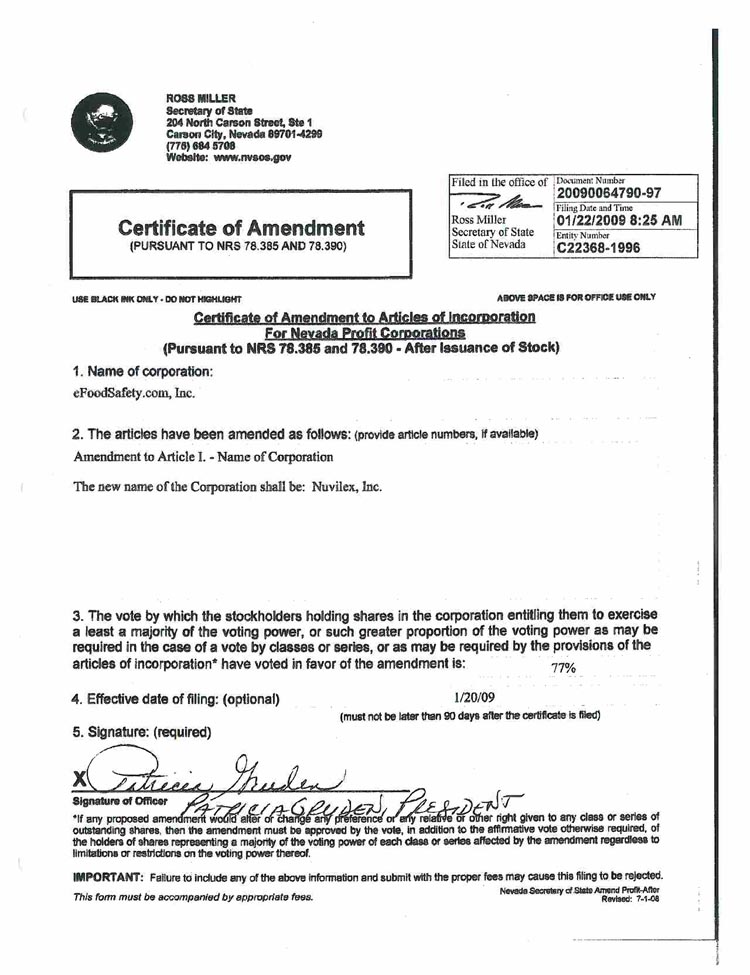

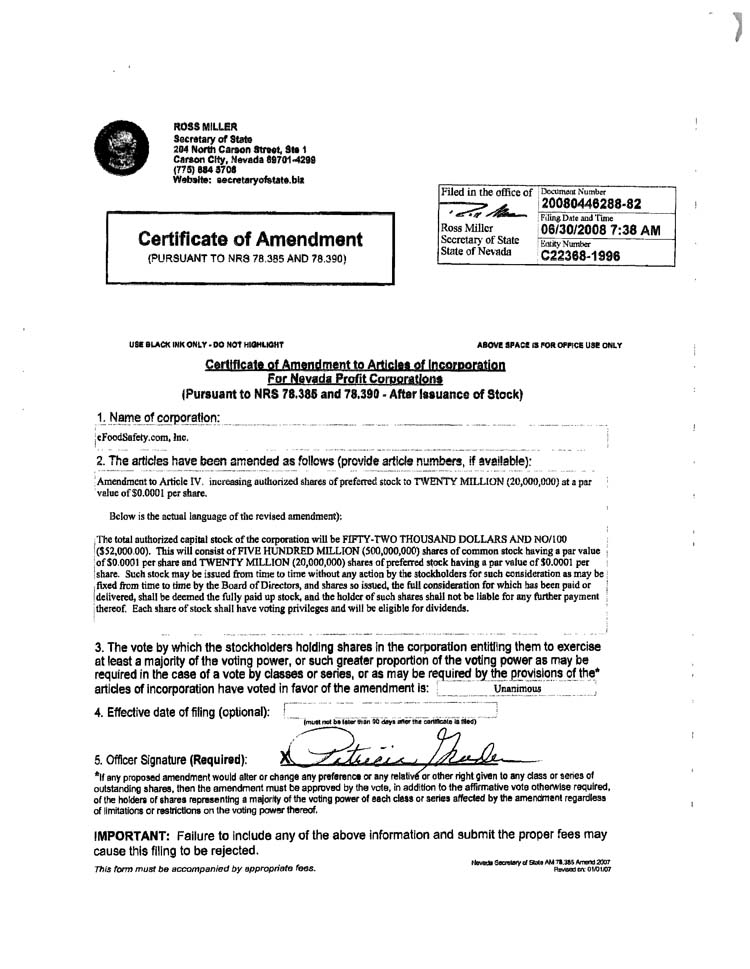

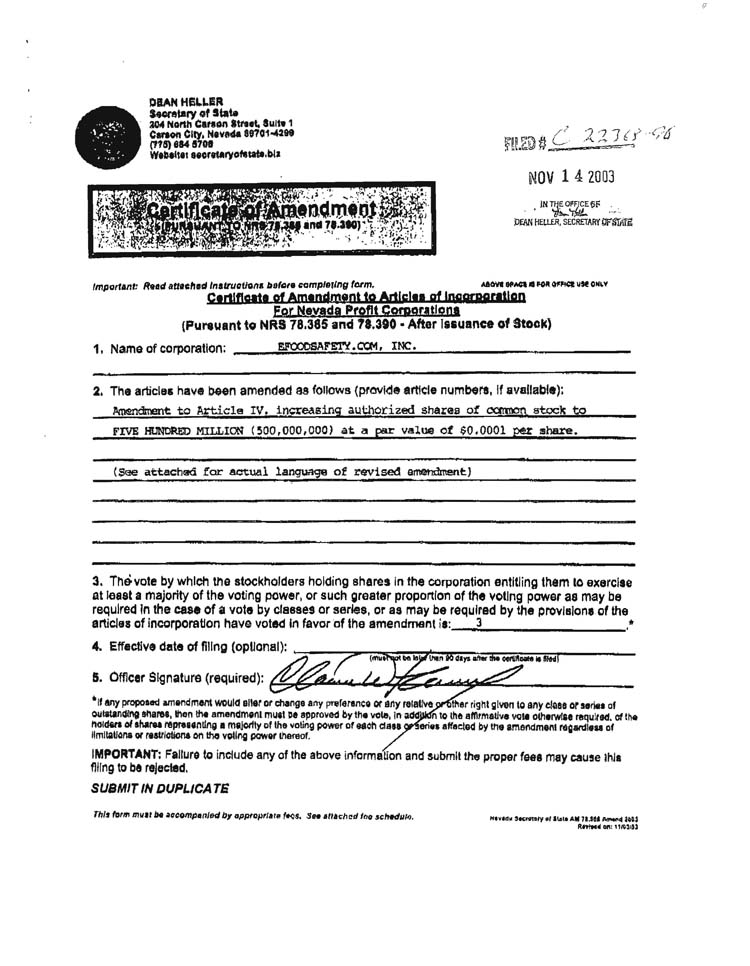

FILED # C22368-96

OCT 25 2000

IN THE OFFICE OF

[DEAN HELLER]

DEAN HELLER SECRETARY OF STATE

CERTIFICATE OF AMENDMENT

OF

ARTICLES OF INCORPORATION

OF

DJH INTERNATIONAL, INC.

The undersigned, C. William Karney, President and Secretary of DJH INTERNATIONAL, INC., a Nevada corporation (the "Corporation"), does hereby certify:

That the Board of Directors of said corporation at a meeting duly convened, held on the 20th day of October, 2000, adopted a resolution to amend the original articles as follows:

RESOLVED, ARTICLE ONE is hereby amended to read as follows:

"The name of this corporation is:

eFoodSafety.com, Inc."

The number of shares of the corporation outstanding and entitled to vote on an amendment to the Articles of Incorporation is 29,335,000; that the said change and amendment have been consented to and approved by a majority vote of the stockholders holding at least a majority of each class of stock outstanding and entitled to vote thereon.

| /s/ C. WILLIAM KARNEY | |

| C. William Karney, President | |

| /s/ C. WILLIAM KARNEY | |

| C. William Karney, Secretary |

State of California

County of Tulare

On October 18, 2000, personally appeared before me, a Notary Public, C. William Karney, who acknowledged that they executed the above instrument.

| /s/ SHANA DAVIS | |

| (Signature of Notary) |

----------------------------

SHANA MAE DAVIS

[SEAL] COMMISSION #1157301

NOTARY PUBLIC-CALIFORNIA

TULARE COUNTY

MY COMM. EXPIRES OCT 2, 2001

----------------------------

| 33 |

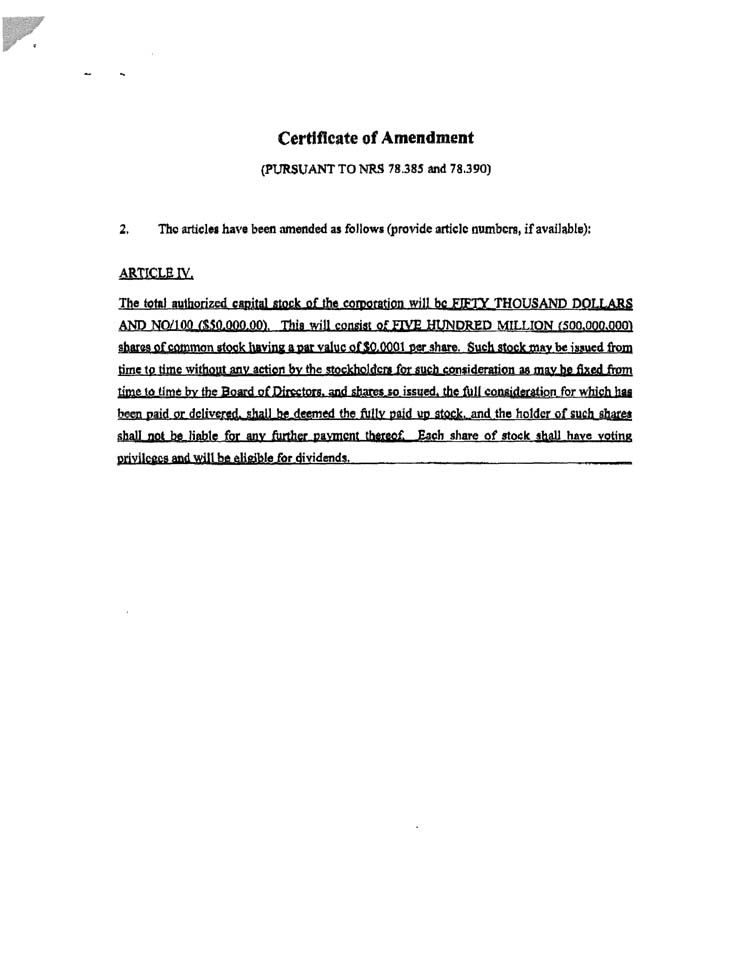

FILED

IN THE OFFICE OF THE

SECRETARY OF STATE OF THE

STATE OF NEVADA

OCT 28 1996

C22368-96

ARTICLES OF INCORPORATION

OF

DJH INTERNATIONAL, INC.

a Nevada Corporation

I.

The name of the corporation shall be DJH International, Inc. and shall be governed by Chapter 78 of the Nevada Revised Statutes.

II.

The Resident Agent is Michael J. Daniels, 537 E. Sahara, Suite 209 Las Vegas, Nevada 89104.

III.

The nature of the business of the corporation will be to engage in any lawful activity permitted by the laws of the State of Nevada, and desirable to support the continued existence of the corporation.

IV.

The total authorized capital stock of the corporation will be Twenty-Five Thousand Dollars ($25,000.00). This will consist of Fifty million (50,000,000) shares of $.0005 par value common stock. Such stock may be issued from time to time without any action by the stockholders for such consideration as may be fixed from time to time by the Board of Directors, and shares so issued, the full consideration for which has been paid or delivered, shall be deemed the fully paid up stock, and the holder of such shares shall not be liable for any further payment thereof. Each share of stock shall have voting privileges and will be eligible for dividends.

V.

The governing board of this corporation shall be known as directors and shall be styled directors, and the number of directors may from time to time be increased or decreased in such manner as shall be provided by the bylaws of this corporation, provided that the number of directors shall not be reduced to less than one (1) director. The name and address of the first director is as follows:

Michael J. Daniels: 537 E. Sahara, Ste. 209, Las Vegas, NV 89104.

VI.

The name and address of the original incorporator is:

Michael J. Daniels: 537 E. Sahara, Ste. 209, Las Vegas, NV 89104.

| 1 |

VII.

The corporation shall have perpetual existence according to NRS 78.035.

The undersigned, being the original incorporator hereinbefore named, for the purpose of forming a corporation to do business both within and without the State of Nevada, and in pursuance of the general corporation law of the State of Nevada, does make and file this Certificate, hereby declaring and certifying the facts hereinabove stated are true, and accordingly has hereunto set his hand this 28th day of October, 1996.

| /s/ Michael J. Daniels | |

| Michael J. Daniels |

STATE OF NEVADA )

)SS

COUNTY OF CLARK )

On this 28th day of October, 1996 personally appeared before me, a Notary Public in and for said County and State, Michael J. Daniels, and acknowledged that he executed the above instrument freely and voluntarily for the uses and purposes therein mentioned.

SUBSCRIBED AND SWORN to before me

this 28th day of October, 1996.

/s/ SINDI PATRICIA MORENO

NOTARY PUBLIC, in and for said

County and State.

------------------------------------

NOTARY PUBLIC

[SEAL] STATE OF NEVADA

COUNTY OF CLARK

SINDI PATRICIA MORENO

APPT. NO. 95-1663-1

MY APPOINTMENT EXPIRES NOV. 16, 1999

------------------------------------

| 2 |